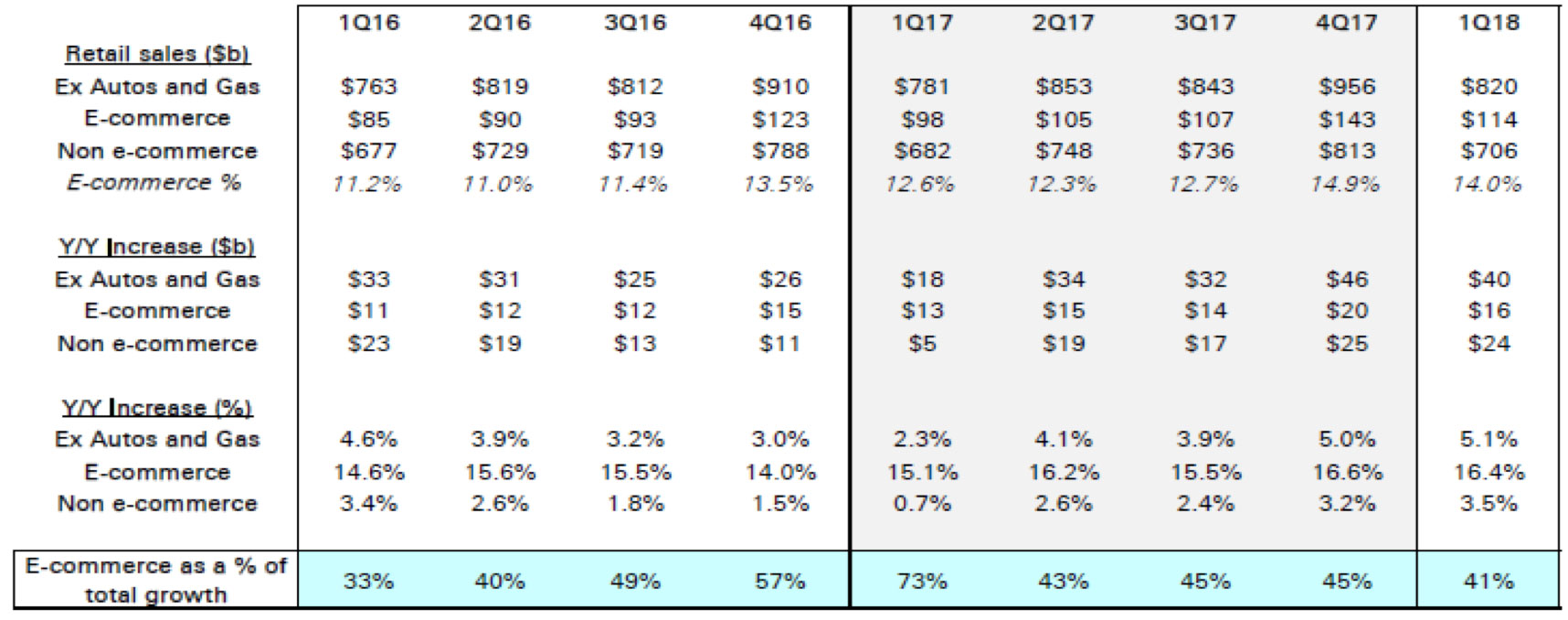

Growth can certainly be linear, but not always. It ebbs and flows, often times inflicting pain along the way. However, pain drives change, and for investors, that creates opportunity. We frequently find growth opportunities in companies recovering from downturns after restructuring, simplifying, and evolving into more efficient organizations. We are seeing this unfold today in the retail and apparel industry. After several years of share losses to ecommerce retail and margins pressured by bloated inventory, companies with strong brands are making changes to drive higher-quality sales leading to inflecting earnings growth. Not too long ago, many of these companies were left for dead. However, the ones that have survived are reaping the benefits. The first quarter of 2018 saw the best brick and mortar retail sales growth in three years, +3.5%, marking the third consecutive quarter of acceleration. Growth in e-commerce, while still outpacing brick and mortar, decreased as a percent of overall growth. (Exhibit 1)

Exhibit 1: E-commerce Impact to Retail Sales (ex autos & gas) - Quarterly

Source: Deutsche Bank

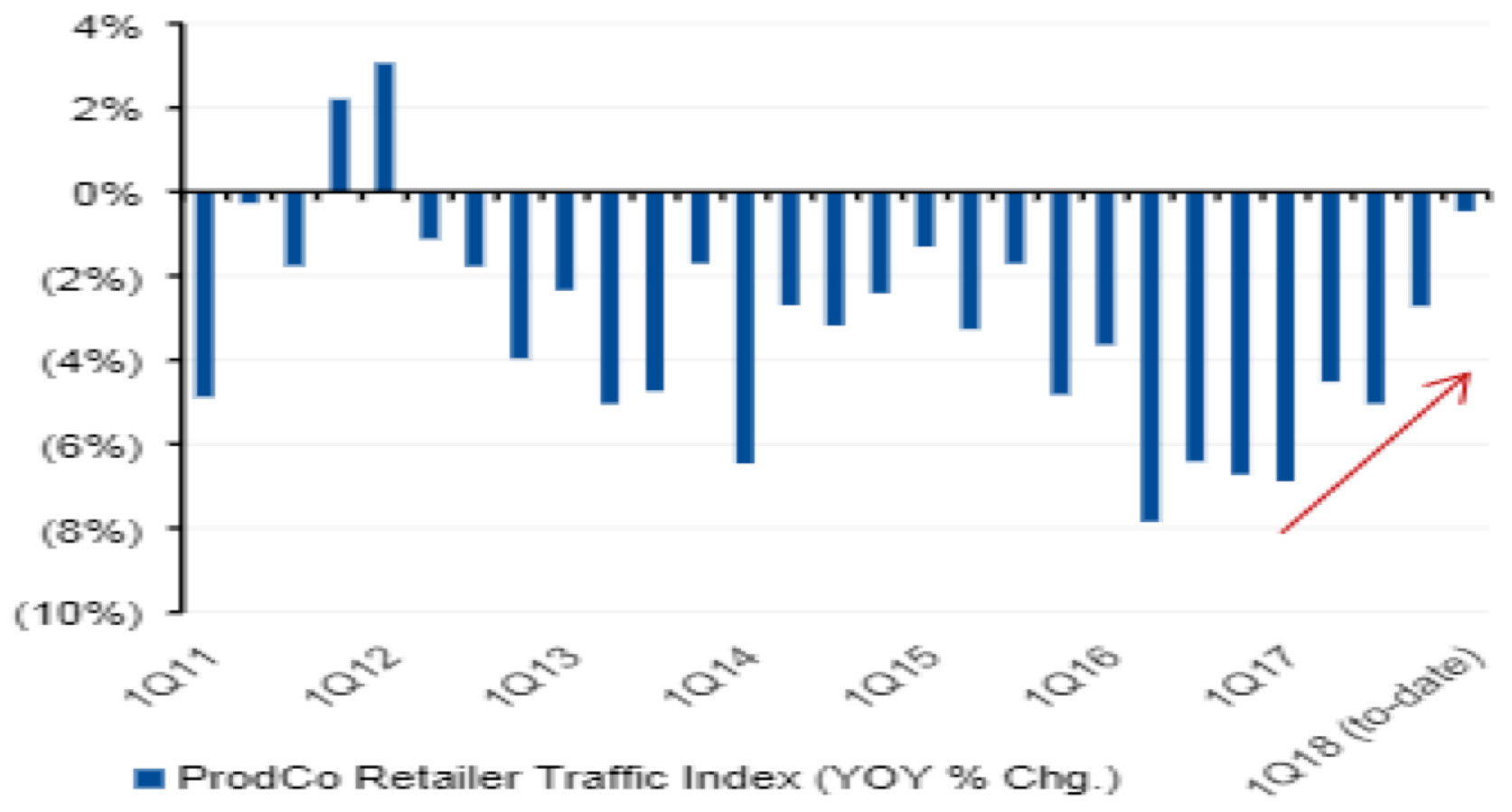

Better inventory management has enabled brands to optimize their channel mix. The days of stuffing and discounting excess inventory into their highly-visibly websites are over. This behavior not only lowered sales quality but had adverse effects on brand perception, resulting in a double-whammy for revenue growth. One of the reasons for improving brick and mortar sales growth mentioned above is better traffic trends. For the first time in several years, traffic is near a positive inflection. (Exhibit 2)

Exhibit 2: Traffic Trends at Brick & Mortar Stores

Source: ProdCo, Credit Suisse estimates Note: Represents calendar quarterly

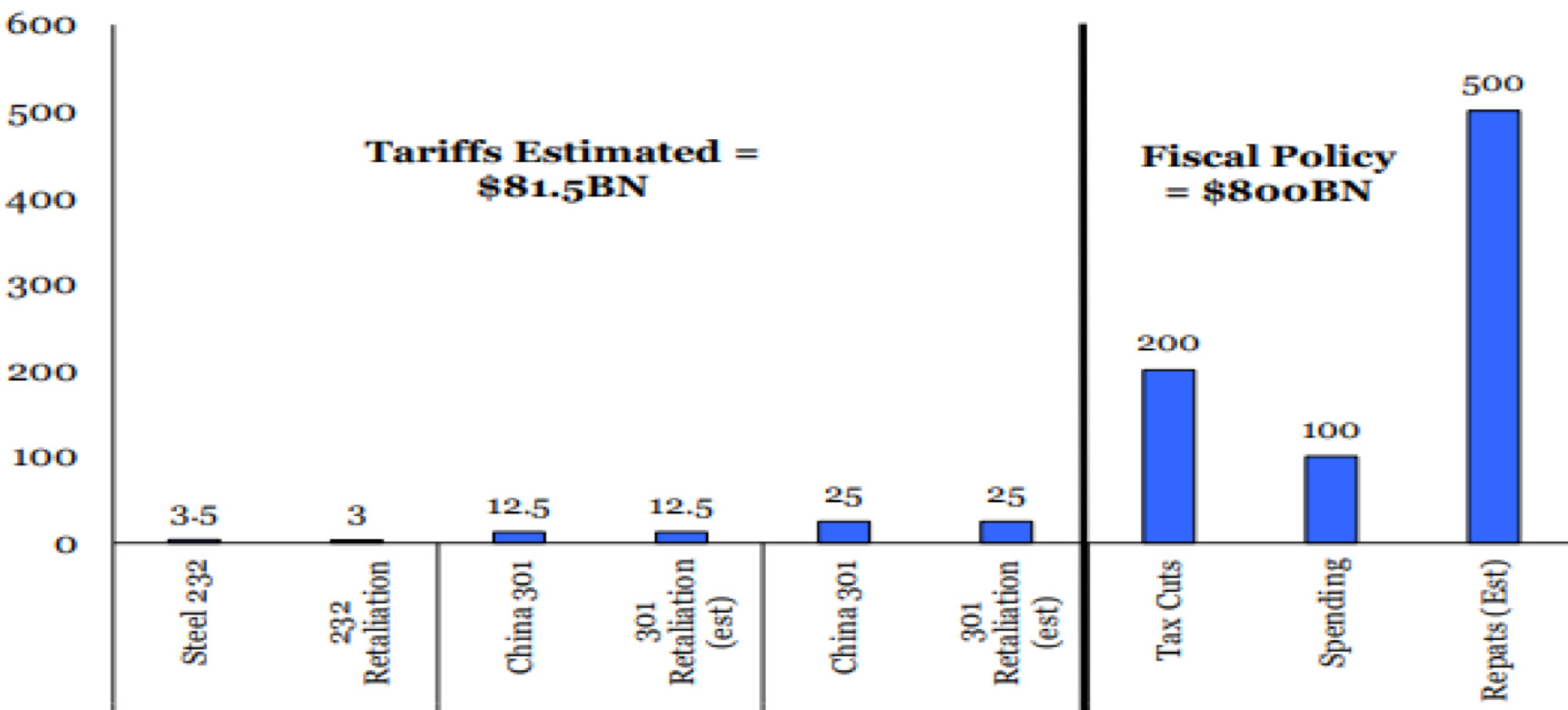

Concurrently, the consumer is in the best financial health in years and should remain so for years to come. Unemployment is beneath 4%, interest rates are still low by historical standards, and consumers are enjoying the impact of shock-and-awe fiscal policy. While there is fear of a trade war slowing growth, the size and magnitude of fiscal tailwinds dwarfs this threat on an annual basis. (Exhibit 3)

Exhibit 3: Comparing the Size of Tariffs with Incremental Fiscal Policy, CY 2018 $BN

Source: Strategas

We are enthused by these developments, because it presents us with opportunities in a newly investable space. Many of these stocks currently fit within the recovery category under our growth philosophy. These types of investments can create great outperformance when identified correctly. The apparel space has underperformed the broader market until very recently, and we view its recent outperformance as sustainable.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of June 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since June 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team