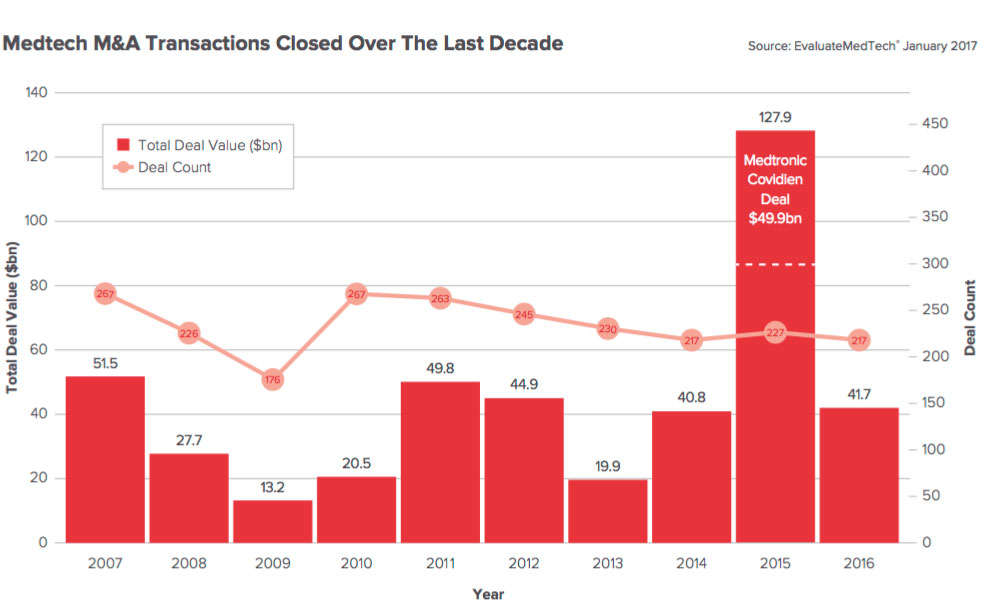

From 2011-2016, there has been $40+ billion spent annually (with one exception), on over 200 transactions within the medical devices industry (Exhibit 1). The acquisition, integration and prioritization of the acquired companies' product lines and operations into the acquirers have the potential to (and often are designed to) substantially impact existing market dynamics.

Exhibit 1: M&A transactions closed over the last decade in medtech

Beyond the intended effect of a merger, such as the acquisition of a strategic product line or scale, unintended byproducts of a deal can often impact the market and participating organizations in less obvious ways. These disruptions can create opportunities for small cap companies. When large acquisitions occur in medical devices, we often look critically at the market dynamics around the acquisition to seek out these opportunities. To be clear: these opportunities do not always exist. However, in our experience, when they do materialize, they have the potential to create positive earnings revisions that drive stock outperformance.

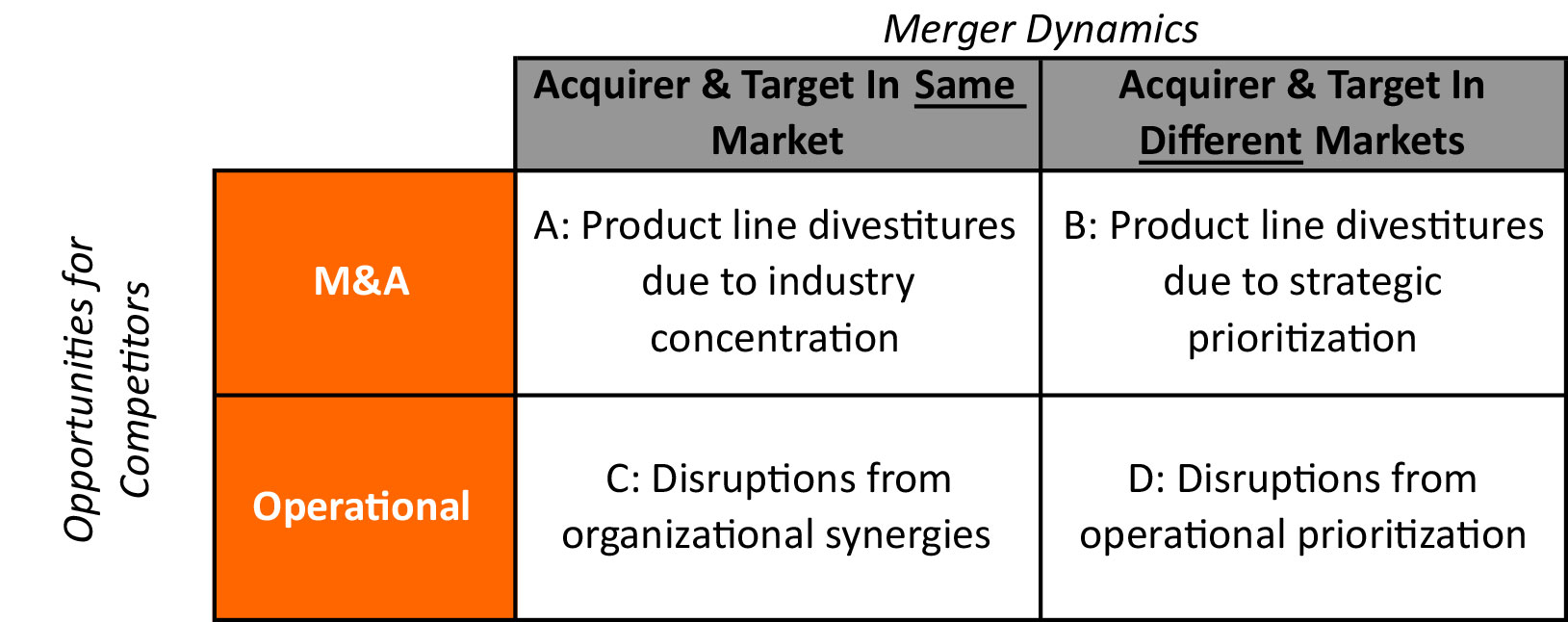

To help conceptualize where and how these opportunities could potentially materialize, we have created a tool from our prior experience (Exhibit 2). This is a representation of concepts and characteristics we consider in a potential acquisition.

Exhibit 2: Merger Dynamics

Source: Driehaus Capital Management

In essence, the matrix says that based on the dynamics of the merger, there may be operational and M&A opportunities for tangential players. Each box represents a potentially different opportunity. Below, I'll address each in turn but before I do so, it is important to note the tool’s limitations. First, the tool does not include the element of time (e.g. the "A" opportunity does not necessarily come before the "D" opportunity). Second, the tool is neither exhaustive nor each box mutually exclusive. Third, and most importantly, it cannot and should not replace extensive fundamental analysis, as every acquisition opportunity is unique. This is simply designed as a jumping off point. With those limitations in mind, here are a handful of ways we may look at opportunities from an acquisition:

A. M&A opportunities when acquirer and acquiree are in the same market.

One strategic reason companies acquire others is to increase or improve the competitiveness of the products in their portfolio that they intend to commercialize. When this happens (especially in larger deals), there can be overlapping product lines that are at risk of being deemed anti-competitive by regulators. These regulators can block the deal unless the acquirer agrees to divest assets to prevent market concentration. In this situation, the seller may be motivated to sell an excellent asset for a below-market price. Selectively purchasing excellent assets at below-market prices is frequently a successful strategy, and we look for companies who may be in a position to execute such a strategy.

B. M&A opportunities when acquirer and acquiree are in different markets

Another strategic reason companies acquire others is to move into new markets. When this happens, the acquiring company often goes through a prioritization process to determine where it wants to be positioned. This prioritization may differ from the prioritization of the acquired company, and therefore the acquirer may, as in Example A above, be motivated to sell excellent assets. As with the previous example, we look for companies who may be in a position to benefit from excellent product lines at below-market prices.

C. Operational opportunities when acquirer and acquiree are in the same market

There are also operational disruptions from acquisitions. These disruptions can be company initiated (e.g. cutting costs or removing redundant positions from the combined company) or employee initiated (e.g. leaving the combined company in favor of a smaller or more focused company). Regardless of who initiates them, these disruptions can negatively impact the short-term combined company performance due to internal uncertainty and/or personnel turnover, while improving opportunities for competitors. For example, competitors can take advantage of this situation at a sales level by increasing share and/or quality of voice, and at an organizational level by recruiting personnel with valuable skillsets, such as intimate market knowledge and key customer relationships. At times of potentially difficult integrations (e.g. merger of two comparably-sized companies with completely overlapping portfolios), we look for competitors who may be in a position to benefit at a sales and organizational level.

D. Operational opportunities when acquirer and acquiree are in different markets

Similar to Example B above, the strategic priorities of an acquiring company may be different from that of an acquired company. As in Example C, this re-prioritization may result in company or employee initiated disruptions, based on how employee goals, as reflected in the priorities of the acquired company, compare to acquirer goals in the new company. In the event that a key or promising area is deemed non-strategic by an acquirer, a competing organization can benefit from landing personnel with valuable skillsets (as described in Example C).

By identifying these and other similar situations, we can be in a position to identify and benefit from value-inflecting opportunities created out of M&A in medical devices.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of June 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since June 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James