With some of the initial panic regarding the failure of two large US banks fading, investors are now trying to assess what kind of repercussions the bank runs may have for economic growth. One area of concern is the impact the panic may have on consumer spending. Will consumers get more cautious and pull back? A review of some early high frequency data may provide some clues.

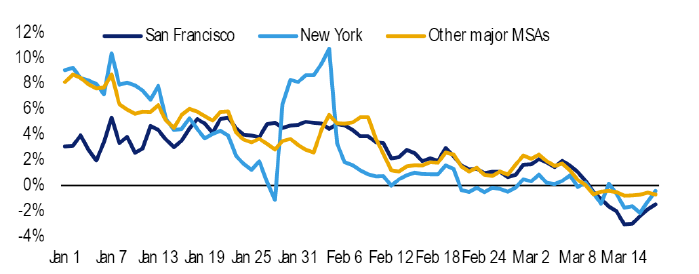

Bank of America, a large credit and debit card issuer, reported slowing sales through March 18th but it was more of a continuation of a slowing trend that has been in place since February, with some incremental weakness in the San Francisco and New York City Metropolitan Statistical Areas (MSA) where the two large bank failures were located.

Exhibit 1: Total Card Spending per HH by MSA (y/y %change of the 7-day moving average (ma) of spending levels)

San Francisco started to underperform other major MSAs around March 12

Source: BAC internal data*

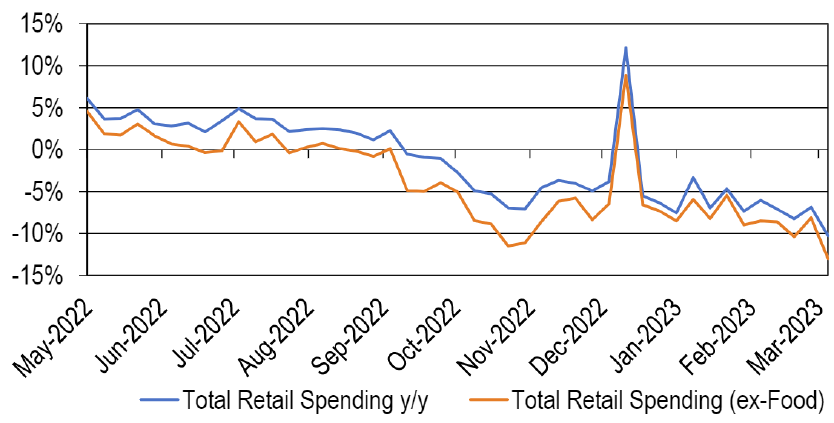

Citi, the world’s largest credit card issuer, publishes weekly retail sales data. Citi reported year-over-year growth decelerated from -6.8% in the second week of March to -10.3% in the third week. Spending for the month through March 18th was -8.3% y/y, a slowdown from February’s -6.0% decline.

Exhibit 2: Total Spending vs Last Year (Weekly)

Source: Citi Research

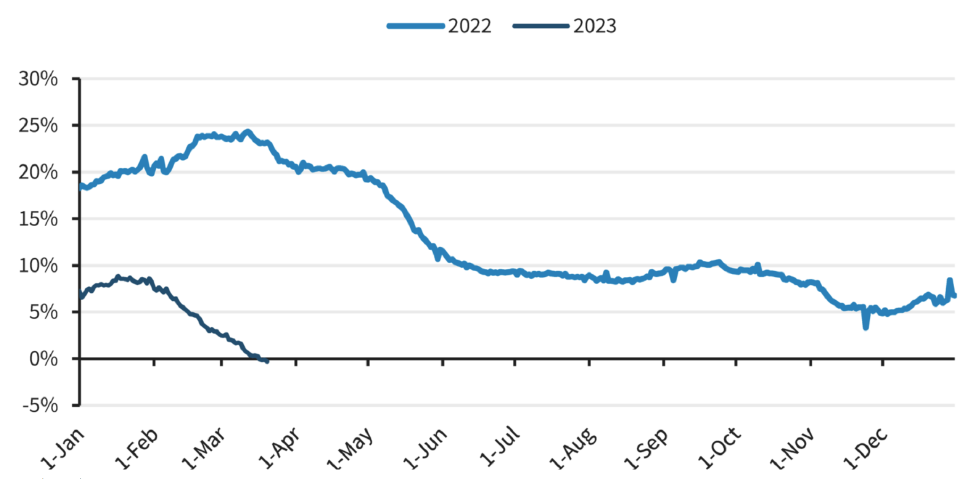

Similarly, Barclays reported a meaningful deceleration in card spending with trailing 35-day growth turning negative in the most recent week.

Exhibit 3: Y/y Growth in 35d Trailing Aggregate Card Spending

Source: Barclay Research

Yet another card spending data point comes from J.P. Morgan’s Chase credit card spending where March is tracking to 2.2% growth, a significant moderation from February’s +6% pace. While specific commentary from companies has been sparse given blackout periods, a luxury furniture retailer reported sales growth slowing 8% as the bank crisis unfolded.

Importantly, slowing consumer spending growth in March may not be entirely attributable to the bank failures as weather, holiday timing, slower tax refunds, a reduction of SNAP benefits and many other factors may have played a role. Spending is not slowing in all categories either, with some companies such as casino operators reporting no change in consumer behavior in March. Further data and corporate commentary will be heavily scrutinized in the coming weeks as the trajectory of US consumer spending will be a key factor in determining the outlook for the economy.

*Note: the other major MSAs are Atlanta, Austin, Boston, Charlotte, Chicago, Cleveland, Dallas, Denver, Detroit, Houston, Las Vegas, Los Angeles, Miami, Minneapolis, Phoenix, Portland, OR, San Diego, Seattle, Tampa and Washington.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2023 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2023 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James