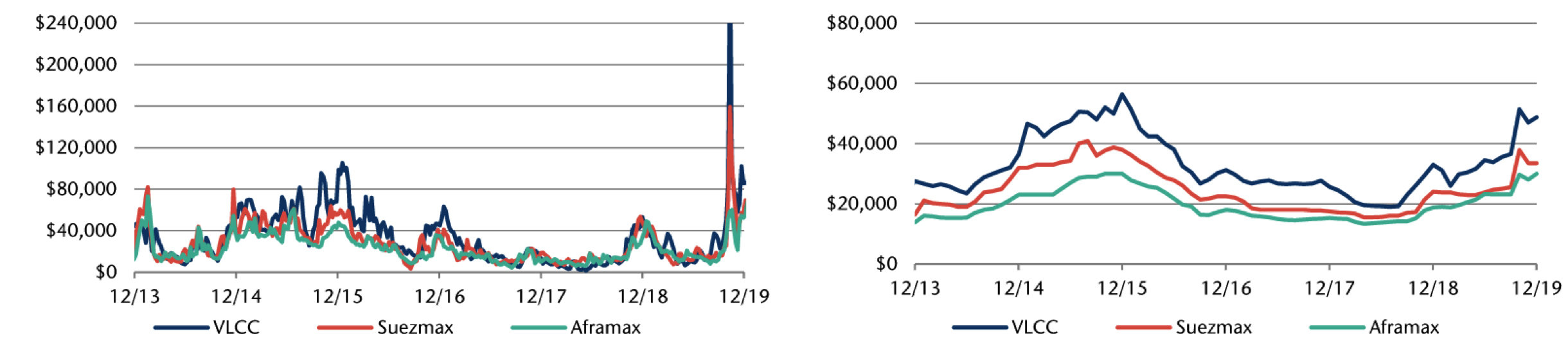

Spot rates for crude tanker charters spiked to multi-year highs in September 2019, following drone attacks on Saudi Aramco oil processing facilities in Abqaiq, Saudi Arabia and the field at Khurais, Saudi Arabia. The attack temporarily knocked out roughly 5% of global oil production and set off a scramble, as many countries looked to replace lost deliveries with shipments that came from a further voyage distance. The spike in spot rates proved temporary, but as shown in Exhibit 1, rates remain at elevated levels and tensions in the Middle East continue to escalate. However, even outside of geopolitical risk, there are several factors driving a more positive outlook for crude tanker spot rates.

Exhibit 1: Crude Tanker Charter Rates

Source: Jefferies Financial Group, CRSL

Positive factors impacting spot rates

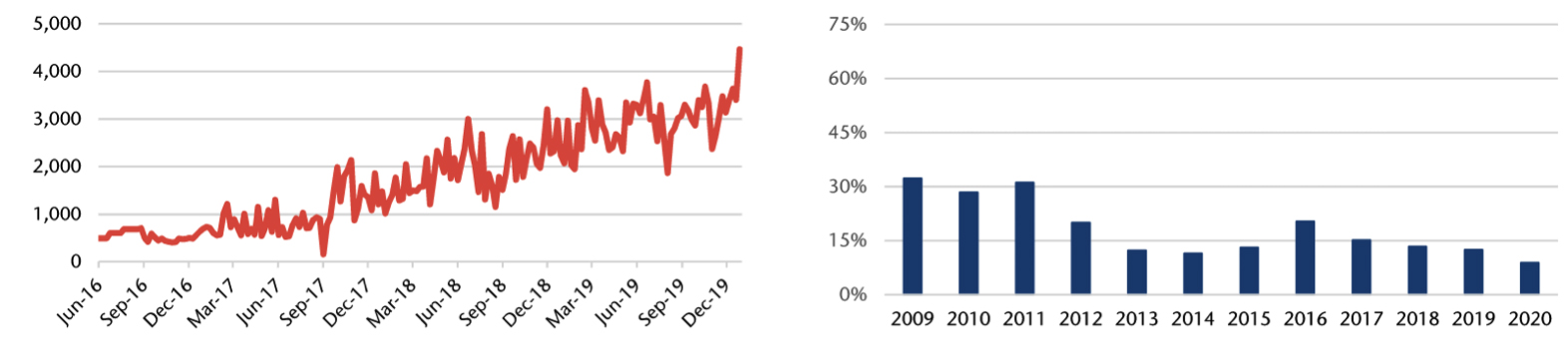

- US oil exports continue to gain global share. Since the US lifted its export ban in 2015, US oil exports have increased from below 0.5 millions of barrels per day (mb/d) to near 4.0 mb/d, as shown in Exhibit 2, and are expected to continue to grow. Growing US oil exports are significant because it is a longer voyage distance, which ties up more vessel supply. Euronav, a crude tanker operator, estimates that it takes roughly double the amount of very large crude carriers (VLCC’s) to transport the same amount of oil from the US to Asia, as compared to from the Middle East to Asia.

- The crude tanker orderbook, as a percentage of the current fleet, has fallen to below 10% which is a multi-decade low, as shown in Exhibit 1. This is significant as it takes roughly 18-24 months for a vessel that is ordered to get built and delivered. Should demand, driven by rising US exports, continue to grow, incremental supply will not hit in the near-term. The amount of available financing for newbuild vessels has also been reduced, as many European banks that typically provided financing, have exited the market.

- A new International Maritime Organization regulation, known as IMO 2020, went into effect on January 1. This regulation cuts the maximum amount of Sulphur that can be used in bunker fuel from 3.5% to 0.5%. In preparation for this regulation, an estimated 20-25 VLCC’s, or roughly 3% of the global fleet, is being used to store IMO 2020 compliant fuel. Using these vessels for storage removes supply from the market in the near-term, but possibly over the long-term as it is thought to be more difficult to place these “standstill” vessels back into service.

- In preparation for IMO 2020, many tanker operators are electing to install scrubbers, which allow vessels to operate using higher Sulfur content fuel. Due to a lack of capacity, scrubber installations have been taking longer than expected. This is an additional factor that is limiting VLCC supply, if only temporary.

- The US has placed sanctions on COSCO Dalian, a subsidiary of China’s largest oil tanker company. These sanctions potentially impact roughly 3% of the global VLCC fleet as they prohibit US-owned entities from directly or indirectly engaging in transactions with sanctioned entities. The US has granted waivers until February 4 to allow a wind down of activities and transactions. It is possible sanctions end if there is a trade deal between the US and China, but speculation has been that these sanctions are more directed at Iranian oil exports and the situation there only seems to be escalating.

Exhibit 2: US Crude Oil Exports and Crude Tanker Orderbook-to-Fleet (%)

Source: Jefferies Financial Group, CRSL and EIA

Potential Risks

- Deteriorating global growth could have a negative impact on oil demand, which would be a negative read-through to VLCC demand.

- Increased ordering of VLCC’s would be a cautious sign. During the last tanker cycle in 2014-2015, tanker stocks topped before spot rates as vessel orders started to rise.

In summary, we see a positive outlook for crude tanker spot rates as demand is positively impacted by rising US export share and expanding voyage distances, while supply growth is limited by a multi-decade low in current orders as a percentage of fleet, an estimated 18-24 months for new vessel deliveries, and other temporary issues limiting supply, such as VLCC’s being used for IMO 2020 compliant fuel storage, scrubber installations taking longer than initially expected, and potential push through of US sanctions on COSCO Dalian. We continue to look for growth opportunities in the crude tanker space for our investment strategies.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2020 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2020 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James