The demand for innovation today in categories like consumer electronics, autos, and energy storage has created unprecedented demand for lithium. Due to lithium’s unique characteristics—low density and high electrochemical potential—lithium-ion batteries are lighter and have greater energy-storage capacity than other materials. It doesn’t take much of the element to power something like a camera or cell phone, just about six grams.

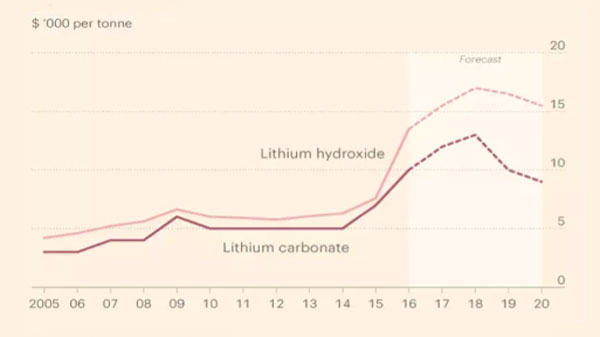

Those characteristics are why it became the element of choice (over lead-acid and nickel-metal hydride) for batteries found inside the majority of electric vehicles produced today. By some estimates demand for lithium could triple by the year 2025 as electronic vehicle adoption grows, battery-storage power plants emerge, and consumer device complexity advances. Expectations are for demand to outpace supply by 50 kilotons through the year 2020. We already see evidence of this supply/demand imbalance in recent price trends. Beginning in 2014, the price of lithium started a dramatic price increase (Exhibit 1).

Exhibit 1: Lithium prices

Source: Benchmark Mineral Intelligence

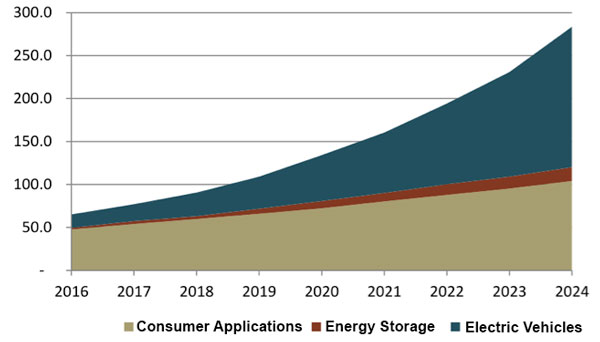

While the largest source of demand today is consumer applications such as phones, the next leg of growth is expected to come from energy storage and electric vehicles (Exhibit 2).

Exhibit 2: Projected lithium-ion battery demand (gigawatt hours)

Source: BNEF, Baird

For investors, along with a strong growth outlook and rising prices, an attractive dynamic of the lithium market is the oligopolistic nature of the supplier base. Three suppliers control 58% of the global supply, while the rest of the market is comprised of smaller Chinese companies. Lithium isn’t necessarily scarce, but government approval and a slow-moving regulatory environment impede access to the resource. The developed infrastructure of existing companies gives the largest producers a significant head start against any new entrant. We expect established suppliers to continue to benefit from the accelerating demand for lithium over the next decade.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of February 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since February 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James