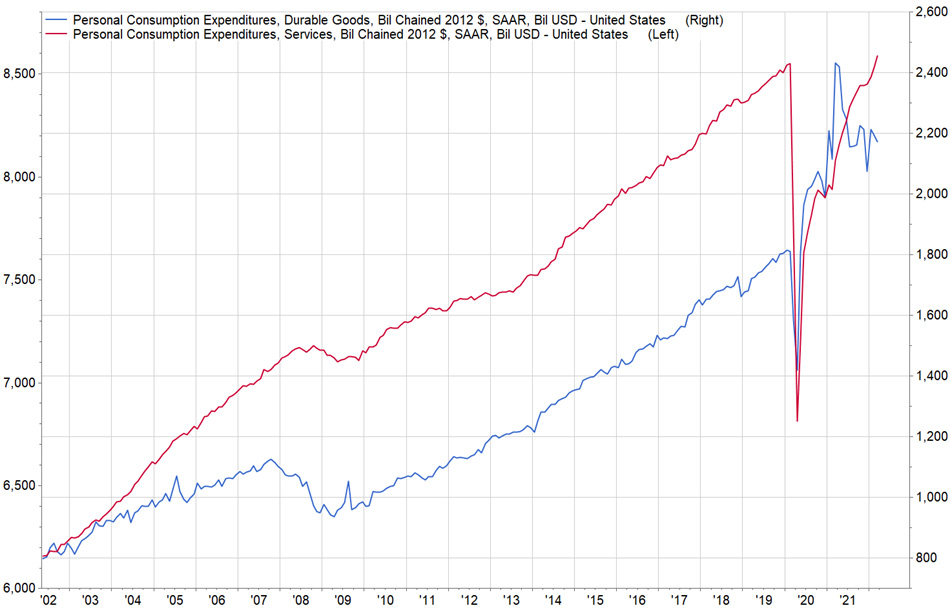

Investors in consumer stocks have been preparing for a shift in spending away from durables (such as washing machines and furniture) and into services (such as restaurants and hotels) for over a year. Relative to historic growth rates, consumer spending on durable goods accelerated well above trend during the pandemic driven by stimulus and a lack of other outlets for spending. Spending on services, while improved from 2020 lows, has yet to fully recover to the prior growth trend established after the Great Financial Crisis.

Exhibit 1 - Durable Goods versus Services

Source: FactSet

As the severity of the pandemic has subsided and comfort with traveling and eating in restaurants has increased, spending on services has been recovering. As one strategist has put it, consumers are transitioning from buying stuff to doing stuff. While this shift is widely expected, the pace of the shift, the extent to which durables spending simply plateaus rather than reverting to trend and the degree to which spending in both categories is impacted by tightening monetary policy are key questions that investors are grappling with. Recent economic data sheds some light on the pace of this transition in consumer spending and provides some hints as to the trajectory of spending on durable goods.

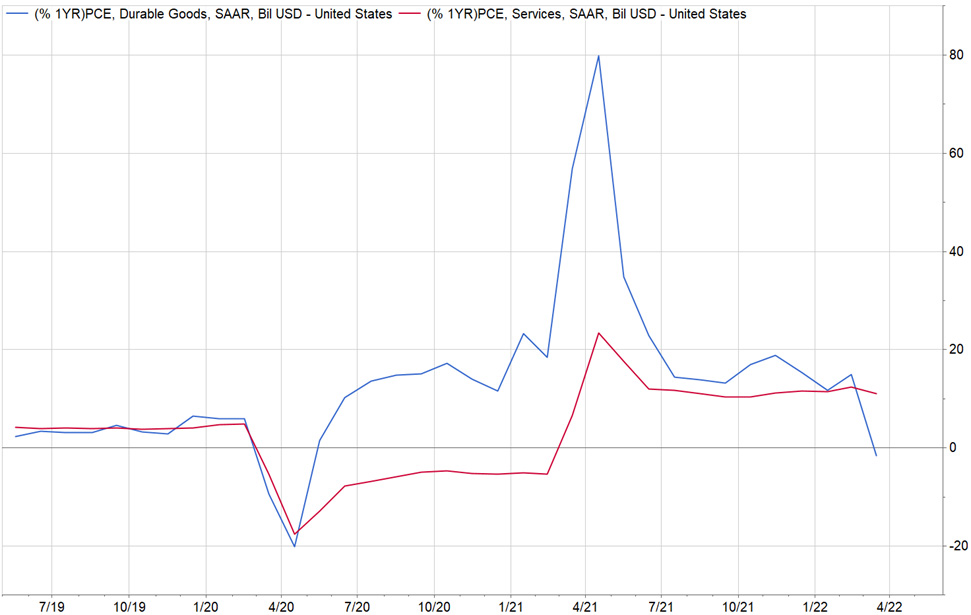

Exhibit 2 shows the change from the prior year in personal consumption expenditures for durables and services. While services spending has been steadily recovering at a low double-digit pace durables spend has begun to decline relative to the prior year, with March being the first month where year-over-year spending growth in services outpaced durables.

Exhibit 2 - Durable Goods versus Services (1YR)

Source: Factset

With the pace of growth diverging, it is no coincidence that stocks in the hospitality, restaurant and leisure industries have outperformed other industries such as home furnishings and apparel retail. Within the large cap universe this can be demonstrated by the outperformance year-to-date of a hotel operator relative to a home improvement retailer.

Exhibit 3: Relative Strength versus Home Improvement Retailer

Source: FactSet

With such substantial outperformance by leisure companies, investors now must try to determine the extent to which this shift in spending has been fully anticipated by the market or if the consensus trade of “experiences over things” will continue.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of May 2022 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since May 2022 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team