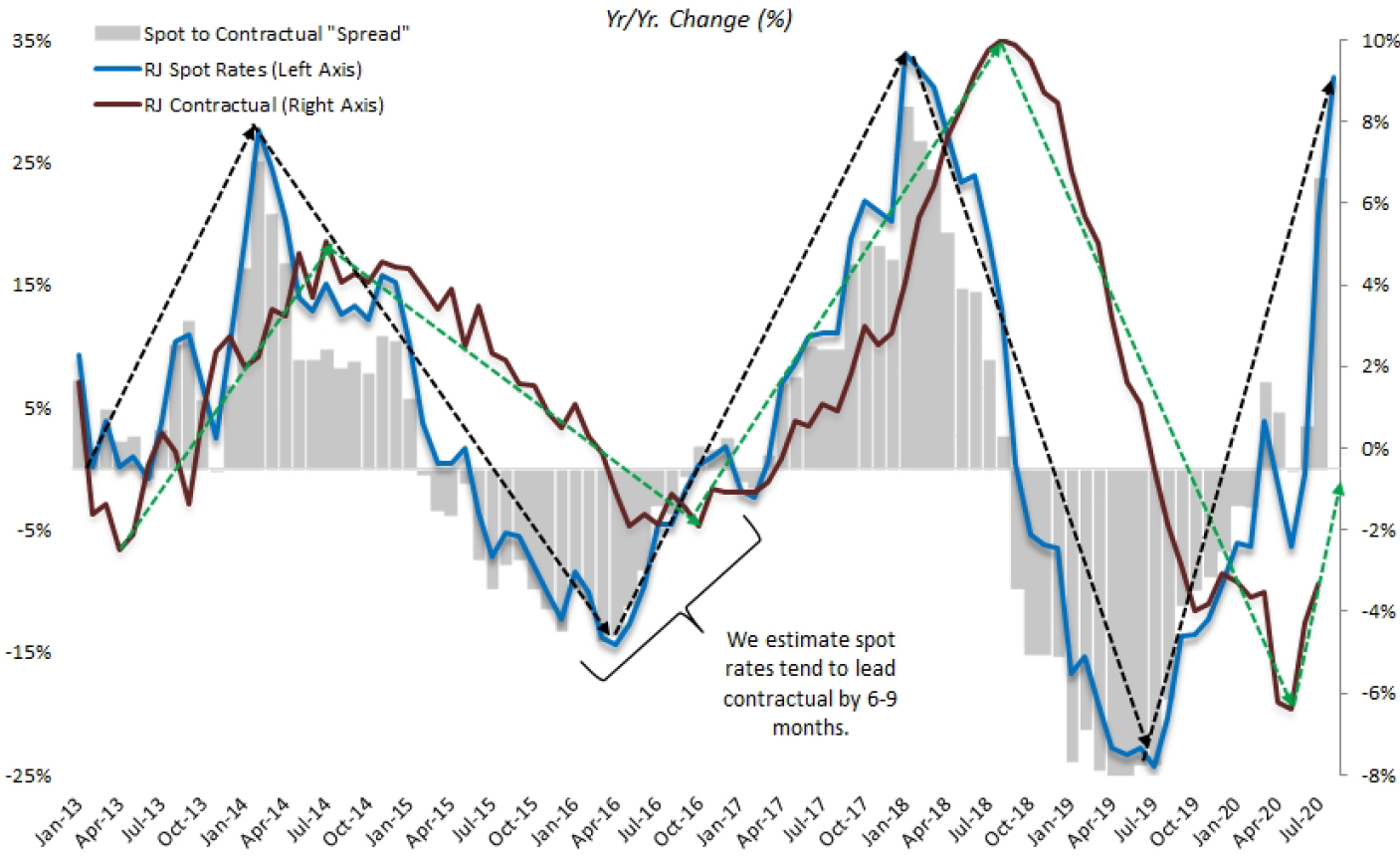

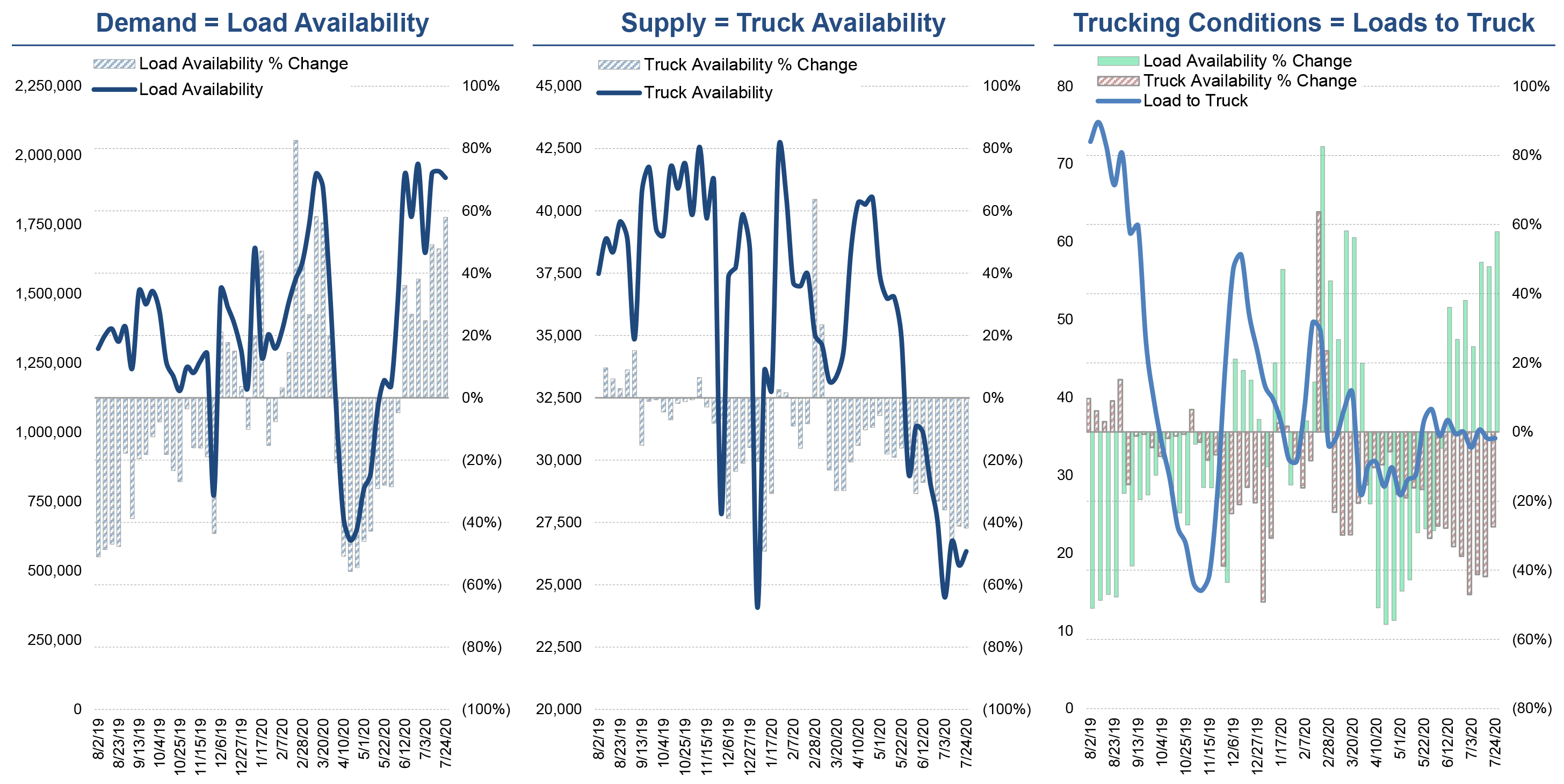

COVID-19 has catalyzed and accelerated the adoption of technology in industries amenable to digital innovation. Electronic commerce (E-commerce) is a great example of a channel experiencing greater utilization due to consumers reducing visits to the store when possible. Enabling the shift in behavior is the transportation and freight industry, which is experiencing very strong demand. Raymond James estimates that core rates ex-fuel for truck carriers are up 35% year over year (Exhibit 1). With so much product demand being funneled online, capacity is becoming more difficult to locate, driving an acceleration in costs for shippers (Exhibit 2). Spot rates will lead contract rates by six to nine months, so based on current market dynamics, carriers are at the beginning of a positive earnings estimate revision cycle.

Exhibit 1: Historical Dry Van Spot vs. Contractual Rates (ex-Fuel)

Source: Raymond James estimates synthesized by DAT trendlines, Internet Truckstop, Truckloadrate.com

In order to manage more loads, freight brokers are in a race to develop better technology to improve their service. Improved technology is expected to play a major role in the future of freight brokerage. Winners will be first movers with scale that offer seamless desktop and mobile applications, utilizing algorithms and predicative analytics to offer real-time pricing and improved access to capacity. This could be a big source of savings for both shippers and carriers, at a time when the market is experiencing great cost pressure from labor, regulations, and rising insurance premiums. One broker who has already invested in offering a mobile brokerage platform, has reported servicing four million carriers per year and improved load-purchasing rates by 12% for shippers. Adoption of digital freight solutions by carriers is accelerating as they are realizing additional benefits from preemptive load recommendations that reduce empty miles by 16%. As these platforms evolve and grow, the owners of the technology will optimize monetization and gain a high-margin revenue source. This dynamic should allow these companies to earn higher earnings multiples over time.

Exhibit 2: Current Supply Demand Imbalance

Source: ATA, Evercore ISI Research

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of September 2020 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since September 2020 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James