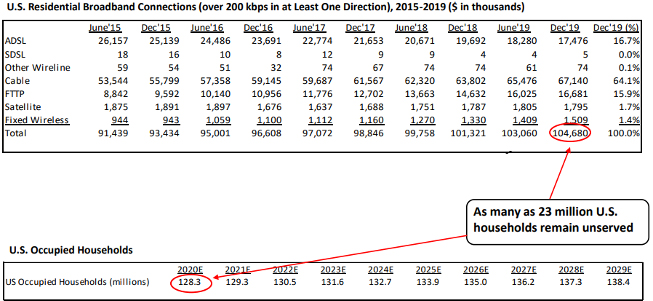

After the large-scale broadband internet infrastructure buildout in the late 1990’s in the US, investments towards broadband internet infrastructure have been below end market demand over the last two decades, as absorption of existing capacity and capital intensive nature of buildouts have resulted in slower buildouts. The most impacted in this under-investment has been rural America, where a good segment of the population does not have access to broadband internet. The table below shows that more than 20 million households in the US do not have broadband internet coverage, with much of the uncovered households being in rural and suburban America, where the population tends to be less dense and presents lower return on investment (ROI)/incentives for service providers (Exhibit 1).

Exhibit 1: US Residential Broadband Connections

Source: Jefferies

Additionally, from bandwidth demand perspective, the pandemic has caused many new trends to emerge, which increased household internet bandwidth demands. Some of these trends include work from home, remote learning, and over the top (OTT) television, all of which consume large amounts of bandwidth. This has resulted in existing users covered by broadband needing more bandwidth/faster speeds to accommodate these new bandwidth-hogging services, therefore forcing service providers to add more capacity.

Given the above backdrop, several fully funded US federal programs have launched in recent times to incentivize/subsidize broadband buildout in rural and less dense areas. One program of importance is the Federal Communications Commission’s (FCC) Rural Digital Opportunity Fund II (RDOF), which is a fully funded program in excess of $11 billion. The FCC is in the process of mapping out rural areas that are underserved and will conduct auctions to allocate funds to service providers who would engage in broadband build out, especially in rural areas by the end of this year. Once the auction winners are decided, this program will provide funding of almost $1 billion per year starting in 2022 and continuing for next 10 years.

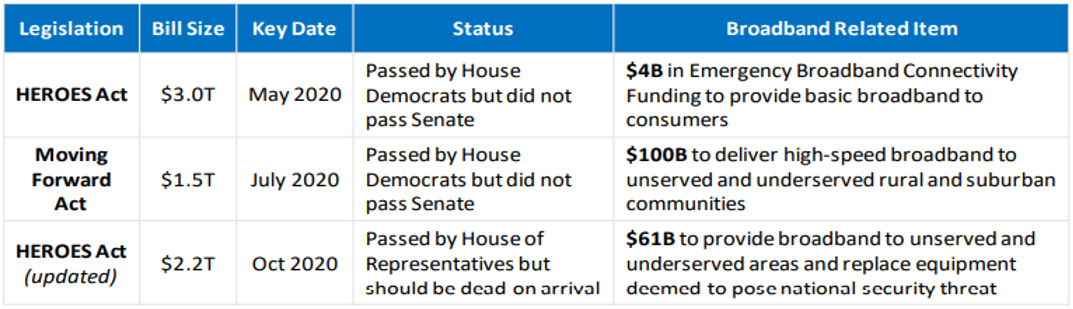

In addition to above RDOF II funding, additional dollars are expected to be allocated for broadband internet build out in underserved rural and suburban areas in the widely touted infrastructure bill expected from the new administration this summer. For context, in 2020, several broadband funding initiatives that were in the stimulus bill were passed by the Democratic controlled House but failed in the Senate, as Democrats did not have majority (Exhibit 2).

Exhibit 2: Broadband Related Legislation

Source: US Congress, Jeffries Analysis

But with Democrats having the majority in both the House and Senate, chances are high for additional broadband related funding to be present in the upcoming infrastructure bill (in addition to RDOF funds).

This once in a multi-decade telecommunications infrastructure buildout that is expected to unfold over the next several years with these new funding programs is presenting several investment opportunities in companies that will benefit disproportionately. Specifically, we believe networking equipment companies that enable the transmission will benefit. Fixed wireless is one area we believe will see faster growth than other areas, as additional spectrum has been released by the FCC, thereby increasing bandwidth/enabling faster speeds. Wireless is ideal to cover larger, less dense rural areas with less damage to environment. In addition to fixed wireless, we believe core platform vendors for internet service providers will benefit as service providers will onboard new customers and will need to add more capacity at the core.

In summary, we believe rural broadband internet buildout/increased bandwidth is an exciting investment theme over the next decade and have several investments in companies that would do well with increased revenue growth and earnings potential.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of March 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since March 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James