Investors have a love/hate relationship with the semiconductor memory sub-sector, exacerbated by skittish market conditions. At the beginning of the year, triggered by the sell side raising the scenario of large price declines in memory, investors trashed any and all stocks associated with NAND or DRAM memory, though the specific concerns were related to NAND flash memory pricing. Despite these concerns, earnings reports from memory related companies in February showed a very strong fundamental backdrop in the first half of 2018 and this has resulted in memory and related stocks being strong performers year to date, well outperforming broad indices.

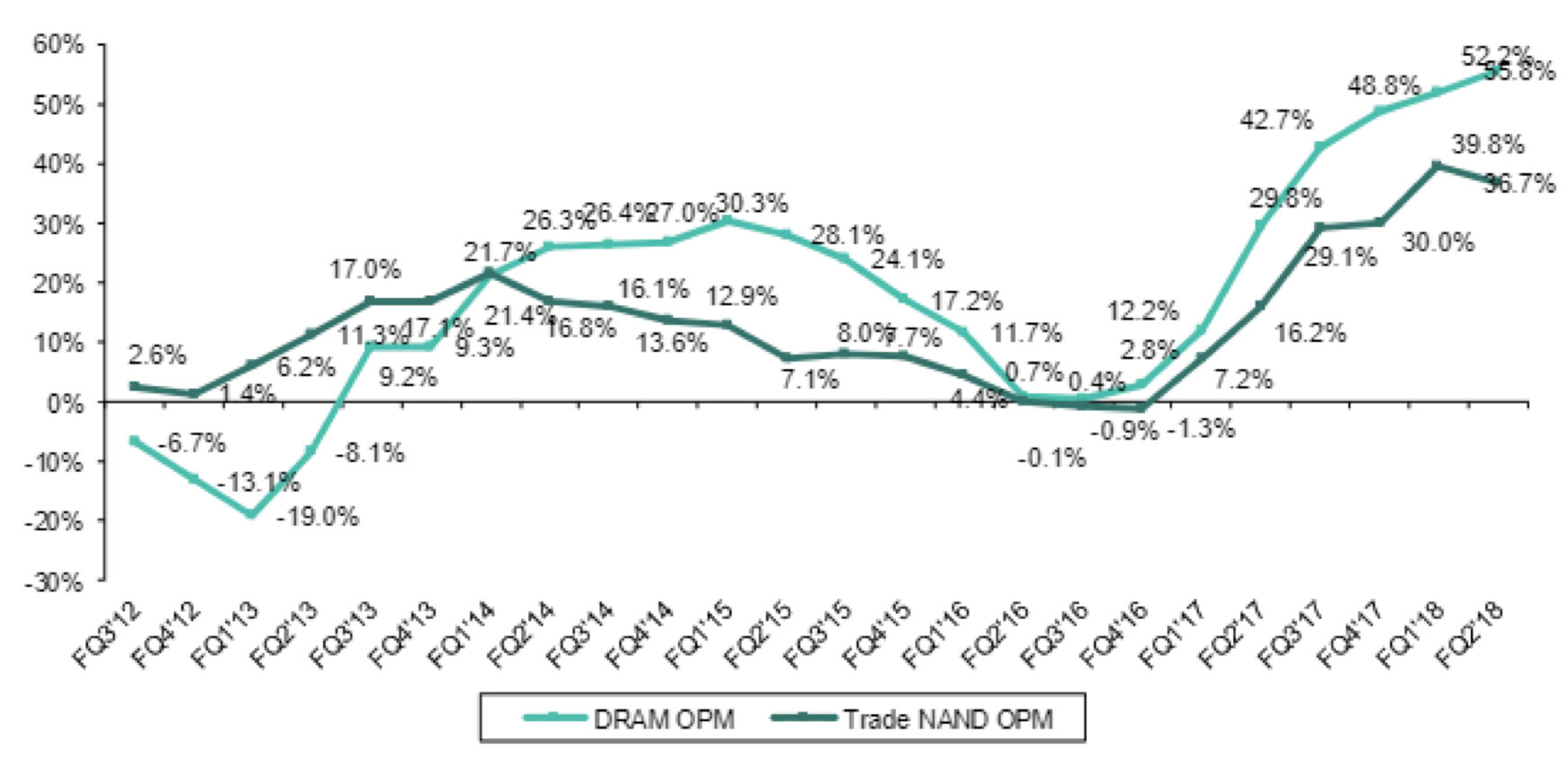

Memory devices are pure commodities and are subject to both competitive forces and supply/demand balance-related cyclicality, like all commodities are. As a result, investors’ non-committal approach to the sector is reasonable. In the past, selling memory stocks at the first sign of gross margin compression has worked out very well – but in the current cycle, most memory manufacturers are posting gross margins well above prior peak levels. This time around, rather than a singular, narrow demand driven by PCs or smart phones, a much broader set of drivers are at work, including web 2.0 datacenters, new emerging technologies such as machine learning, artificial intelligence and autonomous driving, all of which are highly memory intensive. With deep and strong demand drivers, supply has not been able to catch up to demand over the last 12-18 months despite continued technology advancements with the adoption of lower geometries and 3D patterning., unlike the past, where supply/demand would typically come into balance within a year. This has resulted in memory manufacturers continuing to ride on a "super cycle" of strong pricing and demand, which in turn has led to strong investment spending on capital equipment. With the industry having high fixed costs and low variable costs, better demand and a good pricing environment has resulted in operating margin levels well above prior cycle highs. (Exhibit 1)

Exhibit 1: Operating Margin Trend of Top Three Memory Manufacturers

Source: Bernstein

Despite the positive fundamental backdrop, the memory industry still remains a commodity and thus cyclical. As by definition, any commodity market will come into balance or over-supply eventually as suppliers continue to try to fill the void. This is a dynamic industry and new data points need to be constantly monitored – but the macro backdrop supports a scenario that supply/demand balance may be further out into the future resulting in a larger upcycle than the typical three to four quarter upswing we have experienced in the past decade.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team