After being the top performing S&P 500 sector in 2021 with a total return of ~53%, the S&P 500 Energy sector is off to a blazing start in 2022 with a ~10.8% return year-to-date through January 12. Several positive factors make us optimistic this outperformance in Energy will continue. These factors include Energy’s market capitalization relative to the S&P 500 being well below historical averages, the sector having a high estimated dividend yield despite a valuation multiple below the overall market, and a favorable supply/demand outlook for the oil market.

Low representation in the S&P 500.

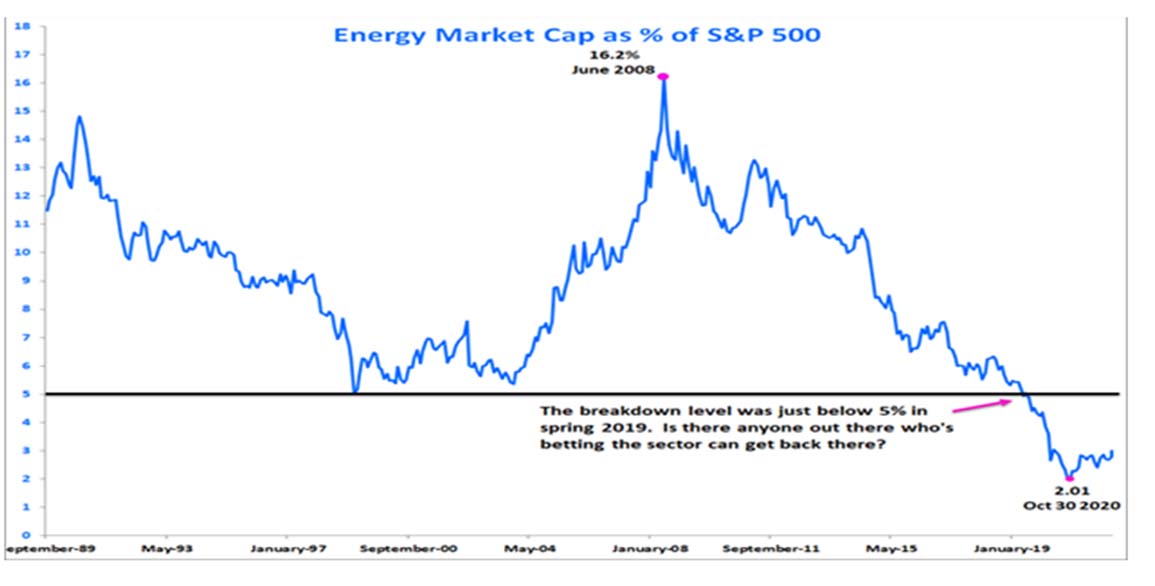

Energy’s market cap as a percentage of the S&P 500 has fallen to below 5% from a prior peak of over 16% in 2008 (Exhibit 1). As the Federal Reserve begins to hike rates, there is potential for investors to continue to rotate out of Technology and into Energy. Even if Energy’s market capitalization as a percentage of the S&P 500 doubled it would still be well below its prior peak.

Exhibit 1: Energy Market Cap as a % of the S&P 500

Source: 22V Research

High Relative Dividend Yield

The estimated dividend yield for the Energy sector of 3.88% is highest among S&P 500 sectors (Exhibit 2). The Energy sector has historically had a low dividend yield as exploration and production companies generated little free cash flow. This has begun to change as many Energy companies emerged from bankruptcy. As investors gain conviction that dividends are sustainable, it can drive increased flows into the sector.

Exhibit 2: Estimated Dividend Yield by S&P 500 Sector

Source: Bloomberg

Reasonable valuation

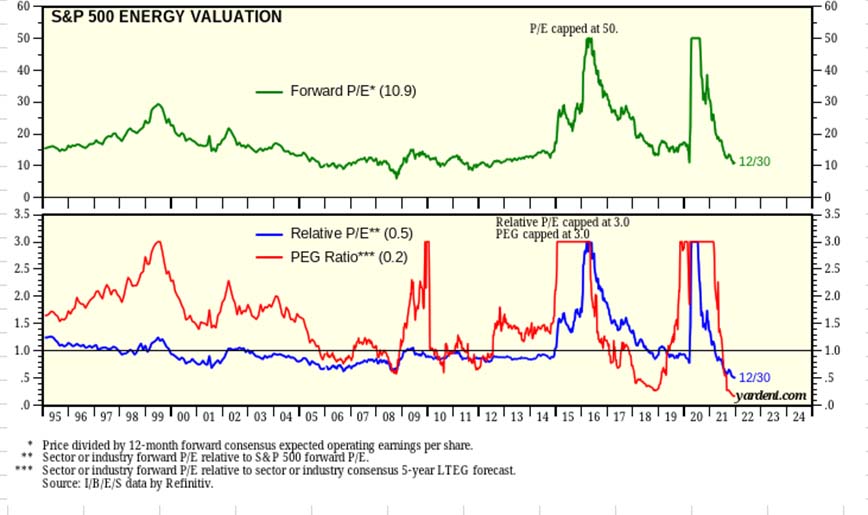

Despite having the highest estimated dividend yield of all sectors, the Energy sector is trading at a discount to the S&P 500 (Exhibit 3). The combination of low market representation, high dividend yield, and lower market valuation is a catalyst that can drive investor fund flows into the sector.

Exhibit 3: S&P 500 Energy Valuation

Source: Yardeni.com

Supply/Demand

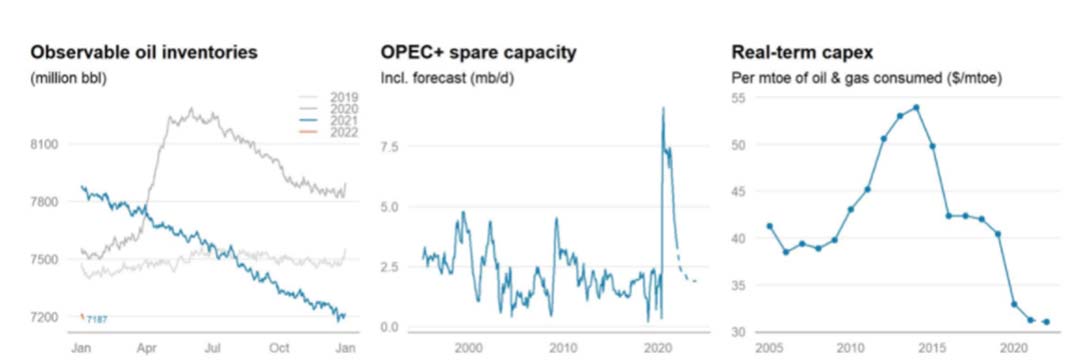

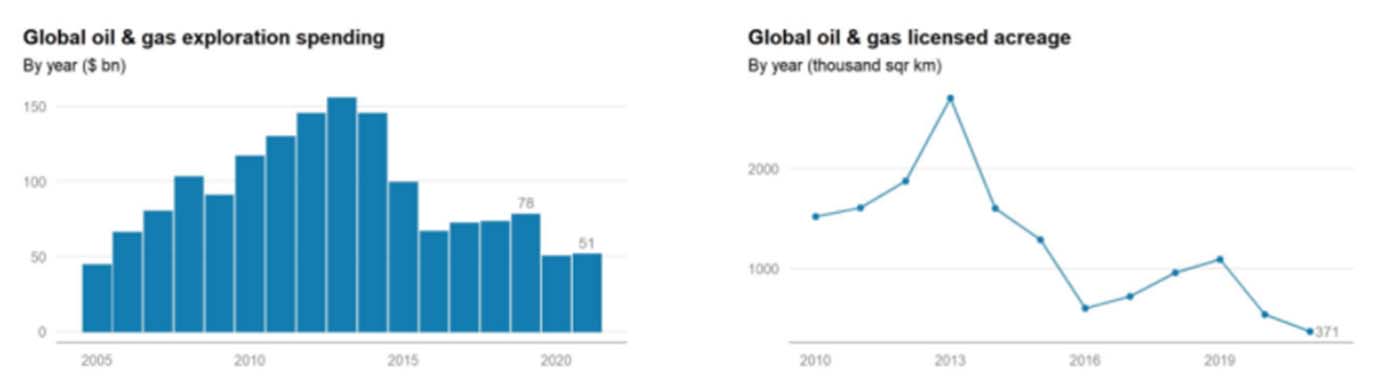

On the supply side, global oil inventories are at five-year lows, OPEC+ spare capacity is falling, and exploration spending is down significantly from prior years (Exhibit 4). On the demand side, Covid continues to create uncertainty, but the Omicron variant appears more easily transmittable than other variants. Being more easily transmittable makes it likely Omicron will become the dominant variant. With Omicron seemingly more mild than prior variants, its spread could accelerate the end of the pandemic and the re-opening of the global economy by driving faster herd immunity. This would be bullish for oil demand at a time when supply is low.

Exhibit 4: Global Oil Inventories

Source: IEA, EIA/DOE, PJK, IE, PAJ, Platts, Kpler, BP Statistical Review, HIS, Rystad Energy, Morgan Stanley Research analysis

Exhibit 5: Exploration Spending

Source: Rystad Energy, Morgan Stanley

While we believe the Energy sector can continue to outperform, we are cognizant of the risks as it is a very macro-driven sector. The growth rates in both gross domestic product (GDP) and the consumer price index (CPI) in the United States are at very high levels and not likely sustainable. Should the market begin to price in a deceleration of these growth rates in the second half of 2022, we would expect elevated volatility within the Energy sector. Taking these factors into account, we continue to look for growth opportunities within the Energy sector for our investment strategies while remaining prepared to be nimble should the macro environment change.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2022 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2022 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James