We started writing Counting Cards in Biotech: A Checklist for Improving the Odds of Success in Early Stage Targeted Therapies in Cancer in early 2016 (if you haven’t read it, check it out, it’s still relevant!), and posted this white paper to our website in July 2016. Since then, numerous new kinase inhibitors have been approved in genomically defined cancers.

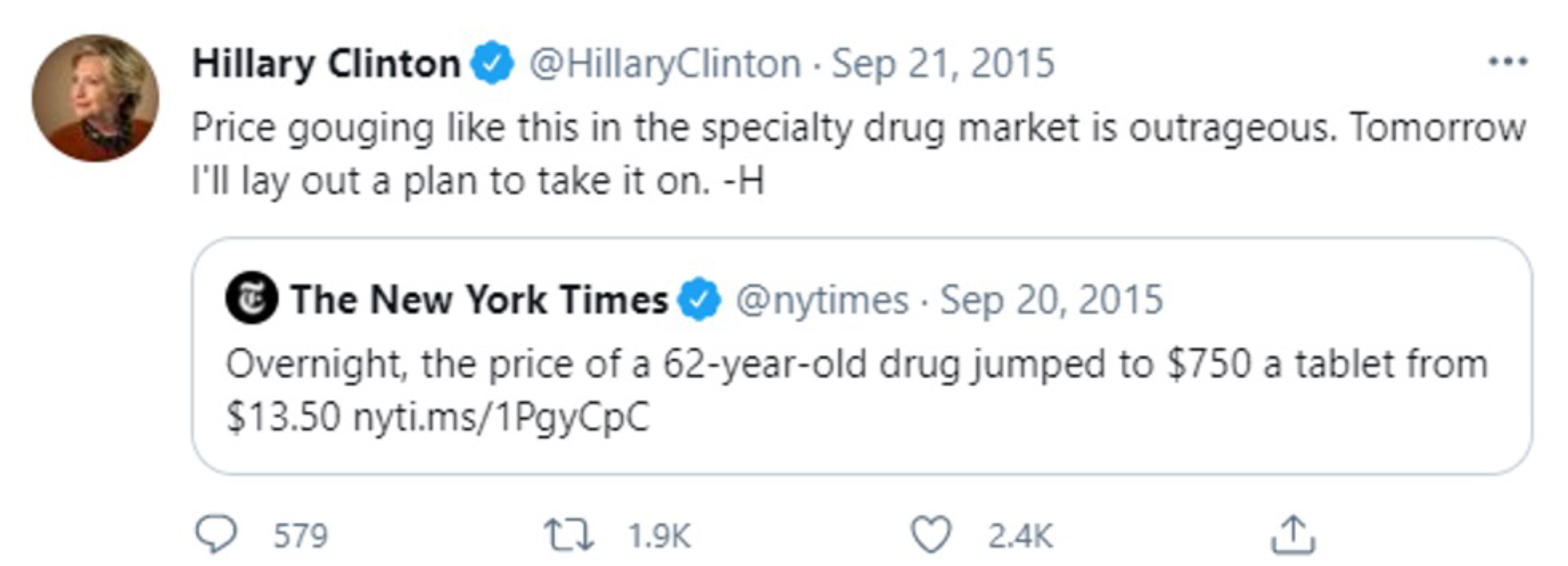

Source: Twitter

The Hillary tweet of 2015 had sent biotech capital markets into a tailspin, evidenced by the over 50% drawdown in the SPDR S&P Biotech ETF (XBI) by February 2016. Companies like Blueprint Medicines and Loxo Oncology were both still relatively new to public markets, were not well-known, and their equity values got taken to the woodshed during the drawdown like pretty much everything else in the space. Blueprint had a market value <$300M (Enterprise Value<$200M), and Loxo’s was <$700M despite having early proof-of-concept for their lead drug. We thought these valuations were silly low in the context of what both companies were working on, so we made these two stocks our biggest healthcare exposure at the time and going forward for several years. We wrote the white paper mentioned on the space to highlight our view on an emerging category that few investors were paying attention to.

Fast forward five years:

- Loxo (now a part of Eli Lilly) has TWO drugs approved.

- Blueprint has TWO drugs approved.

- Across biotech industry there have been more than a dozen approvals in the precision oncology category in the last 18 months alone (!)

- The category of precision oncology has exploded with new entrants iterating on the success seen by pure-play trailblazers such as Loxo and Blueprint.

- There have been >>$25B in takeovers in precision oncology since 2016.

- Instead of being the ugly duckling of oncology, trading at a discount to the group, precision strategies now garner a premium.

Despite this massive change in sentiment over the last five years, the opportunity in precision oncology does not look tapped-out to us. We see multiple, multi-billion dollar sub-categories that still need to be created in precision oncology, leveraging well-characterized tumor biology and purpose-built medicines to modulate that pathogenic biology. As well, we think increasing usage of comprehensive genomic profiling (CGP) of tumors will be a tailwind to patient identification. In addition, we think earlier usage of CGP position precision medicines for longer periods, will enhance the value of individual assets, and possibly the category at large. Finally, broader use of CGP likely will enable the identification of new patient subsets that can be addressed in a precision manner. However, with so many relatively new drug approvals in the category, with so many newer companies standing on the shoulders of Loxo, etc., we think it is reasonable to expect investors to increasingly anchor to the success/failure of launches to define risk appetite for analogous markets. We are tracking these launches, and will have more to say about their implications in the future.

As of May 2021, Driehaus Capital Management is the beneficial owner of shares of Blueprint Medicines and Eli Lilly. Holdings are subject to change and we assume no obligation to update this information to reflect subsequent changes.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of May 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since May 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James