Over the past 40 years, the vast majority of therapeutics that entered human testing failed to make it to market. Over the past 20 years – and really accelerating over the past 5 years – new technologies and clinical development strategies emerged that made it possible to dramatically improve on those historically dismal rates. “Precision medicine” holds the promise of the right medicine for the right patient at the right time, and represents a paradigm change from the empirical medicine practiced in the past.

We’ve written1 and invested extensively in precision therapy approaches since 2013 at a time when many of our peers were pivoting hard into next-gen Immuno-oncology (IO) companies (many of which failed). Over the past couple years many of our peers have attempted to zig back toward where we have been all along. While all precision therapy approaches are not equally promising and we continue to find excellent opportunities in precision therapies, we’ve been zagging to the other side of the precision medicine coin: genetic diagnostics. And, just like we were with precision therapies in oncology in 2013, we’re loving what we’re finding.

Molecular diagnostics are enabled by a battery of tools used to identify biological markers, such as protein, DNA, or RNA, from a patient sample. Molecular diagnostics are critical to stratify the patients likely to benefit for a particular therapy, and therefore are critical to the application of precision medicine. For various reasons (particularly weak IP protection and low barriers to reimbursement), molecular diagnostics evolved over the past century into markets of “value-enabling,” low-price commoditized products that have favored scale players with established capital equipment bases and commercial channels. Like with many things, this changed with genomics.

The sequencing of the human genome in 2003 provided the foundation for new applications of genetic diagnostics while the subsequent democratization of sequencing technology enabled de-centralized innovation. As a result, there has been an explosion in the development of novel “value-driving” applications for genetic diagnostics. For example:

- In transplant medicine, kidney rejection used to be identified by a generic marker for systemic inflammation which could be wrong just as often as it was right. With genetic diagnostics, we can now tell (through changes in levels of circulating donor kidney DNA) with greater precision if the donor kidney is being damaged and respond accordingly, driving better therapeutic outcomes.

- In family planning and reproductive health, it used to be difficult for would-be parents to know if their future children would be at heightened risk for genetic diseases. With genetic diagnostics, we can now tell (through carrier screening) who is at risk for conceiving children who will suffer from cystic fibrosis, fragile X syndrome, or spinal muscular atrophy.

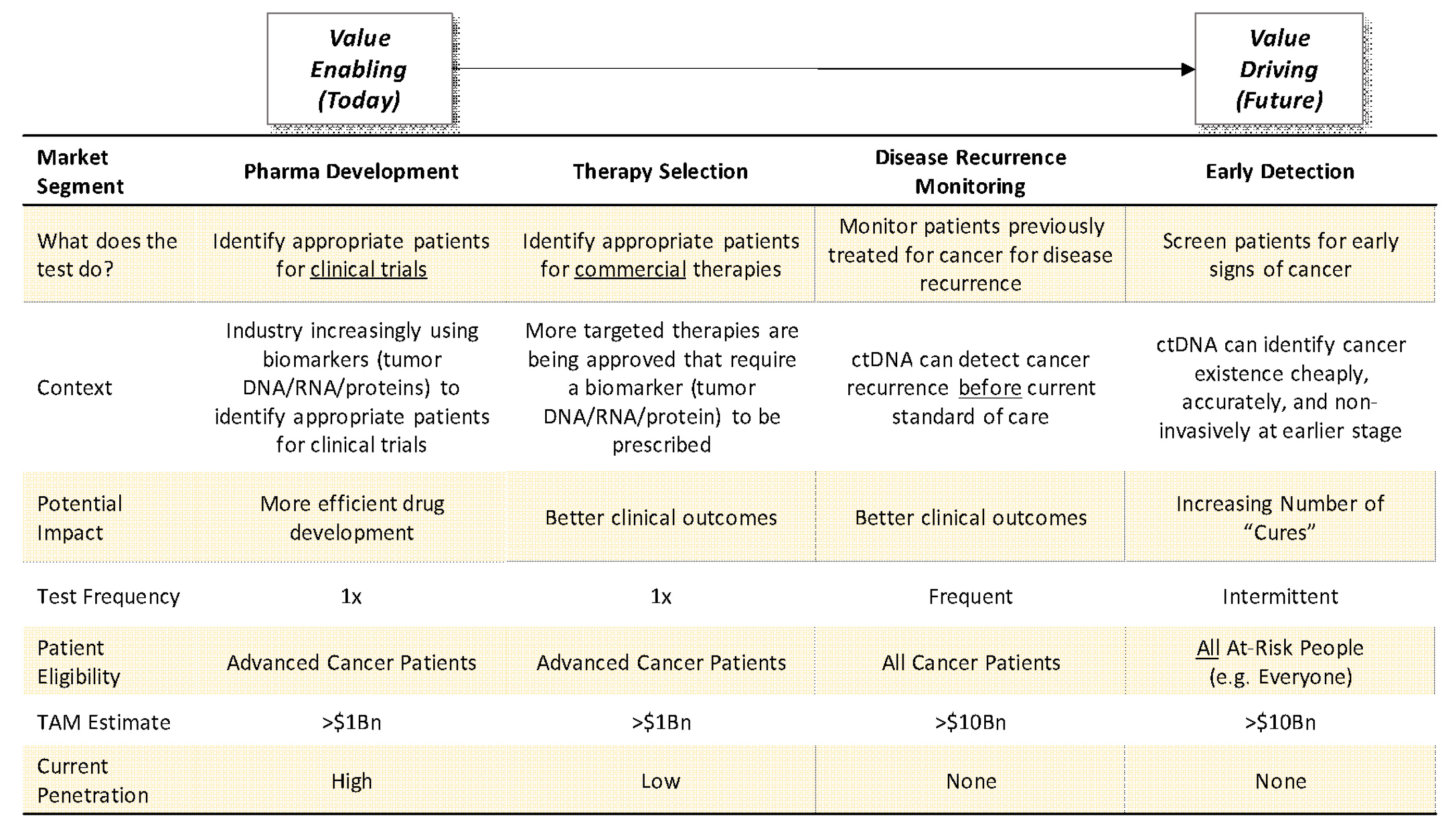

Perhaps nowhere is the paradigm in genetic diagnostics shifting more from “value-enabler” to “value-driver” than in oncology (see Exhibit I below):

Exhibit I: Genetic Diagnostics Shifting from “Value-Enablers” to “Value Drivers”

Source: Driehaus Capital Management

Genetic diagnostic tests have historically been limited to “value-enabling” tests where the lion share of value created was captured by pharmaceutical companies. However, new “value-driving” tests are coming to market that have the potential to drive superior clinical outcomes (in some cases dramatically so) as standalone tests and enable greater value-capture by diagnostics companies. This table illustrates that evolution as we progress from the what exists today (“Pharma Development” column) to what will increasingly exist in the future (“Therapy Selection,” “Disease Recurrence Monitoring,” and “Early Detection” columns).

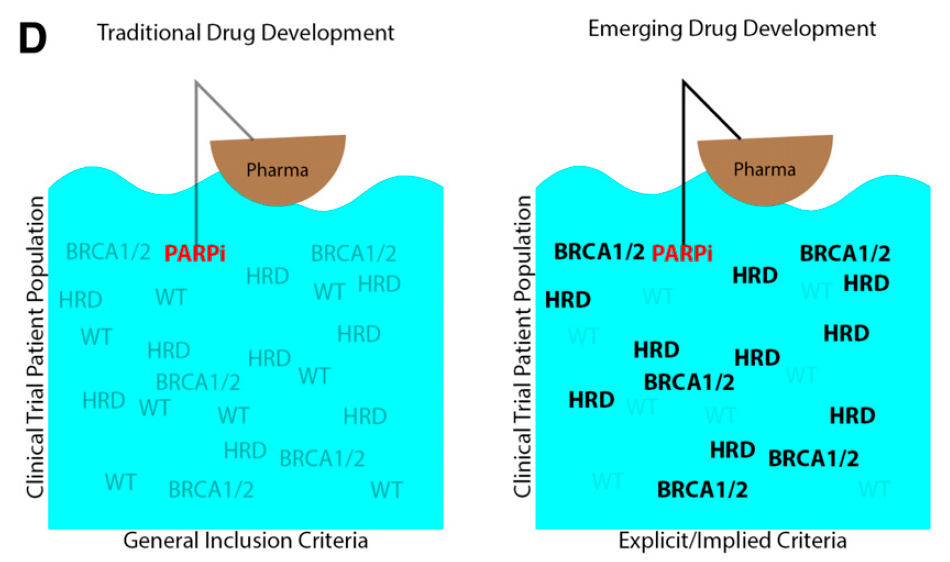

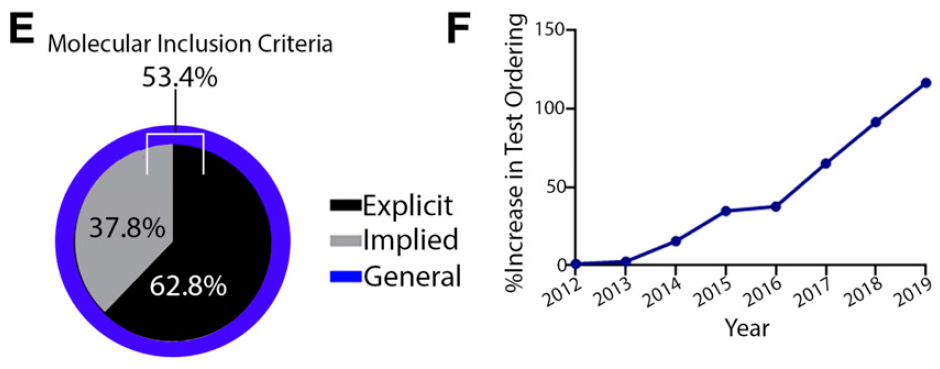

Historically, diagnostic tests in oncology were almost exclusively single-marker, single tumor site “companion diagnostics” designed to identify patients for an accompanying targeted therapy. Because there were few targeted therapies and only a small fraction of the treatable population would be theoretically eligible if found, penetration of genetic diagnostics was generally low. Over the past few years, though, more and more targeted therapies have been approved or are in development in the drug industry that require genetic or other molecular criteria. This has driven demand for further testing in clinical trials and, correspondingly, an increase in demand in test ordering (see Exhibit II2 for a specific example within one of the largest oncology trial networks in the US).

Exhibit II: How Advances in Targeted Therapies Have Driven Demand for Genetic Testing at a Large Comprehensive Cancer Center

Sarah Cannon Research Institute is a clinical research network with headquarters in Nashville, Tennessee. They conduct clinical trials of more than 200 unique compounds each year and have conducted research on the majority of approved cancer therapies over the last decade. In a 2020 publication, they described the landscape for therapies in drug development in oncology at their centers in the following way:

“[I]n an effort to increase the likelihood of clinical response, pharmaceutical companies are becoming more specific about the patient populations allowed to enroll, even in early-phase trials. Instead of enrolling patients from the ‘ocean’ of potential clinical trial patients, pharmaceutical companies are trying to ’fish in the right pond’ of molecularly subtyped patients at the earliest stages of drug development.”

In order to be able to “fish in the right pond,” this requires more rigorous clinical trial inclusion criteria and broader adoption of genetic testing, both of which have occurred at Sarah Cannon. The figures below depict the breakdown of trials at Sarah Cannon in 2020 that require some sort of molecular (genetic or proteomic) requirement for inclusion, and relatedly the increase in Next Generation Sequencing (NGS) genetic testing at Sarah Cannon from 2012 to 2019, based on a percentage of 2012 testing:

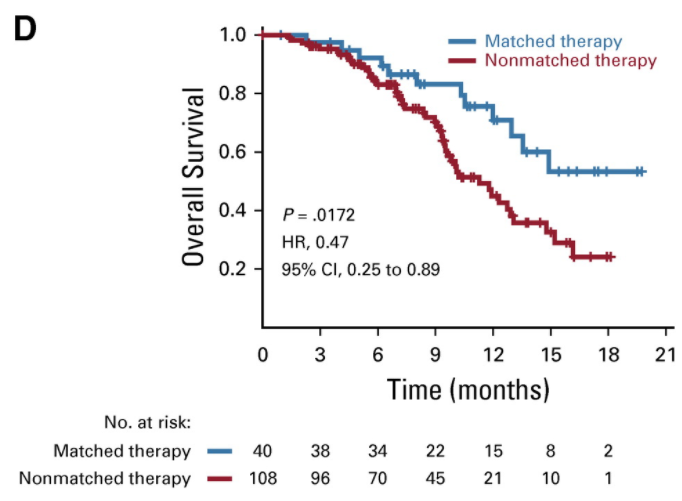

The corresponding movement to more targeted therapies has resulted in seemingly better clinical outcomes for matched patients. A representative study from another large and venerated research institution, MD Anderson in Houston, showed that in a cohort of genetically sequenced patients with an actionable genetic mutation who were treated with a matched targeted therapy had significantly improved survival compared to patients with nonmatched therapy (see Exhibit III3 below ):

Exhibit III: Retrospective Patient Survival Analysis Based on Matched Therapy at MD Anderson

How to interpret: This is a Kaplan-Meier survival curve. The x-axis represents time. The y-axis represents percentage of overall subjects who experience an event (in this case, death). The plotted lines represent the proportion of patients receiving each intervention that experience an event in a way that can be visualized and compared. The appropriate way to compare two lines is with a hazard ratio (HR), as the hazard ratio compares the full area under the curve of each line. For example, in this case, one may observe that patients receiving matched therapy experience 53% improvement in survival vs. patients receiving non-matched therapies. However, for ease of comparison, it is not uncommon for point estimates to be cited. For example, in this case, one may observe that the median overall survival for patients receiving matched therapies is approximately 15 months vs. approximately 10 months for patients receiving non-matched therapies.

Despite this increase in demand from the drug industry and mounting evidence that increased utilization of genetic sequencing and matched targeted therapies drive superior clinical outcomes, adoption of genetic diagnostics remains low, with estimates suggesting only ~1 in 5 advanced cancer patient receives a genetic diagnostic test. Over the coming years, we expect this to become standard of care.

Beyond therapy selection, additional “value-driving” diagnostic tests are on the verge of disrupting cancer care even more than targeted therapies. The discovery and characterization of circulating genetic and proteomic markers distinct to cancer cells have made it so that the presence of cancer can be detected earlier, cheaper, more specifically, and in a more clinically feasible way than what is possible today.

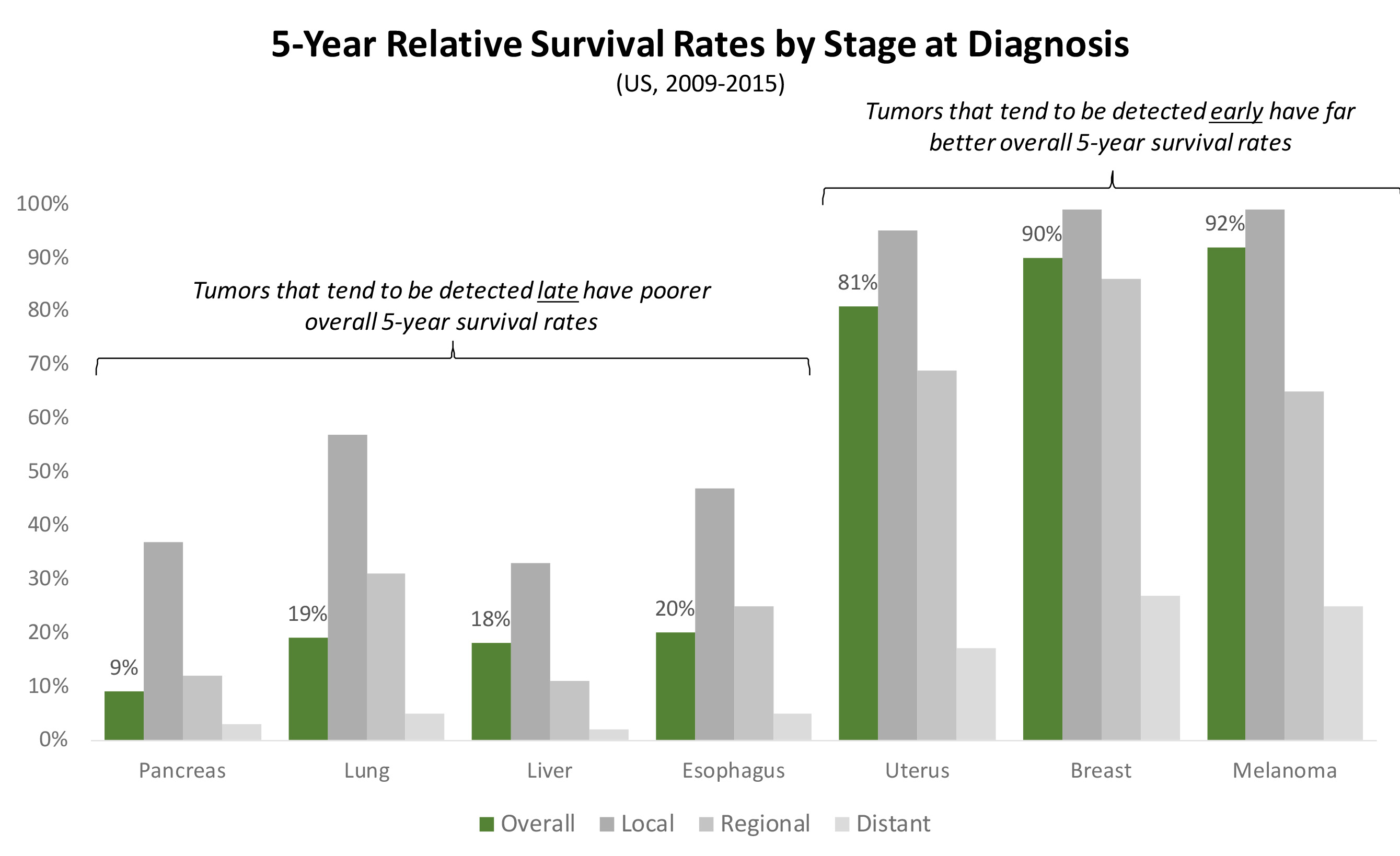

We cannot understate the importance of this discovery: cancer is generally deadly because it tends to be caught late. Cancers that can be detected early, before they’ve metastasized (for example, a high proportion of melanomas, breast, and uterine cancers) can be surgically resected with very good 5-year survival rates. However, cancers that tend to only be discovered only after they’ve metastasized (for example, a high proportion of pancreatic, lung, and liver cancers) tend to have very poor 5-year survival rates (see Exhibit IV4 below).

Exhibit IV: 5-Year Survival Rates by Cancer Type Based on Time of Detection

Thus, a blood test that can detect cancer months or years earlier than the current standards of care– either in patients who never knew they had cancer (e.g. asymptomatic screening5 ;) or those who previously had cancer but didn’t know it had recurred (e.g. recurrence monitoring6 ) – has the potential to dramatically alter the course of cancer outcomes.

While these markets exist in a limited extent today7 , key IP, technical, clinical, regulatory, and reimbursement barriers have been either removed or reduced over the last few years, and first-movers in each market have recently launched or are poised to launch commercial diagnostics in the coming years. We expect these markets to be built over the coming decade, and for the winners in the space to realize value on par with biotech winners in the markets such as PD-1 and TNF.

Given the scale of these markets and the nature of risk (predominantly operational) moving forward, we believe picking and investing in winners today is possible. There are a dozen public companies and many more dozens of private companies vying to penetrate these markets. We expect them to compete on a multitude of factors, such as, but not limited to the following:

- test specifications (chemistry, single tumor site vs. site agnostic, DNA/RNA/proteins measured, off-the-shelf vs. patient specific, centralized vs. de-centralized, training datasets used, data analytics, test hardware, clinical trial strategy, etc.);

- commercial channel (oncologist, pathologist, system-wide, DTC);

- physician/pathologist/patient experience (turnaround time, interpretability);

- market structure;

- geography;

- price;

- scale of operation;

- cost of capital;

- data assets

The path forward will not be straightforward and is not without risk, and even if the thesis is right in the long-term it may be wrong in the short- to intermediate-term. Things we’re constantly thinking about include the following:

- The bar for inclusion in clinical practice guidelines is high, and often requires very large datasets (at times, tens of thousands of patients) with significant follow-up time (measured in years).

- The operating models will require scale capable of running millions of tests with few logistical or technological errors.

- The commercial model required to build these markets will likely require behavior and operational change from multiple stakeholders – some of whom may be disintermediated by the adoption of these new technologies.

- The ultimate price at which these tests may be reimbursed (or paid for out-of-pocket) may make it impossible to be successful

In sum: we believe this will be a market where stock selection matters and we at Driehaus are well-positioned to take advantage of it. We’ve invested in clinical diagnostic companies for over a decade and have relationships with many of the players at the forefront of the space. Like anything else, successful management of investment in the space will require vision, analytical capabilities, a grounding philosophy, open-mindedness, access, conviction, and as always, humility. We will challenge ourselves daily to summon these qualities in the pursuit of success in the space.

1 See our 2016 presentation “Counting Cards in Biotech: A Checklist for Improving the Odds of Success in Early Stage Targeted Therapies in Cancer,” accessible from https://www.driehaus.com/system/uploads/fae/file/asset/266/Counting_Cards_Presentation.pdf

2 Jones, “Molecular Profiling in Drug Development: Paving a Way Forward” ASCOpubs.org, accepted May 8, 2020. Accessed 1/8/2021 from https://ascopubs.org/doi/pdf/10.1200/EDBK_100024.

3 Kopetz, “Use of a Targeted Exome Next-Generation Sequencing Panel Offers Therapeutic Opportunity and Clinical Benefit in a Subset of Patients with Advanced Cancers,” JCO Precision Oncology, 2019. Accessed 1/8/2021 from https://ascopubs.org/doi/full/10.1200/PO.18.00213. Note that there are methodological limitations with the generation and extrapolation of these data, as they were not generated as part of a prospective, randomized trial, but rather a retrospective comparison of matched patients; we believe them to be directionally accurate based on a preponderance of data.

4 American Cancer Society, “Cancer Facts & Figures: 2020.” Accessed 1/12/2021 from https://www.cancer.org/content/dam/cancer-org/research/cancer-facts-and-statistics/annual-cancer-facts-and-figures/2020/cancer-facts-and-figures-2020.pdf.

5 See Lennon, “Feasibility of blood testing combined with PET-CT to screen for cancer and guide intervention,” Science, Jul 2020. Accessed 1/12/2021 from https://science.sciencemag.org/content/369/6499/eabb9601.full.

6 See Coombes, “Personalized Detection of Circulating Tumor DNA Antedates Breast Cancer Metastatic Recurrence,” Clin Can Rsrch, Jul 2019. Accessed 1/12/2021 from https://clincancerres.aacrjournals.org/content/25/14/4255.

7 Notably, Cologuard, a genetic screening test for colorectal cancer run on a patient’s stool.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James