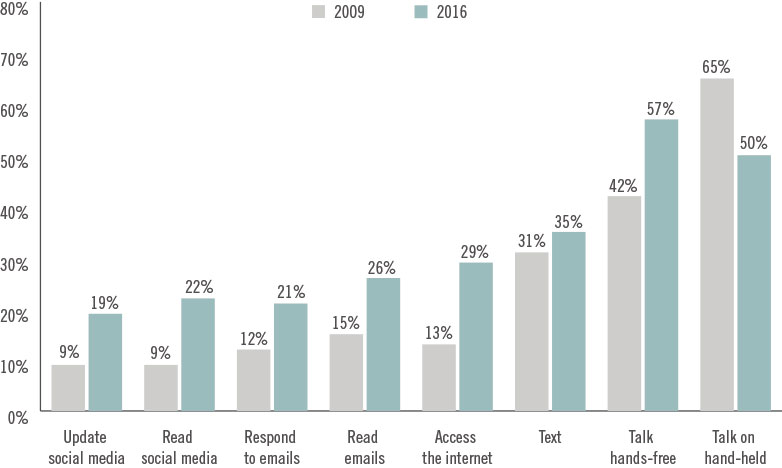

Put down your cell phones! The percent of accidents resulting in a totaled vehicle is the highest it has been in decades. (Exhibit 1 and 2) The causes are many including an aging fleet, faster driving speeds, miles driven (Exhibit 3), distracted drivers, more accidents, vehicle complexity, higher repair costs, and a large supply of vehicles after years of strong production by auto original equipment manufacturer (OEM’s). For consumers, repairs are more costly, not just monetarily but also because turnaround times are lengthening.

Exhibit 1: Distracted Drivers

Source: State Farm Survey, CCC Information Services, Baird research

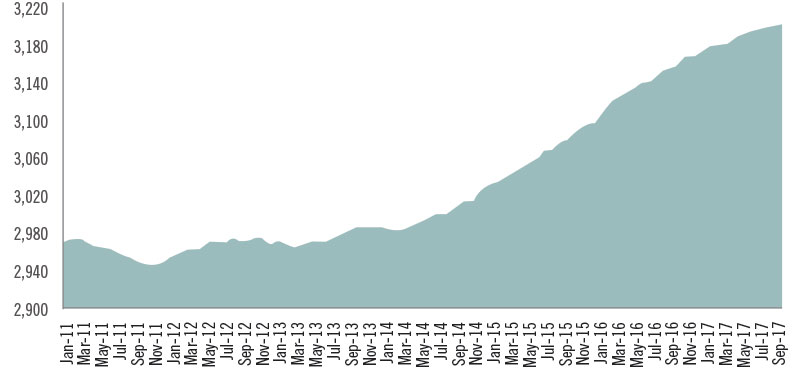

Exhibit 2: Totaled Rate (% of accidents resulting in a totaled vehicle)

Source: CCC, Baird research

Exhibit 3: Miles Driven

Source: Dept. of Transportation, Jefferies estimates

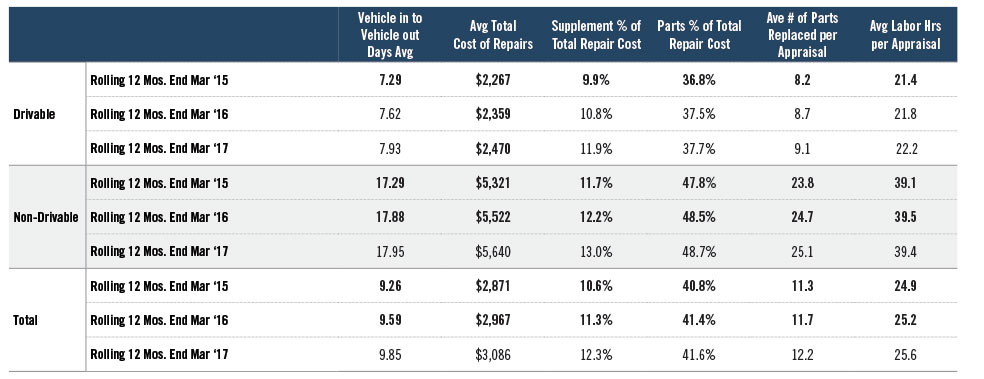

The vehicle-in-to-vehicle-out time at repair shops has increased 6% over the last three years, according to CCC Information Services. Insurance companies are working with repair shops to do everything they can to expedite this process. The slowdown is predominantly due to an increase in average labor hours and parts replaced per claim. (Exhibit 4)

Exhibit 4: Repair Costs and Repair Times

Source: CCC Information Services Inc.

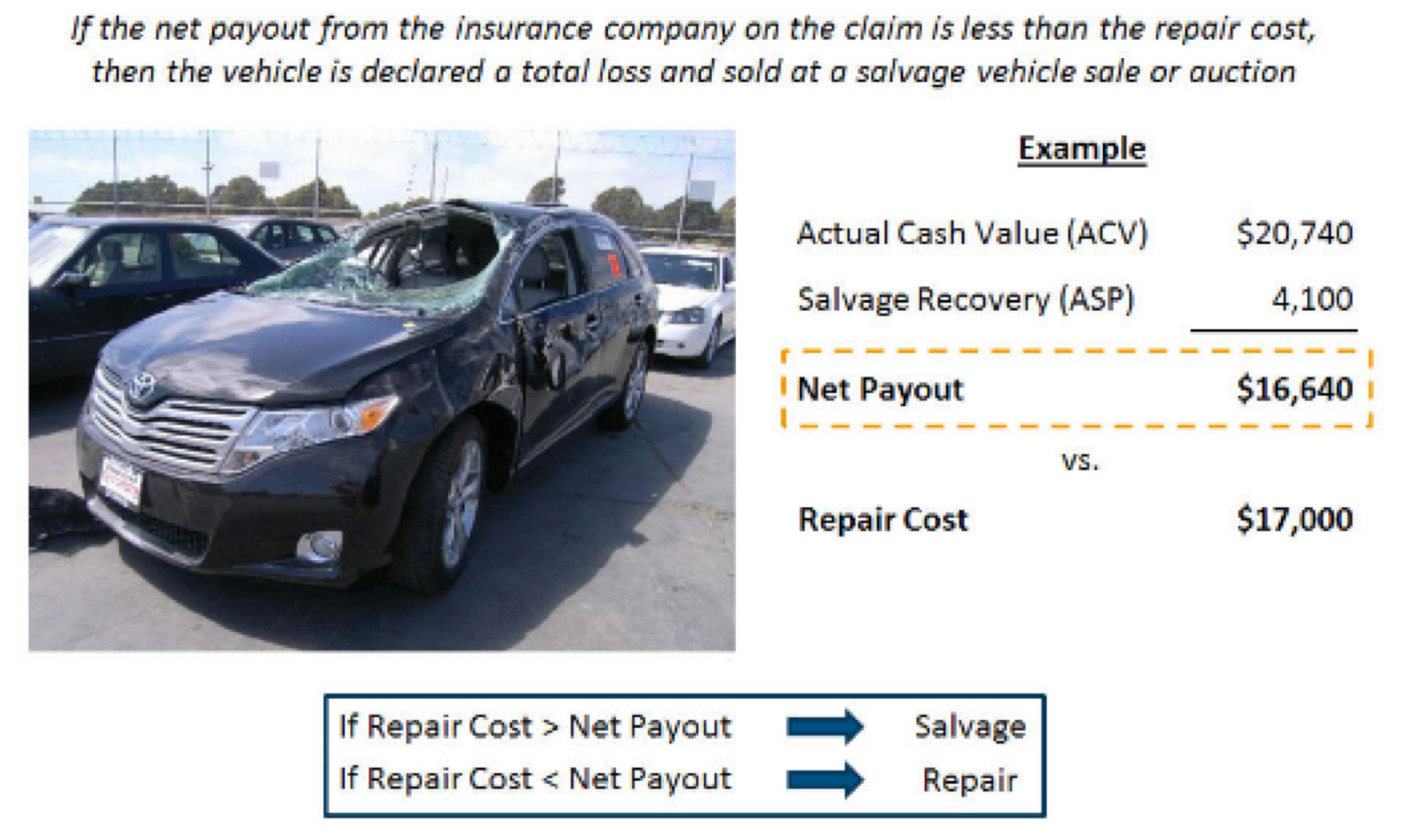

Simple math determines the future of a damaged car. (Exhibit 5)

Exhibit 5: Repair vs. Salvage

Source: Copart, Inc. and Stephens Inc.

What’s an investor to make of this? There are opportunities in salvage auction operators. Collecting a fee for each transaction, they bring the totaled cars to their facilities to be sold to buyers interested in certain reusable parts or for its scrap if nothing else. In addition to the sustainable trends mentioned above, the industry has consolidated into an oligopoly making it tougher for smaller competitors to gain market share. One potential risk to these stocks is autonomous driving, which could decrease accident frequency by creating a safer driving environment, but we don’t view that as a near to intermediate-term threat. An additional risk is a decrease in miles driven due to higher prices at the pump. Typically though, gas need to be close to $4.00 per gallon before we see miles driven take a significant hit, so there is still some room to run.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James