In the wake of the US presidential election, nothing was an easier whipping boy for President-elect Donald Trump than Mexico. Seemingly without consequence, he routinely disparaged our neighbor to the south in a continuation of his campaign rhetoric. The North American Free Trade Agreement (NAFTA) was described as the “worst trade deal ever” (apparently unfamiliar with the decision to give China Most-Favored Nation status…); Mexico was going to pay for the wall; and any US company that had any investment in Mexico was roundly punished on Twitter. Not surprisingly, this created quite a dislocation in Mexican assets. We visited the country earlier this year to assess the opportunity set and found that much value had emerged. Since that time, there has been no signal of intention to renegotiate NAFTA, and it’s unclear whether there will be a wall at all. And as of this writing, no American companies have been punished on Twitter for Mexican investment in months, and Mexican assets have outperformed (Exhibit 1). We briefly assess our main takeaways about the country on a multi-asset basis and where we still see opportunities.

Exhibit 1: Mexican equities outperformed the MSCI AC World Index by over 10% year-to-date

Source: Bloomberg

Following Trump’s inauguration, the tone shifted significantly regarding Mexico. From conversations with politicians, industry group leaders and trade negotiators, we deduce two major reasons for this shift. First, the administration has acknowledged a very basic reality that publicly attacking one of your biggest trading partners and weakening its currency to incredibly competitive levels is quite counterproductive. Second, it seems that industry groups both within Mexico and the United States have correctly communicated to the administration that the true trade threat is China, not Mexico. Moreover, given the extremely high level of integration between the US and Mexican supply chains, an attack on Mexican industry is an attack on US competitiveness. The message has been clearly communicated that the presence of Mexico and its integration in US industry is one of the best defenses against Chinese manufacturing. As such, we have gone from assuming that a renegotiation of NAFTA was imminent post-inauguration to at times questioning whether the United States will even trigger renegotiation this year. Even if renegotiation does begin this year, as now seems likely, we do not believe it would necessarily be negative for Mexico. It is likely that local content (specified as North American local content) minimums would be increased to reduce the re-export of Chinese manufactured goods into the United States. The only place those goods can be produced cheaply in North America is Mexico. Further, the sooner renegotiation is triggered, the better. A renegotiation is much more likely to produce a positive outcome for both countries if it is conducted between the Trump administration and the current government in Mexico, rather than a potential more nationalistic Mexican government which is possible next year. We suspect the Trump Administration is aware of this.

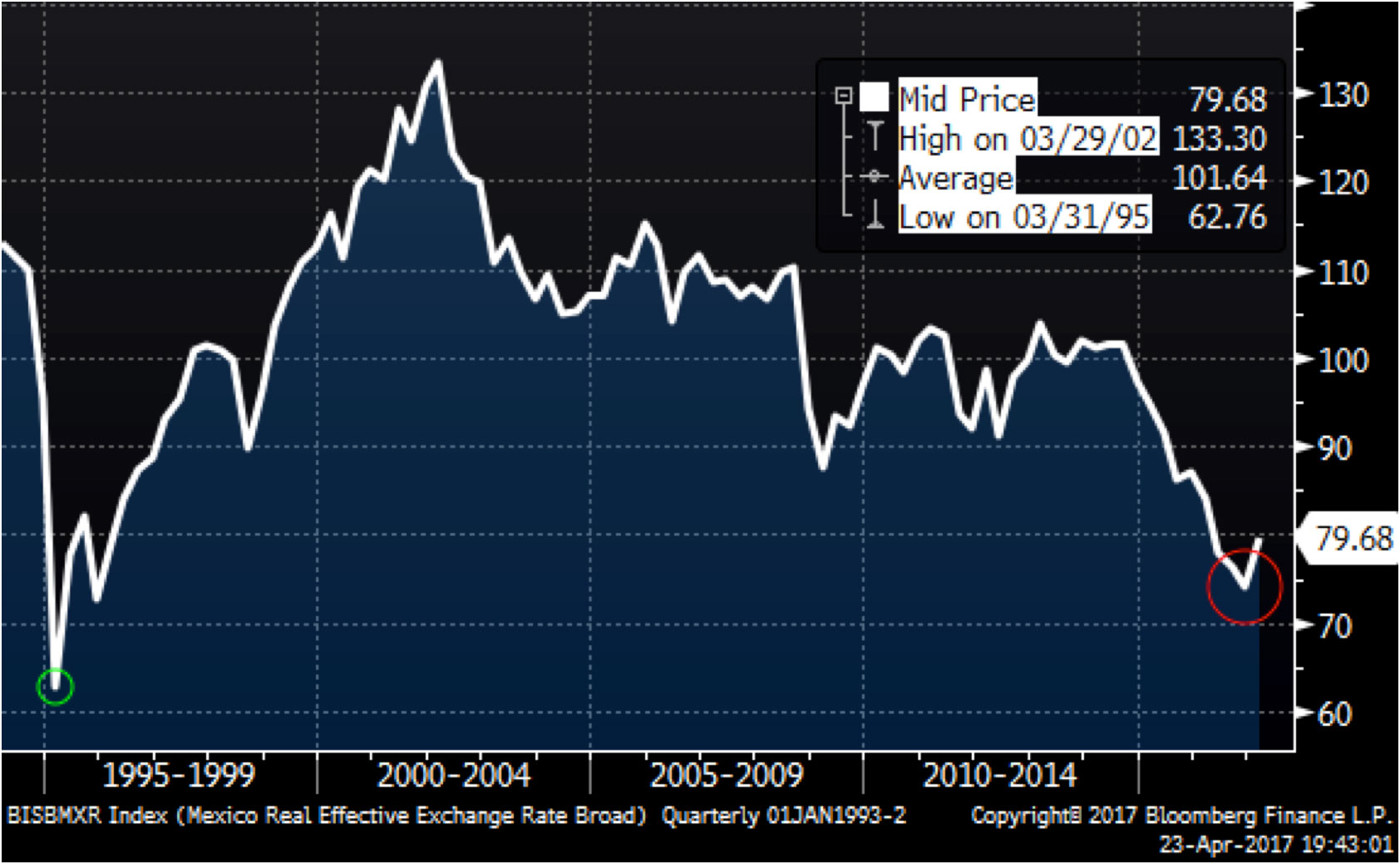

The market’s initial overreaction to the adverse impacts of the Trump election created dislocations across Mexican assets, and we took those opportunities to increase exposure across our portfolios. The clearest mispricing at the start of the year was the currency, with the peso reaching its cheapest level since the 1994 Tequila Crisis (Exhibit 2). The perception that the currency would continue to depreciate in perpetuity also materially weakened Mexican fixed income and increased interest rates across the curve. Investors bet that the central bank would go to great lengths in raising rates to defend the currency. Both of these realities caused significant equity weakness as investors ratcheted the discount rate higher and growth expectations lower. Within equities, we increased exposure to companies the weak peso hurt and to consumer-facing firms punished by the assumption that higher inflation from the peso’s decline would reduce purchasing power. In our multi-asset portfolio, we increased exposure to the currency and long-duration interest rates. These stood to benefit from both a reduction in risk premium and a reconsideration of how much central bank tightening would be required.

Looking ahead, we see a more challenging outlook for Mexican assets but one where opportunities remain, particularly in fixed income. With valuations more normalized in equities, we expect the best earnings growth in 2017 likely will come from the financial sector. Elsewhere, muted growth is still seen, with the US industrial cycle struggling and US auto sector weakness chilling growth in Mexico. Likewise, investment in the energy sector is unlikely to accelerate. While consumption should be ok, we see no reason to expect a material acceleration and anticipate higher inflation throughout the year with no offsetting increase in wage growth. This all indicates there is still value in Mexican fixed income, where additional tightening remains priced in across the curve despite expectations that inflation will peak in the second half. Inflation also has much less upside risk, given the peso’s recent appreciation. We think the greater market risk in the months ahead involves the political polling before Mexico’s 2018 presidential contest, in which nationalist-populist Lopez-Obrador is likely to do quite well. While we remain comfortable that bear-case outcomes with regard to trade will be avoided, investors in Mexican equities now need to be more selective as valuation has become less attractive with growth remaining tepid. For fixed income investors, the backdrop of attractive relative value, hefty tightening priced in, and slow growth with peaking inflation provides an easier landscape to navigate.

Exhibit 2: The Mexican peso reached its cheapest real level since the 1994 Tequila Crisis following the US election, materially boosting the country’s competitiveness

Source: Bloomberg and BIS

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab