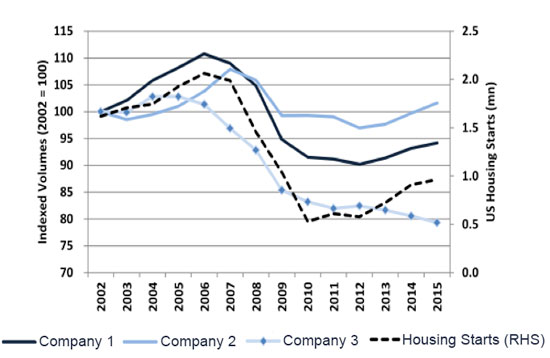

Every household needs a garbage service provider, and an equity portfolio can benefit from one too. Typically, the waste industry lags an economic recovery by about 9-12 months. As the US economy has moved into its 8th year of recovery since the financial crisis, the waste industry has continued to follow. Fundamentally, the industry is driven by population growth, housing starts, non-residential construction, and new business formation. The inflection point towards growth typically commences with acceleration in housing starts and construction. These projects produce vast quantities of waste. Once the home or building construction is complete, its occupants will continue to produce waste. This powerful dynamic is at the core of waste companies’ growth cycles. As shown in Exhibit 1, waste volumes are highly correlated with housing starts (0.98 per Goldman Sachs).

Exhibit 1: Waste volumes v housing starts (left) and housing starts (right)

Source: Goldman Sachs Investment Research

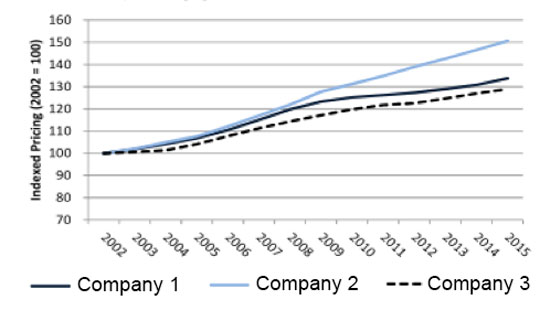

Additionally, over the past two decades, as the market has matured and landfill ownership has consolidated, companies started pushing price at a level above inflation. From 2002-2015 (Exhibit 2), the average annual yield has grown 2.5% vs. Consumer Price Index (CPI) inflation of 2.2%. For investors, pricing power is a highly sought after characteristic that the strongest companies enjoy. We feel the pricing power that is now inherent in the industry is structural and unlikely to change.

Exhibit 2: Waste pricing of three waste management companies 2002-2015

Source: Goldman Sachs Global Investment Research

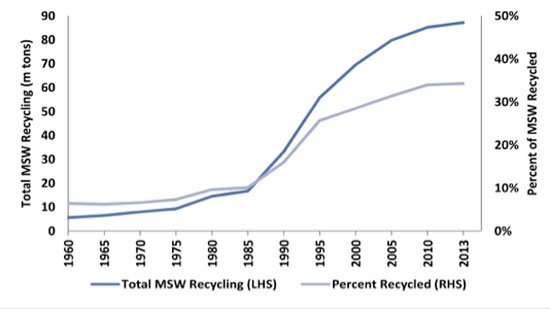

The pillars of growth for waste companies do not end with residential and non-residential collection services. The largest waste companies also process recycling material and waste produced by the oil and gas markets. While these segments are more volatile due to their exposure to commodity prices, they can provide strong tailwinds to earnings power because of their high incremental margins when volumes recover. At a macro level, municipalities continue to put more emphasis on recycling (Exhibit 3).

Exhibit 3: Total municipal solid waste recycling in the US

Source: EPA

The typical waste cycle lasts about five years, and we have moved past that point in this cycle. However, with employment beneath 5%, housing starts below their historical average and GDP growing at a low but steady pace, the cycle is showing no signs of slowing. We believe the waste industry will remain an investable theme for the next few years as strong volumes, pricing power, and industry consolidation continue to manifest.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of August 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since August 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James