Equity markets often experience bouts of violent reversals as new leadership emerges. During the past month, a flattening of the U.S. yield curve served as a catalyst for just such an occurrence. Equity multiple expectations reset and widely held growth stocks were punished.

The Driehaus Emerging Markets Investment Team previously discussed the potential for an abrupt growth-to-value shift and made modest portfolio adjustments to prepare for this risk scenario. However, the indiscriminant nature of the sell-off yielded a harsh environment for fundamental growth managers and the Driehaus Emerging Markets Growth strategy was not immune.

Citigroup’s Quant team produced an insightful factor summary of global emerging markets for the month period following the start of growth-to-value shift. They reported that companies with positive estimate revisions returned -16.62% while Value returned 8.53% over the same timeframe. Exhibit 1 offers an example of this. It shows the price performance for a large Brazilian energy company (white), which advanced more than 40% from its trough in March despite earnings revisions that continue to trend lower.

Exhibit 1: Despite earnings revisions trending lower, this large Brazilian energy company rose 40% from its March low

Source: Bloomberg

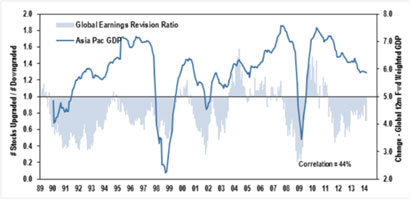

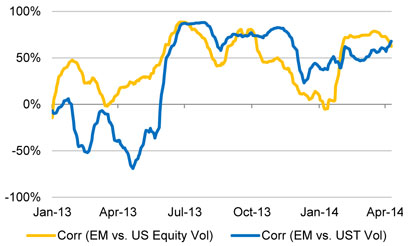

Additional studies from BofA Merrill Lynch suggest global fundamentals also have not inflected meaningfully, adding credence to the notion that the past month’s market gyration is temporary (Exhibit 2). An equally insightful chart from Morgan Stanley Research reflects the extent to which EM volatility has correlated with U.S. Treasurys (Exhibit 3).

Exhibit 2: Global Earnings Revision Ratio and Asia Pacific GDP

Source: BofA Merrill Lynch

Exhibit 3: EM spreads are closely related to U.S. Treasury volatility

Source: Bloomberg, Morgan Stanley Research

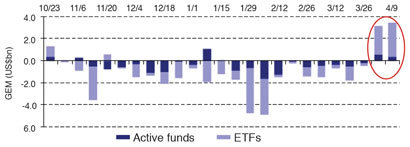

Exacerbating the growth-to-value shift was the simple fact that positioning in some emerging market trades was significantly crowded. The unwinding of these trades resulted in dramatic price declines. Some investors attempted to cover underweight exposures through passive products rather than through the selection of fundamental stock ideas. Not surprisingly, about 95% of inflows into emerging markets came via passive vehicles (Exhibit 4).

Exhibit 4: Emerging market equity flows

Source: Credit Suisse Research

As a fundamental growth equity manager that focuses on positive inflections in company earnings, the past month proved difficult for our investment style. Importantly, however, we have remained consistent with the investment philosophy that has guided the strategy’s long-term success. Bouts of fundamentally unfounded performance such as what we have just experienced tend to transition into periods of new market leadership. We expect that fundamental earnings growth and revisions will again take the helm in terms of market performance, and that passive flows will migrate back into active stock positions.

We are using the market turmoil to opportunistically add to beaten down positions in exciting fields such as industrial automation, casinos/gaming and IoT (Internet of Things), among others. Following disruptive periods such as these, our research suggests that markets tend to remain volatile for about three to five months before stabilizing. During this period, we will seek opportunities to exploit any choppiness to continue bolstering our higher conviction ideas.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2014 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2014 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab