2018 has been a difficult investment year for the materials sector. Materials stocks have underperformed the market year-to-date for several reasons such as inflation, cost pressures, interest rates, and tariff implications. As a result, we have been very selective in adding exposure to this group. While it is difficult to find materials stocks meeting our investment criteria, fertilizer stocks look attractive. Nitrogen fertilizers are positioned at the early part of what we believe is an up-cycle in demand and prices. Natural gas is a key input in nitrogen production, and it's price outside the US has risen meaningfully since oil prices began to recover in 2016. Natural gas prices have stayed relatively lower in the US due to growing supply in shale plays and an increase in associated well drilling, which yields oil and natural gas. In Europe, natural gas supply is less robust and contract-linked to oil prices, giving US producers a meaningful cost advantage. They can continue to supply the market while competitors overseas can’t afford to do so.

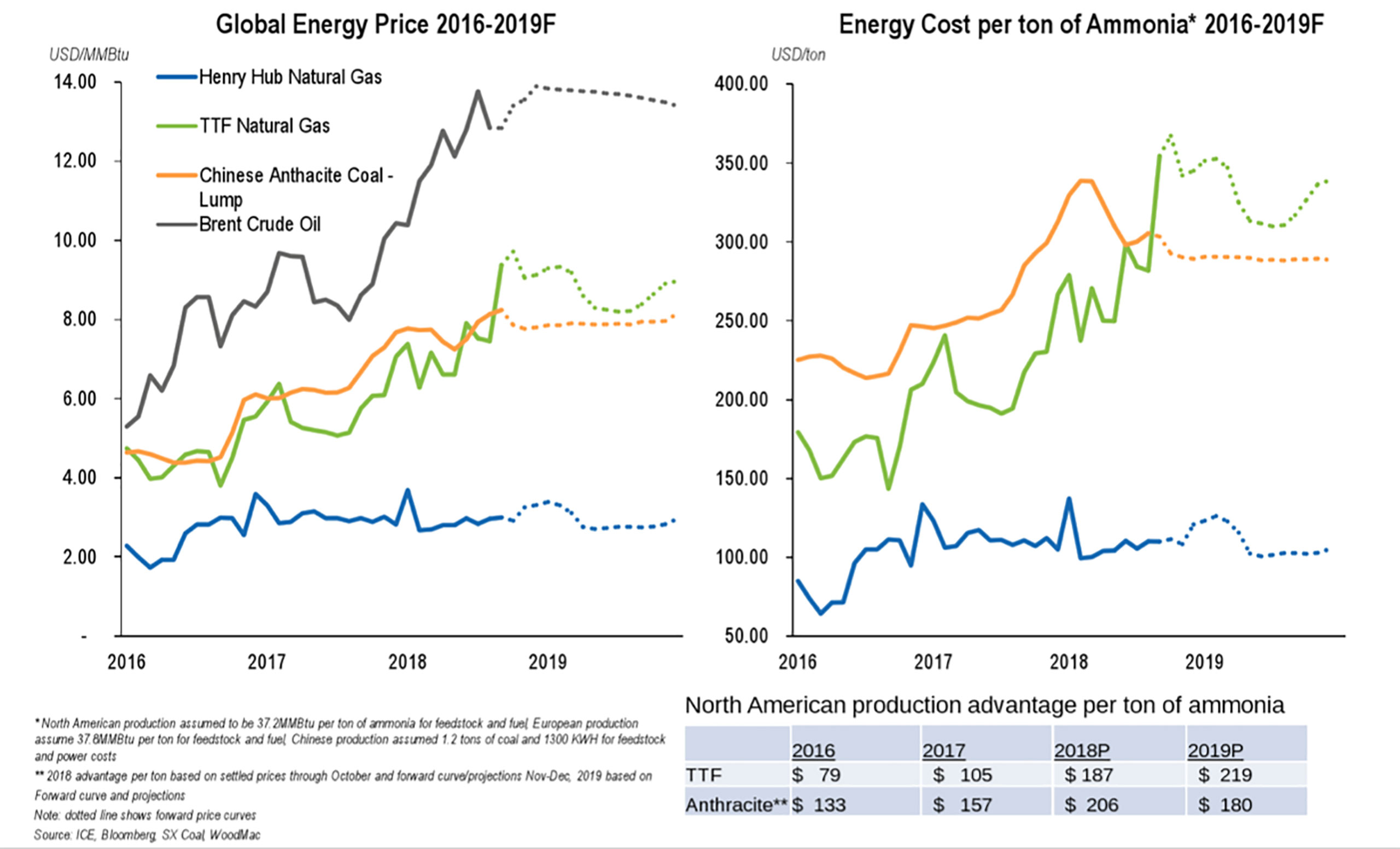

To create nitrogen fertilizers, the Haber process is applied to natural gas and air to create ammonia, a type of nitrogen fertilizer. Ammonia can then be used to derive other types of nitrogen fertilizers such as urea, urea ammonium nitrate, and ammonium nitrate. Exhibit 1 demonstrates the cost spread in natural gas and cost per ton of ammonia (Henry Hub is the proxy for US natural gas).

Exhibit 1: Cost spread of natural gas and cost per ton of ammonia

Source: ICE, Bloomberg

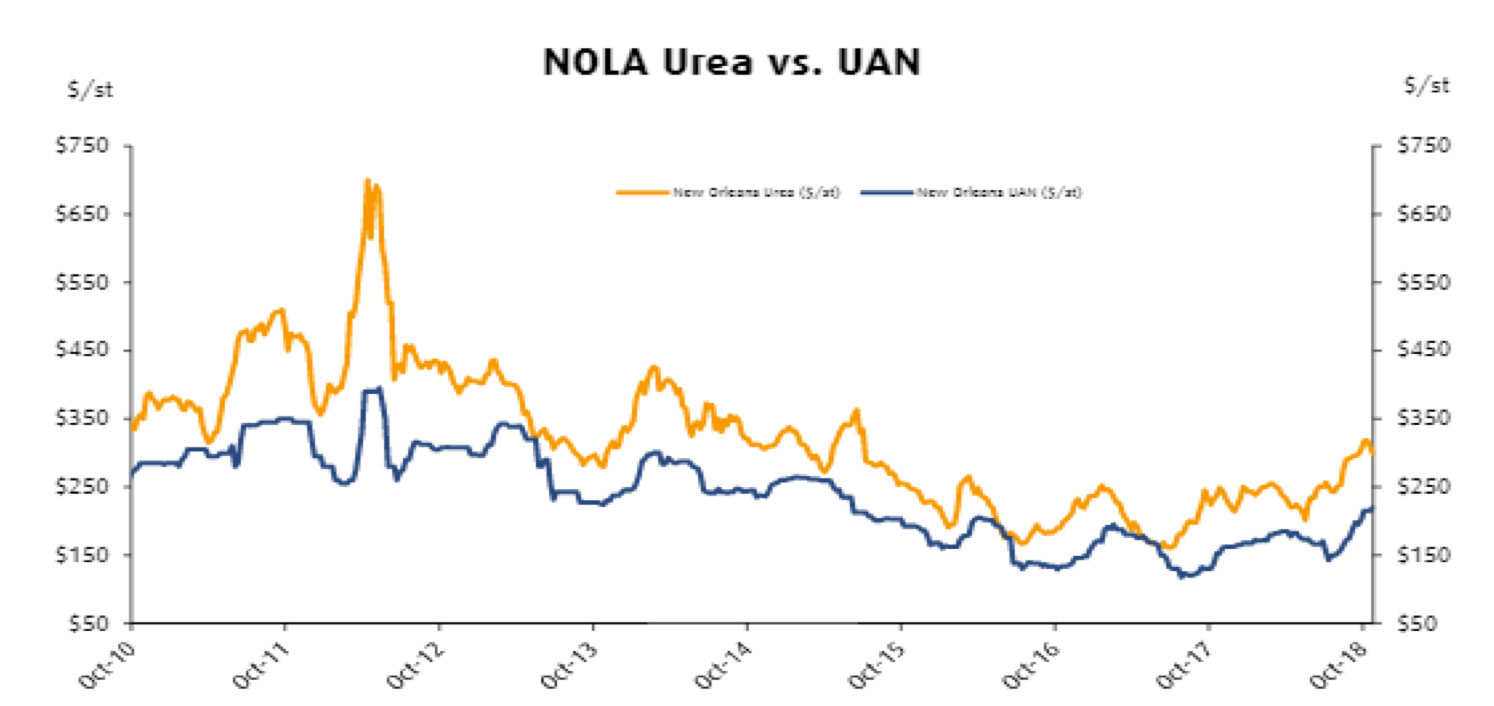

Consequently, nitrogen prices have been driven higher. Nitrogen prices will look to finish 2018 up around 20%. (Exhibit 2)

Exhibit 2: Nitrogen Prices

Source: CRU

Further disruptions or delays in new supply entering the market could exacerbate the current imbalance and drive nitrogen fertilizer prices even higher. Added industry capacity is a risk to prices continuing to increase however, due to timing and high capital requirements, it is unlikely that significant capacity will be introduced over the next several years. The market should remain tight due to environmental regulations in China removing supply, high costs of production in Europe, sanctions on Iran, imports into Brazil, and growing nitrogen-intensive corn acreage in the United States. Nitrogen prices have moved to levels above consensus expectations, putting upward pressure on earnings estimates for 2019 and 2020. We expect this trend of higher earnings revisions to continue as we move into and through 2019.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James