When exporters sell goods into the global marketplace, it is most often denominated in a hard currency such as the Chinese renminbi (CNY), the US dollar (USD) or the Australian dollar (AUD). This means they could be selling goods in USD and subsequently converting revenues back to their local currency as funds are repatriated. Consider the following illustration.

An oil producer in Russia is selling one barrel of crude at USD 50 to an importer in the United States. The producer then brings the USD 50 back to Russia and converts it at the official exchange rate. If the exchange rate is 60 USDRUB (60 Russian rubles to one US dollar), the exporter generates RUB 3,000. If the exchange rate is at 80 USDRUB, the exporter generates RUB 4,000.

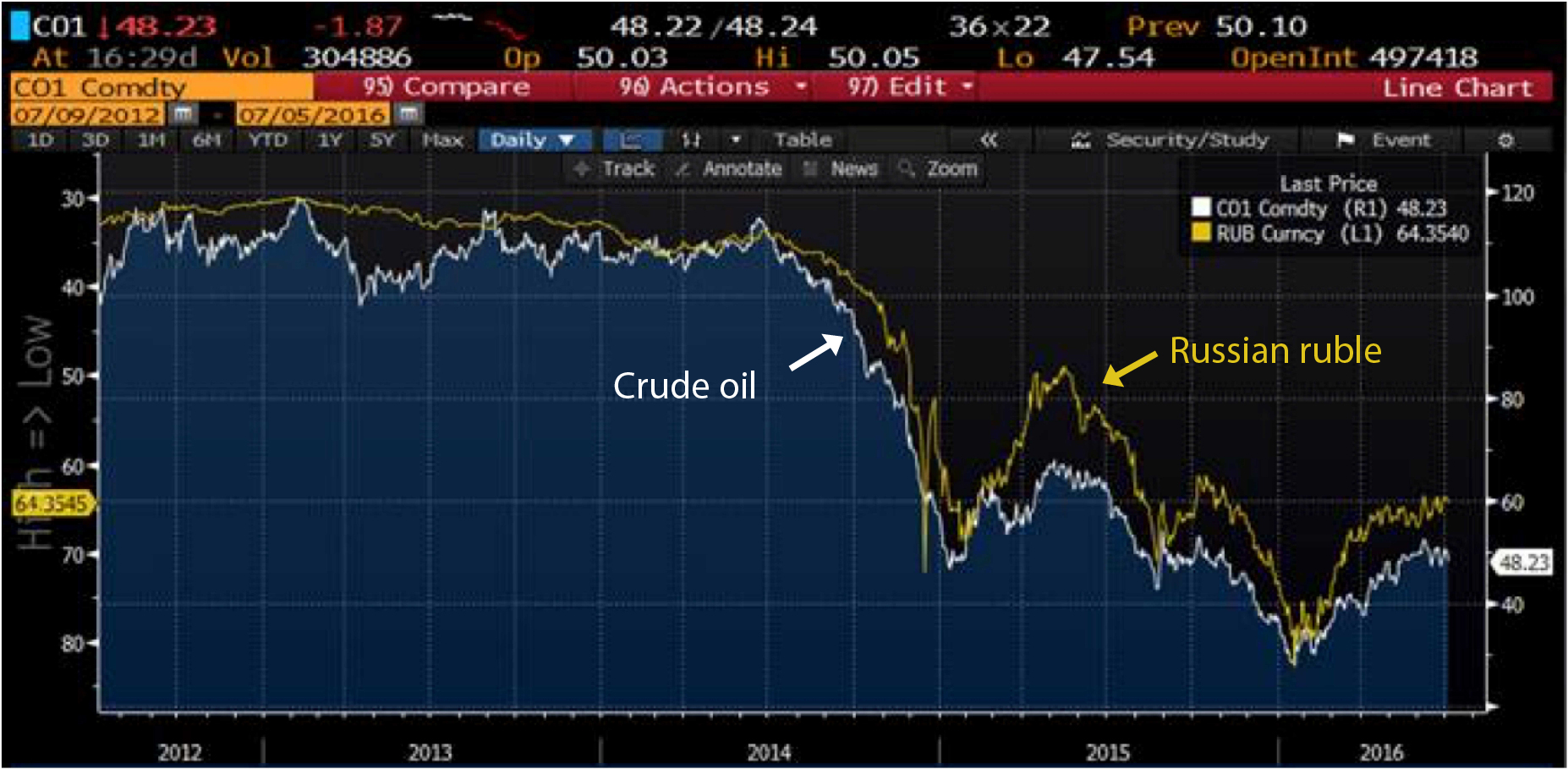

This simplified trade scenario illustrates the incentive for a government to weaken its currency to boost the GDP generated from its export basket (Exhibit 1). But what happens to domestic operating costs during these exchange rate fluctuations? Very little. The impacts of a weaker currency take more time to pass through the local economy than the point of sale. So there aren’t any consequences associated? Is this sustainable? What is sacrificed?

Exhibit 1: The Russian Ruble vs. Crude Oil

Source: Bloomberg

As sovereigns are fighting to stabilize a deteriorating current account by weakening their currencies, they are introducing inflationary pressures into their economy, which has been seen in Brazil recently (Exhibit 2). This could potentially dampen domestic demand, paralyze consumer confidence and scare away investment.

Exhibit 2: Brazilian real (BRL) vs. Brazilian CPI, (year over year change)

Source: Bloomberg

More a qualitative than quantitative measurement, consumer confidence is the backbone of overall economic sentiment. It is not a direct link to the relative value of the currency but the relationship is logical. As the currency depreciates, purchasing power could decline significantly, inflation dynamics can deteriorate, and foreign direct investment can dry up faster than a pond in the Sahara. These factors among others will impair consumer confidence (Exhibits 3 & 4).

Exhibit 3: Brazilian Real vs. Brazilian Consumer Confidence

Source: Bloomberg

Exhibit 4: Russian ruble vs Russian Consumer Confidence

Source: Bloomberg

Another knock-on effect of the weaker currency is declining imports (Exhibit 5). Weaker domestic demand in combination with more expensive foreign goods, could lead to a strengthening trade balance. So in the short term, you could see the current account improving but don’t be fooled, if exports are rising and imports are falling because of a weak consumer and cheap currency, then the economy is not making progress.

Exhibit 5: Brazilian Real (inverted) vs. Brazilian imports

Source: Bloomberg

The lesson: There are tradeoffs to currency management. If a currency is deliberately kept weak for a prolonged period, you could see the current account and trade balance improve but inflation will creep in. Many central banks have an inflation target, and may have to tighten in response to the inflation. As they tighten conditions, we would see investment or credit growth slow.

It’s a painful adjustment to get things back in line again. Policies must be forward looking. Fortunately for Brazil, who misstepped in the not so distant past, we have passed the worst of this costly realignment (Brazil’s central bank has hiked its policy rate 700 basis points since 2013). While currently north of their inflation target (8.5% vs 4.5% target), they have made the necessary policy changes to set the economy on the right path. At the end of all this, the goal should be a free floating currency that can automatically adjust to economic conditions.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of July 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since July 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab

Driehaus Emerging Markets Small Cap Equity Strategy February 2024 Commentary

By Chad Cleaver, CFA