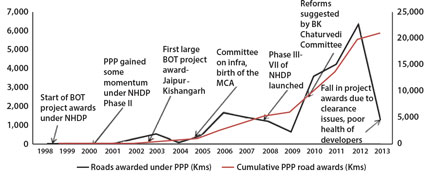

India holds a tremendous amount of potential as a country with a large population, favorable demographics and an entrepreneurial spirit among the corporates. However, in recent years, the lack of infrastructure, policy paralysis and corruption scandals have held India back from achieving its growth potential. Depicted below is a chart of new investment in roads (black line), which fell off a cliff in 2013.

New Investment in India’s Roads

Source: NHAI, MORTH, Ambit Capital Research

During my recent visit to India, the policymakers I met with were intensely focused on infrastructure. A couple initiatives they outlined included streamlining the process for land acquisition and the faster approval of proposed infrastructure projects. Moreover, a credible commitment on the part of the Reserve Bank of India to bring down inflation should usher in a more prolonged period of sustainable growth.

The Driehaus Emerging Markets Growth strategy holds a position in the leading manufacturer of passenger vehicles in India. It has performed well despite a lagging domestic infrastructure but penetration remains extremely low at 18 vehicles per 1,000 persons. To put this in perspective, India’s auto market is about a tenth the size of China’s, which sold nearly 18 million passenger vehicles in 2013. With the right infrastructure policies in place, companies such as this one could see growth well above current market expectations.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of December 2014 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since December 2014 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab