June 1st, 2018 marked the long-awaited inclusion of China’s A-share stocks in MSCI’s market indices. In some ways, this is the conclusion of a long process, as MSCI has been considering the market for inclusion since 2013. In other ways, this is really just a milestone on a longer journey to open the world’s second largest equity market to global investors. A-share market inclusion will drastically change the composition of global markets. China is already the most important country in the MSCI EM index, but its significance will undoubtedly only grow going forward.

First, for those who may be thinking that China was already a major component of the emerging market index, a quick distinction: H-shares, which refer to Chinese company shares that trade on the Hong Kong Stock Exchange, have long been a part of MSCI’s indices. H-shares are fully open to all foreign investors, both retail and institutional. Meanwhile, A-shares refer to Chinese companies whose shares trade on either the Shanghai or Shenzhen stock exchanges. Until recently, these shares had only been accessible by mainland investors and foreigners who had obtained a specific license.

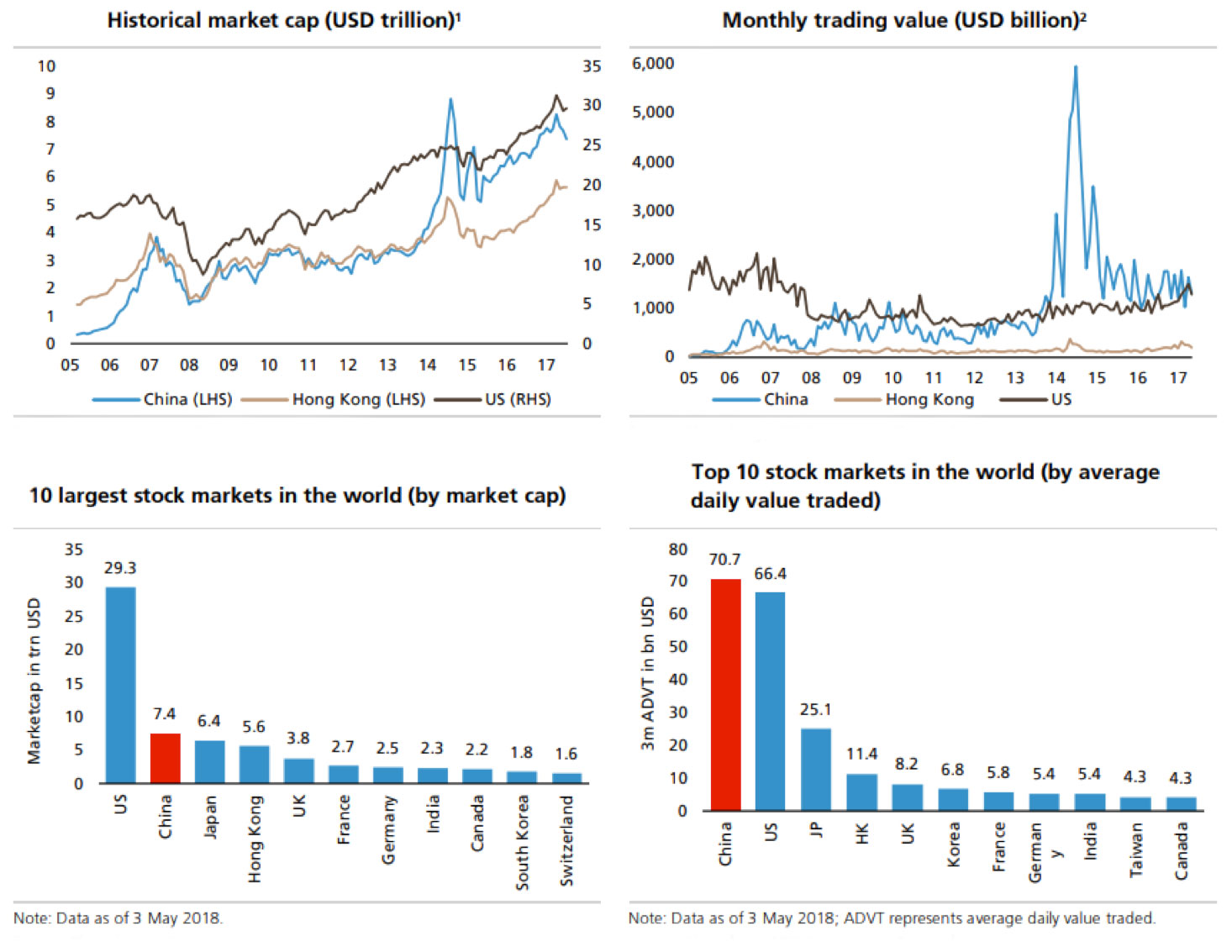

Like many things in China, the A-share market is huge. With 3,500+ stocks and over $8 trillion in market cap as of May 2018, it is the second largest equity market in the world after the US. Despite being less than half as big as the US in market cap, trading volume in A-shares has even exceeded the total volume on the New York Stock Exchange and Nasdaq for the last few years. (Exhibit 1)

Exhibit 1: Historical Market Cap (USD Trillion), Monthly Trading Value (USD Billions), 10 Largest Stock Markets in the World (by market cap), and Top 10 Stock Markets in the world (by average daily value traded)

Source: Bloomberg, UBS Quantitative Research

Aside from the sheer size of the market, there are many other reasons for investors to be interested in A-shares:

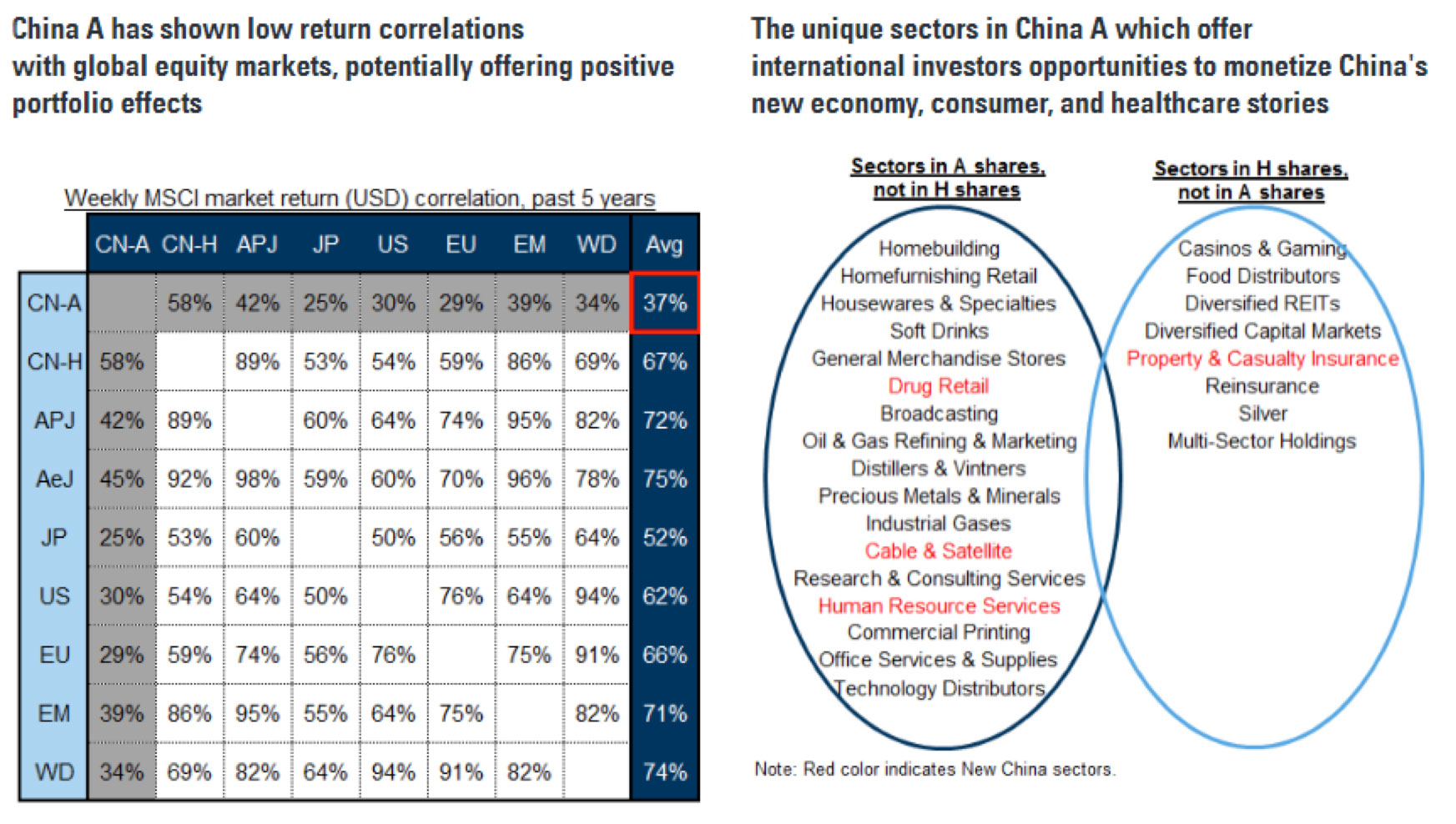

- A-shares offer access to some of China’s unique industries (e.g. Baijiu makers, Traditional Chinese Medicine), have a higher representation of demand-driven sectors like healthcare and staples, have more SMID-cap companies, and contain many of the country’s most innovative companies (the Shenzhen exchange is >60% tech companies). (Exhibit 2)

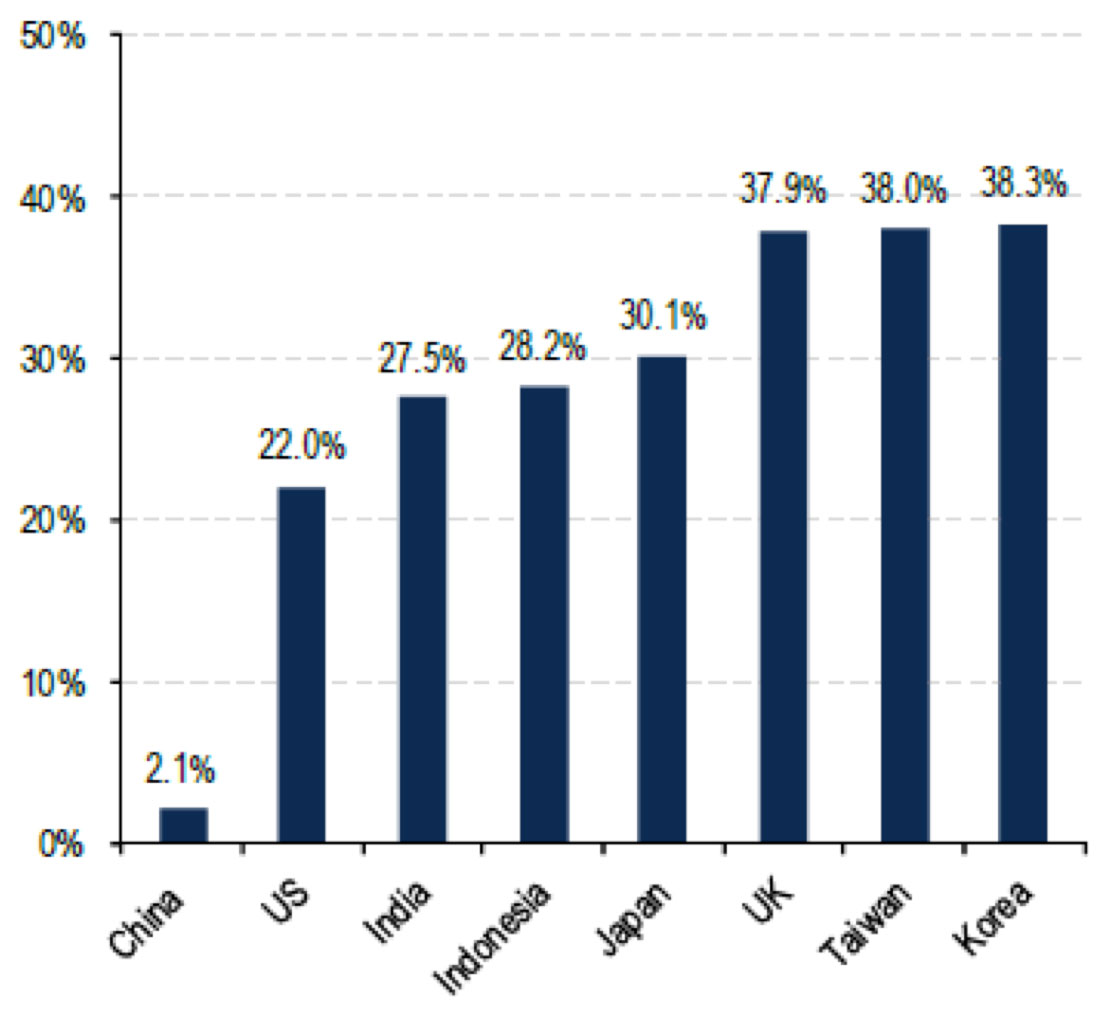

- The market is still dominated by retail investors, who account for roughly 85% of trading volume (as compared to 35% for HK). Foreign investors only make up approximately 2% of A-share ownership currently, still well below comparable markets (generally 20-40%).

- A-shares have historically had a relatively low correlation to global equities and thus offer attractive diversification benefits.

- The average dispersion of returns in A-shares has been substantially higher than other large markets, providing attractive opportunities for active investors.

- Quantitative analysis has shown stronger and more persistent factor performance than other markets.

Exhibit 2: China A shares have low return correlation with global markets and include unique sectors that offer investors opportunities in China’s new economy

Source: Factset, MSCI, Goldman Sachs

MSCI selected 233 A-share stocks to be included in the first round. They have an aggregate weight of 0.39% in the MSCI EM Index at a 2.5% inclusion factor (the weight will double this fall when the inclusion factor is scheduled to be increased to 5%). The initial inclusion was expected to attract over $ 20 billion in inflows to the market but the inclusion factor is likely to rise as market standards improve. In the long-term, as MSCI approaches full inclusion (perhaps a decade away as it took Korea and Taiwan six and nine years to reach full inclusion, respectively), China A-shares could account for roughly 20-30% of the MSCI EM Index on their own! This could eventually drive $ 800 billion+ of inflows into the market!

Exhibit 3: A-share foreign ownership, the lowest among major markets

Source: CEIC, Haver

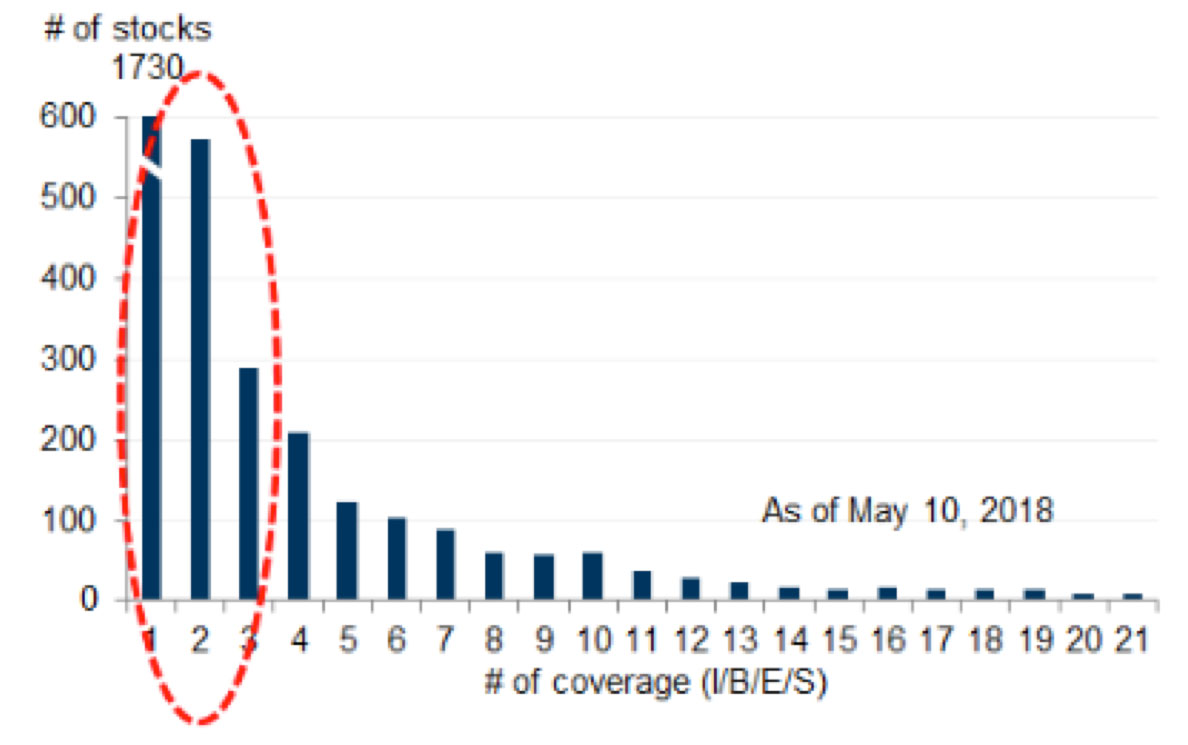

The opening of the A-share market has and will continue to require a lot of work for bottom-up investors. There are a lot of challenges specific to the A-share market. From a macro perspective, the government plays an active role regulating market activity in order to maintain stability. The market regulator is also quick to suspend stocks with pending announcements and these suspensions have been known to last for long periods of time. From a bottom-up standpoint, many corporates have lower standards for disclosure and investor communication. Many stocks are not well-covered by the sell-side and consensus numbers are not necessarily reliable. (Exhibit 4) From a style standpoint, the retail investors who make up the bulk of trading activity today have unique style preferences than global institutions. They strongly prefer small caps, are less valuation sensitive, and are much more prone to momentum-chasing behavior.

Exhibit 4: Alpha opportunities could be abundant in A shares as a long tail of stocks is not well covered by sell-side analysts

Source: IBES, Goldman Sachs

As foreign participation increases and local market participants become more sophisticated, market standards and behavior are likely to gradually converge with global markets over the long-term. The most sophisticated companies with the best management and corporate governance practices should ultimately be rewarded by investors, and that should rub off on less-well-run companies. In the meantime, we expect the market to offer unique opportunities for alpha unlike any other market in the world today.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of June 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since June 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab