A common investor view is that an allocation to emerging markets equals an allocation to commodities. This perception was formed during the China-driven commodities bull market of the 2000s, a time during which the representation of energy and materials companies in the MSCI Emerging Markets Index rose dramatically and the correlation of EM equities to the commodity price index increased significantly. However, this view is growing stale and overlooks a significant shift that has taken place in recent years.

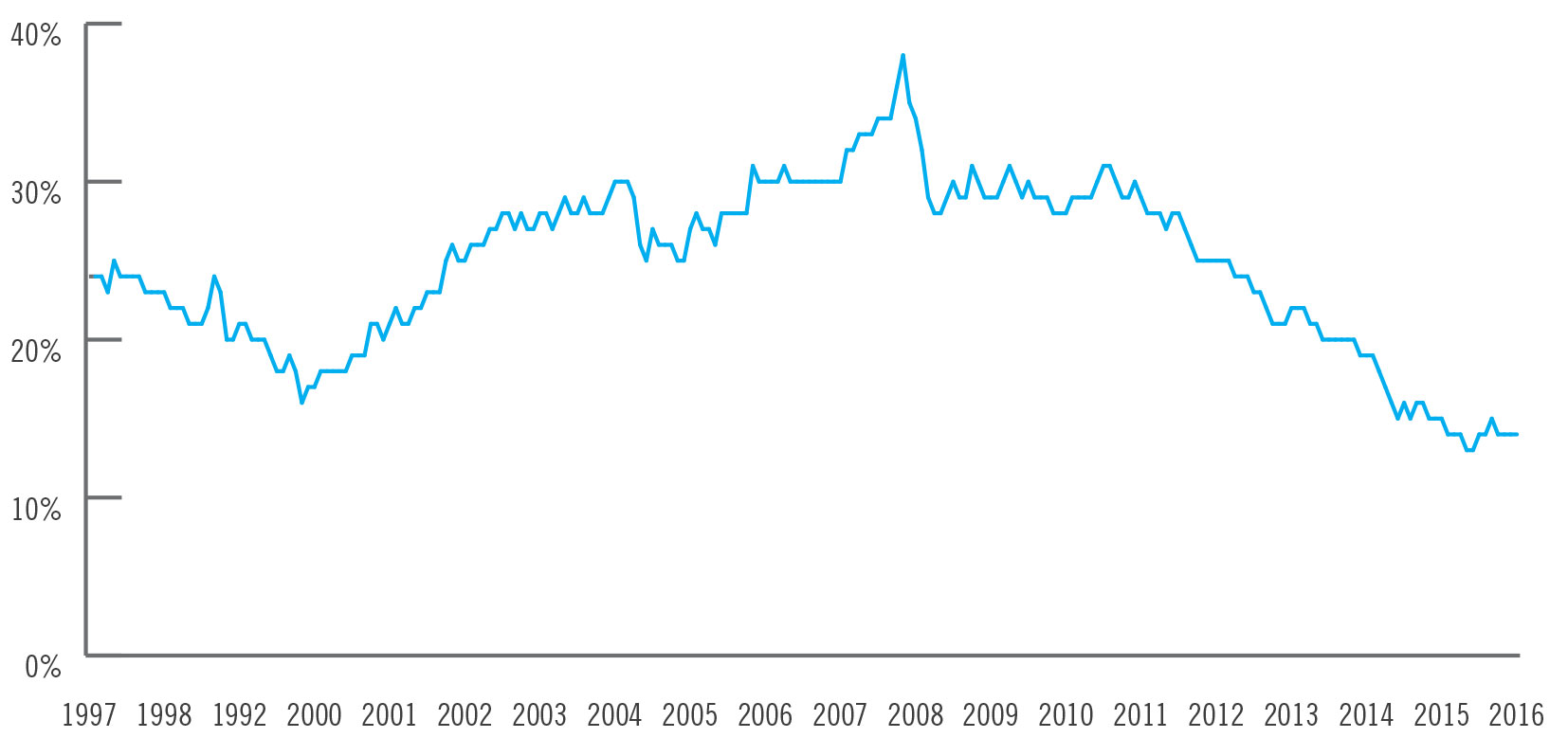

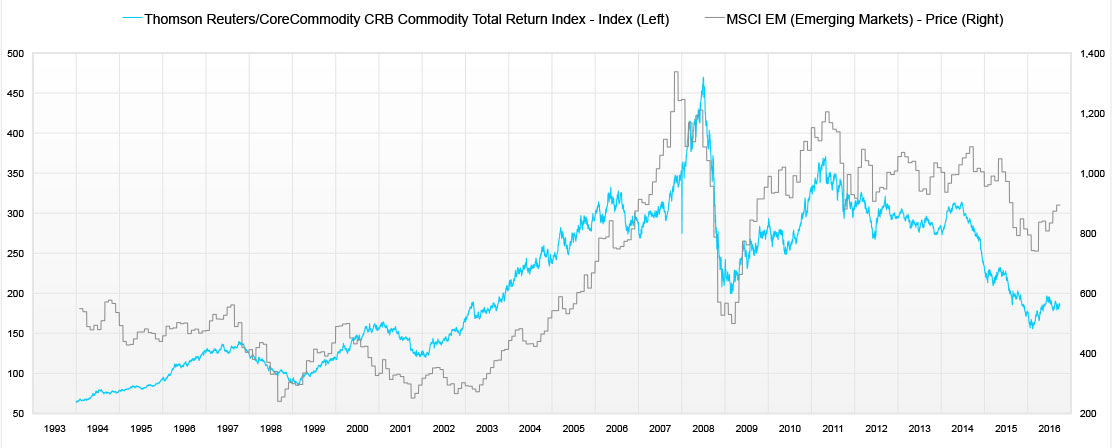

As Exhibit 1 shows, after peaking near 37% in 2008, the combined weight of the energy and materials sectors has fallen to only 14% of the MSCI EM Index. At the same time, performance of the EM index has begun to decouple from performance of the commodity price index (Exhibit 2). These shifts reflect both the shrinking market cap of commodity producing companies and a changing composition of the index in favor of other sectors, such as information technology (as noted in the Driehaus paper, “The Evolving Emerging Markets Opportunity Set”). In fact, the weight of the tech sector in the EM index now exceeds its weighting within the S&P 500 Index.

Exhibit 1: Combined weight of the energy and materials sectors within the MSCI Emerging Markets Index

Source: Driehaus Capital Management | As of August 31, 2016

Exhibit 2: Commodity performance (blue, LHS) is a less significant driver of the MSCI EM Index returns (gray, RHS)

Source: Driehaus Capital Management | As of September 26, 2016

While the economic performance of many emerging market countries remains heavily commodity-dependent (Brazil, South Africa and Russia to name a few), and commodity prices will no doubt continue to impact the asset class, we see the unfolding trend of the past few years continuing. Most of the large emerging countries are commodity importers, and the companies we expect to witness the largest increase in index representation are skewed toward sectors other than energy or materials. This should gradually change the perception that emerging markets are only about commodities.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of October 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since October 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab