Housing and autos are two of the most important parts of the US economy. According to the National Association of Homebuilders, home construction, remodeling and brokerage represents about 3-5% of GDP. The Center for Automotive Research estimates that the auto industry averages 3-3.5% of GDP. While both industries have been meaningfully impacted by COVID-19, prospects for a recovery and sustained growth the next several years are quite good.

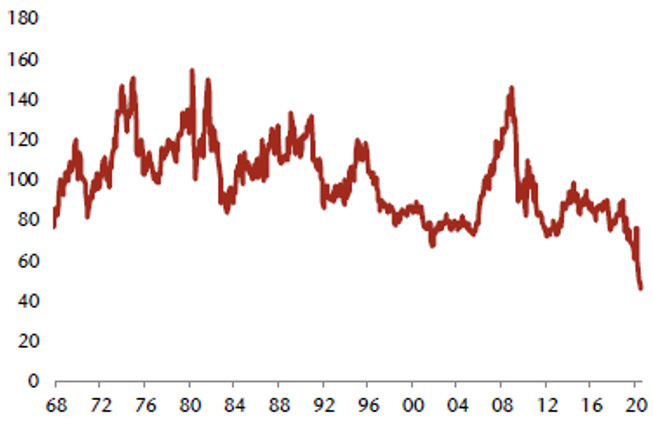

In the near-term, inventories for housing and autos are at record lows. The Jefferies US Housing and Auto Inventory Index has reached a new post-war low as seen in Exhibit 1.

Exhibit 1: US Housing and Auto Inventory (Index = 100)

Source: Bloomberg, Jefferies

Demand has recovered in surprisingly rapid fashion, helped by low interest rates, monetary and fiscal stimulus, demographic shifts and a potentially massive shift in consumer preference for suburban living. Supply has been held back by the difficulty in restarting complicated supply chains and a lack of existing homes being listed by consumers who do not want strangers touring their home. The resulting lean inventory position should result in multiple years of benefit from restocking and rebuilding along with strong pricing power for manufacturers and retailers. With millennials now in their prime home-buying and child-rearing years (see Exhibit 2 below), demographics should sustain elevated levels of demand for housing and autos, even if the COVID-driven desire to leave crowded urban centers proves temporary.

Exhibit 2: Projected U.S. population Aged 30-40

Source: US Census Bureau’s 2017 Population Projections: Low Immigration Scenario; Compass Point Research

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of December 2020 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since December 2020 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James