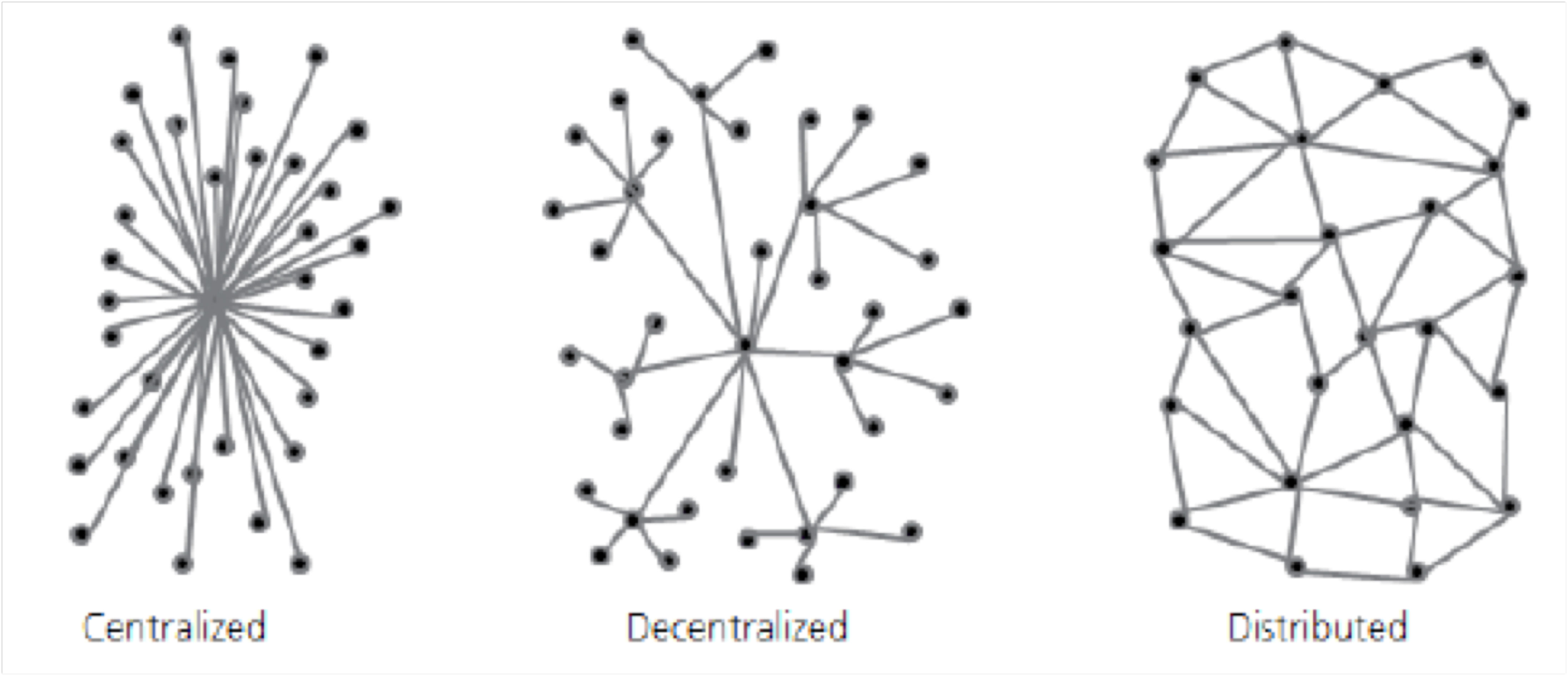

Blockchain is a form of mutual distributed ledger. In a distributed ledger, instead of a single master database held by a central party, various parties hold copies of the whole database. Decisions on what goes into the ledger are based on cryptography and consensus mechanisms. Trust in the accuracy of the entries in the ledger is obtained by mutual consent rather than through a central trusted third party. Distributed ledgers overcome the shortcomings of both centralized and decentralized architectures, which are primarily in use currently. The schematic below (Exhibit 1) shows the differences in the architectures.

Exhibit 1: Distributed Ledger Schematics

Source: UBS

In a centralized architecture, decision making is slow due to bottlenecks and contestation. Decentralized systems’ shortcomings include different nodes coming to different conclusions and its slow nature. Distributed ledgers address both these shortcomings by combining encryption with economic incentives to create a widely accessible and error-proof system. The incentives are used to verify and confirm data entered into the ledger. Every transaction is assigned a unique hash once it is verified. All those validated transactions are then stored and maintained on the open network and all changes are broadcast to all other participants in the system, thereby decentralizing trust. Distributed ledgers can be accessible to all participants (cryptocurrencies for example) or closed (governments, enterprises). In short the three key advantages of distributed ledger technology is speed (settlement of transactions are near instantaneous), costs (while implementation of blockchain is expensive, operational costs are very low) and safety (all the systems holding copy of the database need to be hacked for a hacker to steal data).

As with any new disruptive technology, end market applications for blockchain and use cases will evolve over time as existing architectures become archaic, expensive to manage or databases with sensitive information become easily hacked. Blockchain is the technology that powers cryptocurrency including Bitcoin, as it utilizes all three unique aspects of blockchain, including, fast speed, lower costs and security. Outside of cryptocurrency, blockchain is being evaluated by large companies in financial services, specifically for post-trade reconciliation in capital markets, where existing architectures are very expensive to operate and takes days for process - blockchain would bring that time down to seconds with low operating costs. Over time, blockchain has potential to add significant value in many industries, ranging from governments managing citizen data, to pharmaceutical companies managing drug trial data, to banks and cross border money transfers.

At Driehaus, we are focusing our efforts in identifying attractive growth investment opportunities in innovative companies that are uniquely positioned to benefit from this disruptive technology adoption in the years ahead.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team