The past few years have been a rollercoaster ride for Brazilian equities. The Bovespa Index has been largely at the mercy of fiscal and political uncertainty as well as dramatic swings in commodity prices, FX and interest rates. In 2014, it was tossed around by the weekly election polls, which was then followed by a slew of GDP cuts and credit rating downgrades. The Bovespa lost 63% from 2013 through 2015, compared to a 23% decline for the MSCI Emerging Markets Index. However, Brazil is making a quick comeback this year. It is now the top performing equity index across developed and developing markets, up 23% year to date in USD terms.

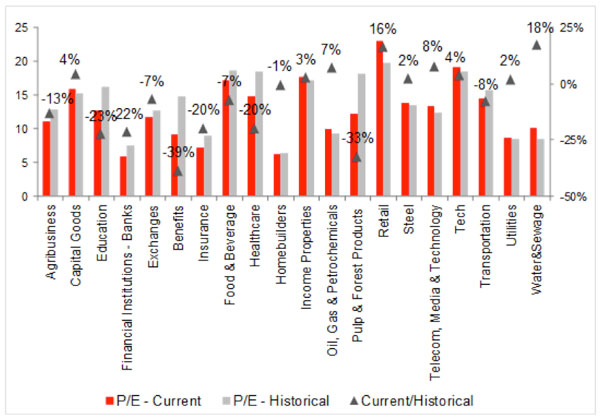

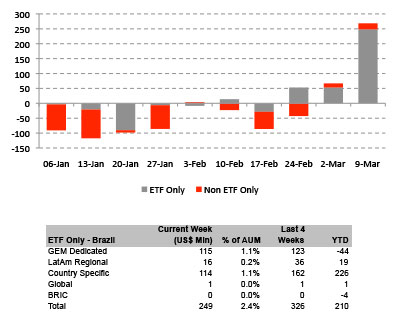

The market is in a state of euphoria at the prospect of President Dilma Rousseff’s impeachment, as investors assume that any change in leadership is better than the current worst-case scenario. Analysts have been rushing to upgrade Brazilian stocks by incorporating a lower cost of equity, as the earnings outlook remains abysmal. As a result, valuations are now at a premium, with the Bovespa trading at an 11.2x forward P/E versus the historical average of 10.3x, with only 25% of the sectors trading at a discount to historical valuations (Exhibit 1). Much of the move has been driven by passive funds and short coverings (Exhibit 2). Active funds have yet to build meaningful positions, though they are following economic data closely as concerns mount that they may miss a sustained rally.

Exhibit 1: 12-month forward P/E by sector

Source: EPFR Global Note: Metals and mining was excluded from the sample as it is currently trading at 32x.

Exhibit 2: ETF flows into Brazil (USD, in millions)

Source: EPFR Global, Santander estimates

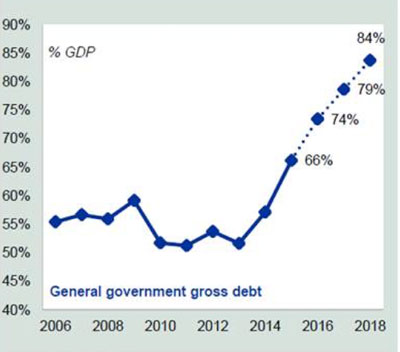

But it’s hard to see how this rally is sustainable with no signs of a recovery in GDP and Brazil still suffering a challenging fiscal environment. For example, at its current run rate, debt-to-GDP will likely reach 70-80% in the next two years (Exhibit 3). Maybe investors have forgotten that Brazil is in dire need of deep structural changes, which will require tremendous political strength and determination to enact the necessary labor, fiscal and tax reforms.

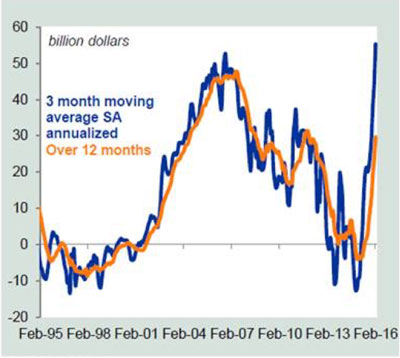

The one bright spot is that the external accounts adjustment has been more intense than expected, mainly due to shrinking imports (Exhibit 4). This should ease pressure on the Brazilian real, though it still doesn’t warrant a significant overweight to Brazil, in our opinion. Interestingly, we have seen the private sector in Brazil starting to restructure, including needed measures such as asset sales and drastic cost-cutting initiatives—something the state-owned companies continue to struggle with. Additionally, those with the balance sheet strength will benefit from consolidation and will emerge stronger over the medium term (e.g., the utilities sector).

In our view, Brazil is a market that today, more than most, requires a discerning eye to separate winners from losers to earn a sustainable positive return. For the foreseeable future, stock picking will be essential to safely ride the Bovespa rollercoaster.

Exhibit 3: Brazil public debt-to-GDP

Source: Central Bank, Itau

Exhibit 4: A sharp adjustment to Brazil’s trade balance

Source: MDIC, Itau

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of March 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since March 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab