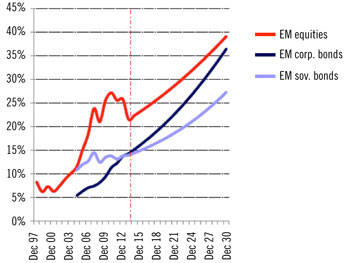

Emerging market equities, corporate bonds and sovereign debt markets are underdeveloped relative to the size of emerging economies. EM equities account for only 22% of global equity market capitalization while corporate and sovereign bonds each account for only a 14% share of global market values (Exhibit 1). Yet, emerging nations produce 39% of global output.

This gap between global output and EM asset ownership levels should gradually close. Increased demand from domestic investment vehicles such as mutual and pension funds will help these economies increase investment in local capital markets by reallocating from overly high levels of domestic savings. By 2030, EM equities and corporate bonds are estimated to more accurately reflect emerging economy global output.

Exhibit 1: Emerging market share of global equity and sovereign and corporate bond markets (%)

Source: Credit Suisse

This convergence, however, does not imply equal growth rates across countries and industries. Under-represented sectors such as health care, technology and consumer discretionary are poised to gain share as are underdeveloped capital markets such as China, India, Vietnam and Turkey. We continue to look for companies positioned to capitalize on these long-term trends.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of July 2015 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since July 2015 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy February 2024 Commentary

By Chad Cleaver, CFA

Driehaus Emerging Markets Small Cap Equity Strategy January 2024 Commentary With Attribution

By Chad Cleaver, CFA