What to do about raw material inflation? Aside from owning commodities, a group that performs well during periods of rising input costs early in an economic expansion is multi-industry and machinery stocks. Toward the end of the downturn, these stocks’ multiples will begin to expand, once there is visibility into an earnings recovery. When the recovery commences, earnings power for these companies can be very strong. Owning stocks facing rising input costs may seem counterintuitive, but it turns out the underlying driver of inflation, which in this sense is economic growth, more than offsets these variable costs.

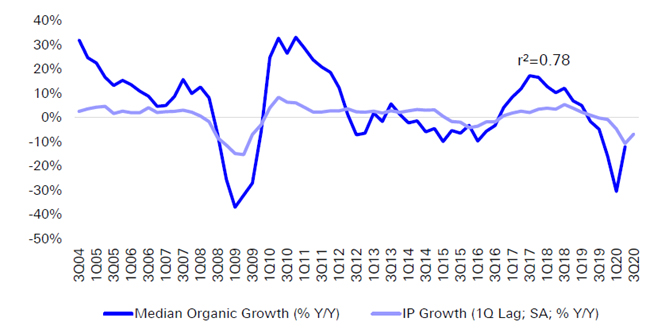

Once an economic recovery ensues, inventory gets worked down and industrial production begins to ramp up in order to meet new demand. Inflationary pressures emerge as demand quickly outstrips supply. Multi-industry and machinery stocks benefit from this early-cycle dynamic, and despite facing rising input costs in the form of steel, energy, or aluminum, fixed cost leverage from volume growth in addition to price increases drive strong earnings growth.Therefore, multi-industry and machinery stocks perform well coming out of downturns and into the early phases of an economic recovery as investors gain confidence in the recovery. The group’s organic growth is highly correlated with industrial production (Exhibit 1).

Exhibit 1. US Machinery Industrial Production Correlation

Source: Deutsche Bank

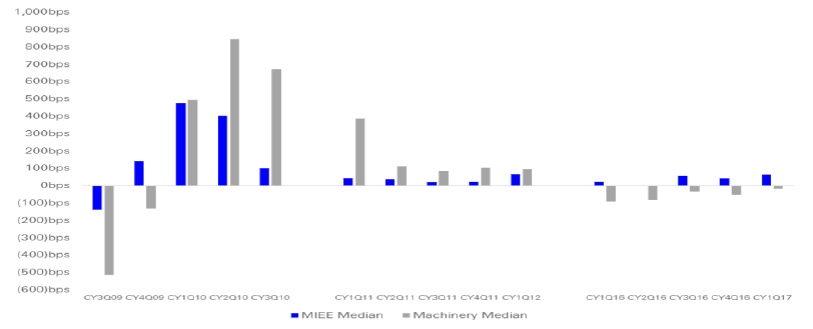

Cyclical earnings growth is a function of both revenue growth and margin expansion. The latter is the more interesting driver. As input costs increase, they often get passed on to customers. One example that demonstrates this well is margin performance during periods of steel inflation. Exhibit 2 shows operating margin performance during episodes of steel inflation.

Exhibit 2. Margin Performance in the Face of Steel Inflation

Source: Deutsche Bank

There are many more relevant nuances involved than outlined in this note, such as hedges that attempt to preserve cash flow, market share shifts, and regulations. Every relationship has outliers, and each cycle is unique, but generally, multi-industry and machinery companies can produce strong earnings growth above consensus estimates for many quarters coming out of a recession despite higher raw material costs.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team