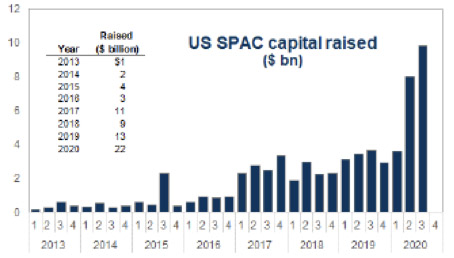

Of late, the financial media has been inundated with articles about the proliferation of the SPAC market. Special Purpose Acquisition Corporations, or SPACs, have been on the rise and gaining more widespread adoption. The number of initial public offerings (IPO), issuance size, accompanying private investment in public equity (PIPE) investments, and investment bank underwriting are all surging in SPACs. For context, consider the year to date market activity (Exhibit 1):

- 55 SPACs went public this year, raising $22.5 billion in proceeds.

- Another 22 SPACs on file to IPO in the coming weeks.

- More than 100 SPACs are currently in the market, with close to $40 billion in their war chests.

- The largest-ever SPAC raised $4 billion in its offering on July 22.

Exhibit 1: US SPAC capital raised has surged YTD

Source: Dealogic, Goldman Sachs Global Investment Research

For comparison purposes, 2019 saw 59 IPOs and $13.6 billion in proceeds, both previous record levels. In fact, SPACs have accounted for one-third of all US IPO activity since the start of 2019, as both sponsors and investors gain increasing confidence in the vehicle.

The Driehaus Event Driven strategy has been investing in the SPAC arena for years. Most recently, we wrote about the attractive yield and total risk adjusted return opportunity left in the wake of the first quarter market sell off here. In light of the recent spotlight on the SPAC market, we thought it worthwhile to highlight our approach to SPAC investing.

We navigate the SPAC investment landscape as we do all other areas of event driven investing; we employ a bottom up, research driven approach, focused on unlocking value through idiosyncratic corporate actions. Specifically, we believe we can increase the odds of success by investing in companies that display strong fundamentals, catalysts to unlock value, alignment of stakeholder incentives, proven and experienced management teams driving tangible outcomes, and exposure to robust end markets at compelling valuations.

Additionally, the managers’ attraction to investing in SPACs is rooted in two key tenets that we seek across all our investments: downside protection and inexpensive optionality. SPAC shares are backed by cash in trust; that cash provides tangible downside protection, which tends to act as a floor to the share price. SPAC shares also carry attached warrants, which can create the opportunity to exploit mispriced upside optionality. The resulting skew of return and risk aides in making the SPAC opportunity set compelling.

While no two SPAC opportunities are the same, the strategy's investment landscape is enhanced by our repeatable playbook navigating this growing area. This has led to a diverse group of compelling investments for the strategy. We anticipate this increased focus on SPACs to remain a fruitful endeavor for the foreseeable future and welcome the increased attention the space has garnered.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of August 2020 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since August 2020 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Event Driven Fund March 2024 Commentary with Attribution

By Yoav Sharon

Driehaus Event Driven Fund December 2023 Commentary with Attribution

By Yoav Sharon