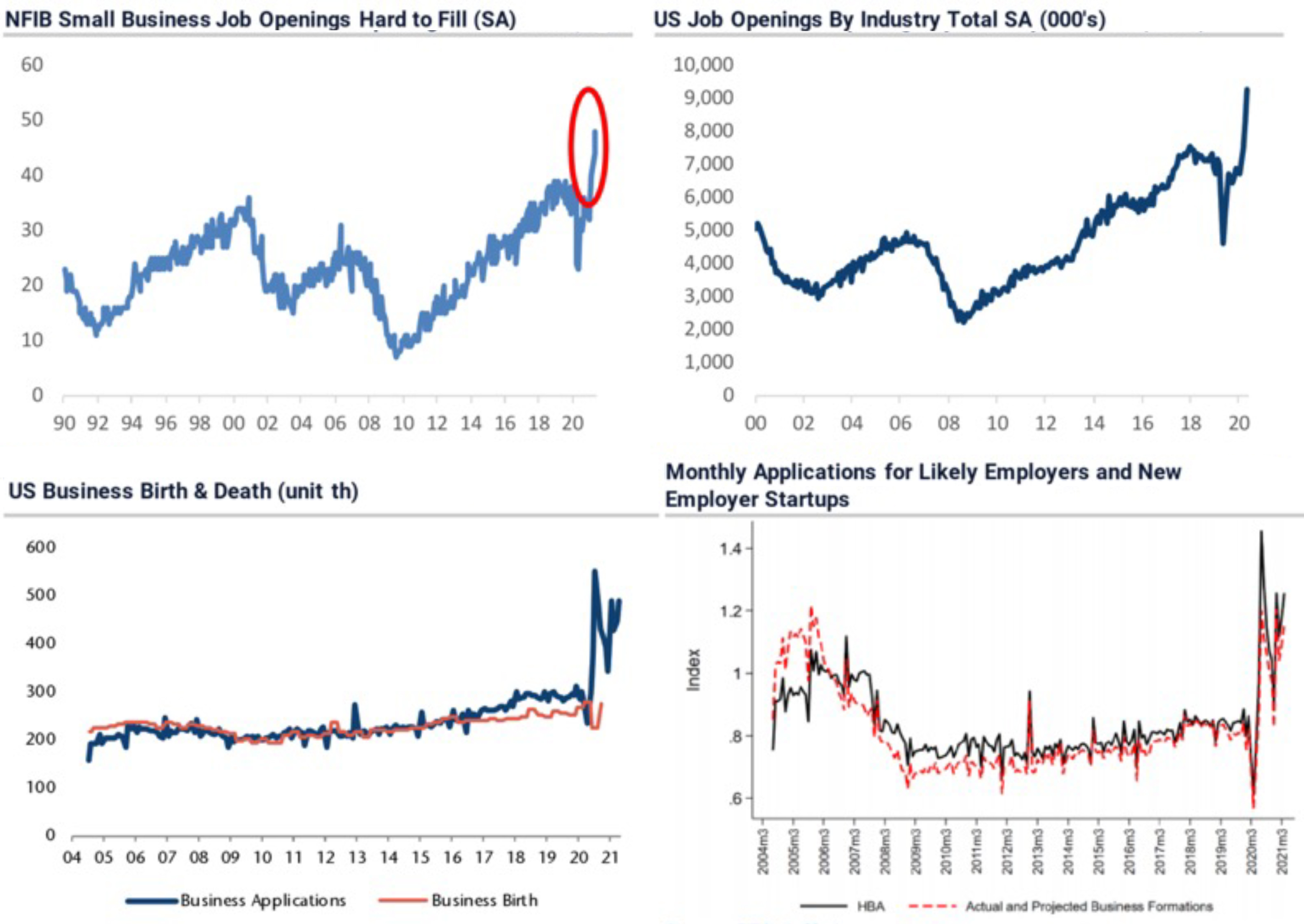

If you have traveled anywhere over the past few months, chances are you have come across multiple signs that read “Help Wanted.” It does not seem to matter if it is the grocery store, a restaurant, or a hotel. Whatever type of establishment it may be, it is likely understaffed, and the service level does not seem to be quite what it was back in 2019 before the pandemic. And it is not your imagination. Job openings in the U.S. are at record highs, while new business formations spiked to multi-year highs as well (Exhibit 1).

While employers are currently struggling to find workers, there are reasons to be optimistic the situation will improve. First, enhanced unemployment benefits are scheduled to expire on September 6, 2021 and some states have already began to cut them. As this happens, it should drive more people to seek employment. Second, with most schools likely returning to in-person learning in the Fall, it could free up some parents to go back to work, also increasing the labor pool. In addition to these two cyclical factors, we see other factors that are creating investment opportunities within companies that offer services to the employment industry.

Exhibit 1: Job openings and new business formations

Source: Bloomberg, CEIC, BFS, Jefferies

Labor market trends

Executive search: Executive turnover was lower than normal during the pandemic and this is beginning to rebound. Several executive search firms we follow had the best months in the history of their respective companies from March 2021 to May 2021.

Outsourcing of recruitment: Many firms cut back internally on recruitment spending during the pandemic. There is a trend towards increased outsourcing of this function, as demand is ramping back faster than expected and there is a realization that geography is no longer a limiting factor for talent acquisition.

Environmental, Social, & Corporate Governance (ESG) & Diversity: As public companies continue to address investor focus on ESG and diversity, it is creating new corporate level positions and thus expanding the addressable market for recruiters.

Freelancing: Freelancing is still a low percentage of the overall employment base, but companies operating these marketplace platforms are growing revenues at 20%+ growth rates. The pandemic has only served to accelerate growth, as many enterprisers are increasingly comfortable with using freelancers for outsourced projects. This market should continue to grow as freelancing is often a form of supplemental income for employees.

Record job openings: As these positions are filled, it will increase demand for services such as background checks and employment verifications.

Record new business formations: As ease of business formation increases, demand for legal services to navigate various laws and jurisdictions will increase.

As the economy continues to grow, demand for labor will continue to increase. This can accelerate growth in each of the labor market trends listed above. We continue to look for growth opportunities related to these labor market trends for our investment strategies.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of July 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since July 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James