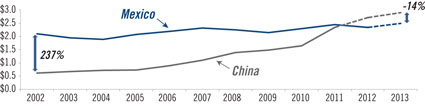

Mexico’s manufacturing sector has been on a steady uptrend in recent years, as evidenced by its 30% increase in trade with the US since 2010. Much of Mexico’s market share gains have come at the expense of China, where significant wage inflation over the past decade has caused Chinese competitiveness to decline relative to Mexico (Exhibit 1).

Mexico’s proximity to the US—providing lower transportation costs and shorter lead times—a healthy supply of engineers, and lower projected energy costs, have made Mexico an increasingly attractive location for auto manufacturers. In addition to NAFTA, Mexico has signed 12 other free-trade agreements. These allow for the export of duty-free goods to the US, Canada, EU, Latin America and Japan, helping to strategically position Mexico in the global auto manufacturing supply chain.

Exhibit 1: Manufacturing wages: Mexico versus China (US$/hour)

Source: U.S. Census Bureau, SHCP, Promexico, Boston Consulting Group, Asesoría y Estrategia Económica

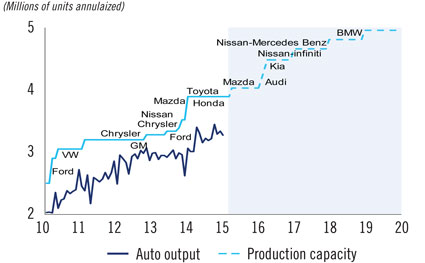

Against this backdrop, numerous global auto OEMs (original equipment manufacturers) have announced a shift of their capacity to Mexico (Exhibit 2). With Nissan ramping up capacity over the next few years, as well as the entrance of Germany’s big three automakers, Mexican auto production capacity is forecast to accelerate from a five-year compound annual growth rate of 10% to 25%. Additional expansion plans are also being considered by other OEMs, including Toyota, so this trend could further expand.

This has boosted several sectors in Mexico, including industrial real estate and airports, with rising traffic driven by new routes opening between Mexico and Europe, Korea and Japan. The unique opportunities presented by this shift in the global auto manufacturing landscape should continue to create differentiated investment opportunities for specific companies.

Exhibit 2: Auto original equipment manufacturer capacity

Source: AMIA and Banxico

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of March 2015 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since March 2015 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab