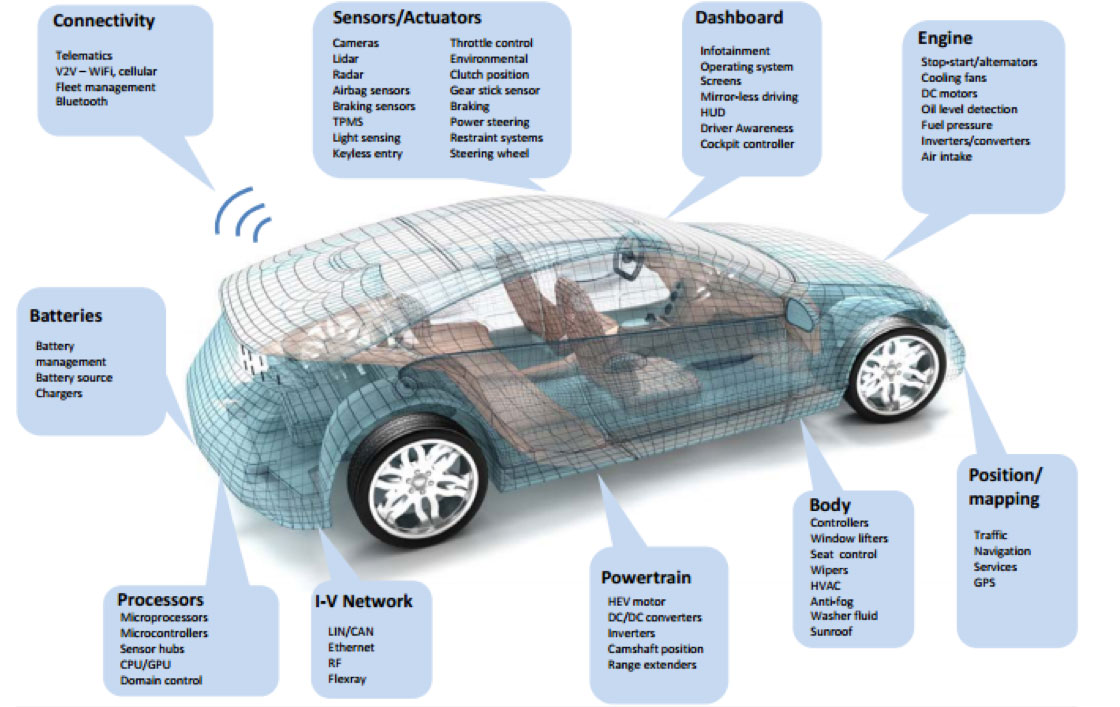

Automobiles are uniquely positioned across several technology megatrends that will transform the driving experience. For example, advances in sensors, cameras, computing power, artificial intelligence, and batteries will make cars smarter, safer and more efficient (Exhibit 1). These advances in technology will revolutionize driving and the auto industry over the coming decades.

Exhibit 1: Future areas of in-vehicle technology

Source: UBS

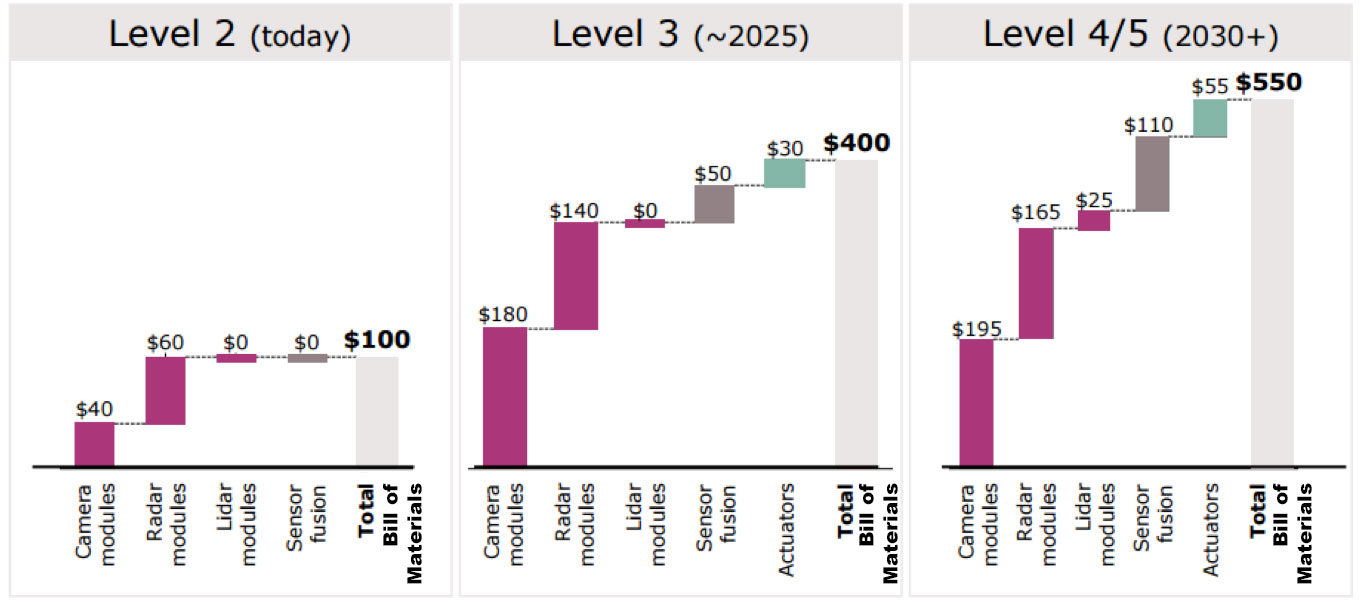

There are some major implications to consider. First, the amount of semiconductor content and technology components that go into every car will rise dramatically (Exhibit 2). This will provide a new growth market for the technology industry. Second, this trend puts the traditional auto manufacturers and their supply chains on a collision course with tech companies. It is not clear who will come out ahead but there is no shortage of “secretive” auto-focused projects at tech companies and technology-focused projects at car manufacturers. We have also already seen several M&A deals as companies jockey for position and look for synergies.

Exhibit 2: Average semiconductor content per car by level of automation

Source: Infineon Technologies AG

These changes also bring up several challenging questions. For example, if the human contribution to driving is reduced and eventually eliminated, who will buy the cars? Will the difference between driving a sports car and a budget sedan eventually be reduced just to brand? What does this mean for the trucking and ride-sharing industries and the people that they employ? How will critical areas like insurance and security be addressed?

However these questions are answered, it is clear that several established players will be upended and new leaders and markets will emerge. We believe these changes will provide numerous opportunities for forward-thinking investors. However, we also think that it is necessary to be equally focused on avoiding the risks to the status quo that will undoubtedly emerge.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab