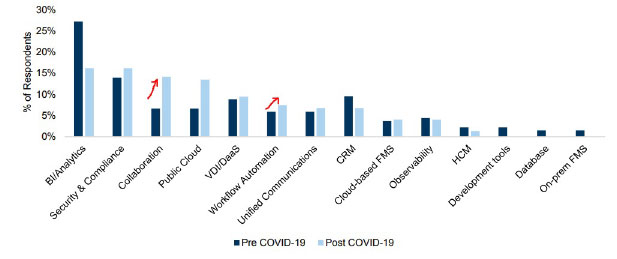

Digital transformation is the adoption of technology to improve business processes, cut out redundancies, and increase efficiencies across all business lines. This fosters innovation and product development, with the result culminating in creating tremendous value for customers. Additionally, the pandemic of 2020 set into motion several trends (such as ecommerce adoption acceleration, hybrid workforce, and remote learning/meetings to name few) that have catalyzed the need for digital transformation in businesses. Amongst digital transformation initiatives seeing increased adoption are workflow automation/collaboration, which makes the work management platform stand out, per recent Goldman Sachs survey among CIOs (Figure 1).

Figure 1. CIO Survey with top priorities for Digital transformation initiatives

Source: Goldman Sachs Global Research

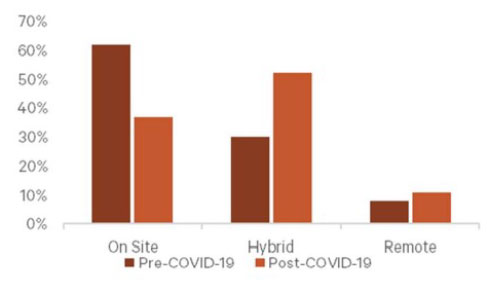

The increased interest in adoption of work management has been triggered by the emergence of the hybrid workforce (mix of in-person and remote), with a recent McKinsey survey showing that the majority of employees see themselves working in a hybrid environment in a post-COVID world, which creates sustainable demand conditions for the next few years (Figure 2).

Figure 2. Employee Survey showing shift into Hybrid work environment

Source: McKinsey Reimagine Work: Employee Survey

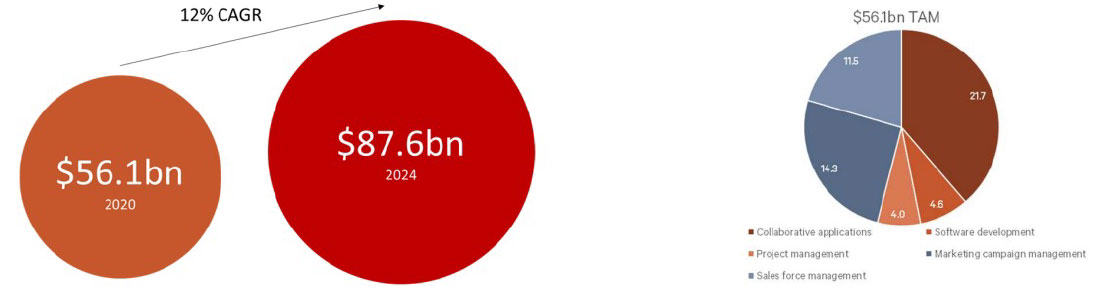

In a work management software solution, reliance on emails and messages is reduced as information is kept in a central organized location and relevant messages and instructions are kept with the tasks to which they are related. Such a platform also enables increased automation of mundane tasks, improving overall productivity of the employees. Market research firm, International Data Corporation (IDC), sees a work management platform addressing departments such as: software development, marketing campaign management, sales force management, and overall collaborative applications. Total addressable market for these work management applications are sized to be $56 billion in 2020, growing to over $85 billion by 2024, at a 12% CAGR. Figure 3 shows IDC growth projections and the components within the Work Management spend.

Figure 3. Total Addressable Market and its Breakdown

Source: International Data Corporation

Among the work management software companies that are currently public, our investments are focused on companies that have embraced a schemaless platform or provide the infrastructure to enable the same. A schemaless work management platform enables a no-code ‘lego’ building block, drag and drop experience for the users to create a fluid workflow process specific to business needs. With the majority of end users of work management/collaboration software being non-technical business users, we believe ease of use, scalability, diverse functionality, and an open-ended nature of the platform are some of the important criteria in determining market share leaders. Accordingly, the strategies have invested in several fast-growing companies that have an open-ended no-code work management platform and/or enable schemaless architecture by being a software infrastructure vendor.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of September 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since September 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James