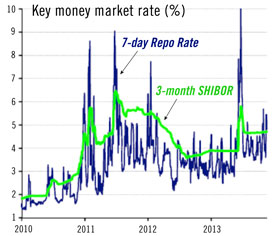

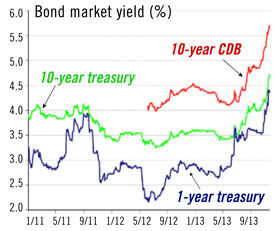

While much attention has been focused on the recent far-reaching Chinese reform initiatives unveiled at the government plenum in November, market participants are beginning to notice the rapid changes occurring among Chinese credit markets. After the well documented spike in interbank rates in October, we have yet to see a resettling of market conditions (Exhibit 1). Similarly and perhaps more alarming, longer-dated Chinese treasury and corporate bond yields are now ascending to new highs (Exhibit 2). China’s current 10-year treasury yield of 4.7% marks the highest rate seen in eight years.

Exhibit 1: China’s interbank rates have stayed elevated

Source: CEIC, UBS estimates

Exhibit 2: China’s bond yields are surging

Source: CEIC, UBS estimates

Although Chinese inflation has risen in recent months alongside improving growth conditions, the coinciding increase in bond yields has been far greater than in similar instances witnessed during prior periods of inflation or improving growth. During a trip to Beijing in mid-November, we concluded that the People’s Bank of China is growing more comfortable with a tighter liquidity environment. In our view, this is because:

- the pace of credit growth has been overly aggressive;

- the economy requires sustained deleveraging to achieve successful rebalancing in the medium term; and

- regulations targeted at limiting interbank (“shadow banking”) lending are encouraging banks to restrict short-term liquidity/interbank operations in favor of building reserves.

The third point is quite important in light of the fervor surrounding interbank/shadow lending. The tightening of interbank activity is now more aggressively transmitted into the “real economy” as a result of the complex network of shadow transactions that rely on interbank activities.

As UBS economist Tao Wang concludes:

Traditionally, banks allocated their assets between loans (on their balance sheets) and bonds. This means that when the lending quota was tight and interbank liquidity tightened only modestly in the past, the bond market would not been affected so strongly. However, with the recent rapid development of off-balance sheet credit, banks can and are increasingly allocating liquidity to a third asset class – interbank asset or other non-bond securitized assets, which can provide higher returns than bonds. Consequently, the recent uptick in interbank rates likely strengthened the incentive for banks to seek higher yields in the (non-standard) credit market and shy away from the formal bond market.

We believe this means:

- Chinese authorities envision a more balanced liquidity environment over the medium-term.

- The advent of Wealth Management Products and other off-balance sheet assets in China are spearheading a de facto liberalization of interest rates, in line with the government’s long-term agenda of encouraging more efficient allocation of capital.

- Sustained and less price-sensitive credit demand from local governments and state-affiliated companies/property developers is increasingly being met through off-balance sheet channels and risks crowding out private borrowers elsewhere in the economy.

- Regulating and/or attempting to contain the shadow banking spirits that now threaten the stability of the Chinese financial system will require innovative policies and experimentation.

For the present, 76% of credit in China is still channeled via loans. This implies that the majority of credit in the system is still priced around benchmark lending rates, which remain much more stable. However the parallel systems of formal and informal lending amplify the risk of credit and liquidity volatility increasing haphazardly in forthcoming years. As part of its reform agenda, the government understands the need to contain the interbank/informal lending market. However, doing so entails significant risks, including the unintended consequences of financial innovation/liberalization as well as the potential for intermittent, unpredictable liquidity squeezes and elevated volatility.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2013 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2013 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy February 2024 Commentary

By Chad Cleaver, CFA

Driehaus Emerging Markets Small Cap Equity Strategy January 2024 Commentary With Attribution

By Chad Cleaver, CFA