OpenAI is an artificial intelligence research organization founded in 2015 by a group of tech luminaries, including Elon Musk. The organization's mission is to develop AI technologies in a way that is safe and beneficial for humanity. One of OpenAI's key areas of focus is deep learning, a subset of machine learning that uses artificial neural networks to simulate the human brain's ability to learn from experience. OpenAI has made significant contributions to the development of deep learning algorithms, including the creation of the GPT (Generative Pre-trained Transformer) language models, which can generate coherent and contextually relevant text based on a given input.

ChatGPT is an AI chat bot based on a Large Language Model developed by OpenAI. ChatGPT is pre-trained by vast amounts of data from Wikipedia, Google and other repositories. After training, ChatGPT analyzes the stored big data, calculates the statistical probability of which text should come next and generates coherent text for a conversation, thus capable of interacting with human beings. Generative AI refers to the AI algorithm that can generate data that resembles human generated data (including text, images, videos, audio, content, etc.), and ChatGPT is one form of generative AI (text).

Large technology companies such as Microsoft and Google have made announcements to incorporate Generative AI chat bot results in their respective search products (Microsoft with Bing and Google with Google Search). Additionally, incorporation of AI models/chatGPT can transform multiple other industries over the next several years with significant productivity improvements with better customer experience – examples include, customer service, call center, content creation, language translation, personalized education material.

The use cases for AI are diverse with market adoption in nascency – but, Generative AI/chatGPT is compute intensive with Natural Language Processing (NLP) query that empowers Generative AI estimated to be 4-5x expensive vs normal Search query. As a result, substantial AI/ML (machine learning) related infrastructure needs to be built out before the product can be rolled out to consumers via search or enterprises to incorporate chatGPT on their website/products. We believe datacenter capital expenditure is an area that is likely to see increased investments as behemoths such as Microsoft, Google and Meta which constitute ~50% of datacenter capex have announced plans to step up their AI/ML related infrastructure investments over the coming years. Despite cost cuts announced by many of the mega cap technology companies, it is our expectation that workforce reduction would be the primary area of cost reduction rather than capital expenditures.

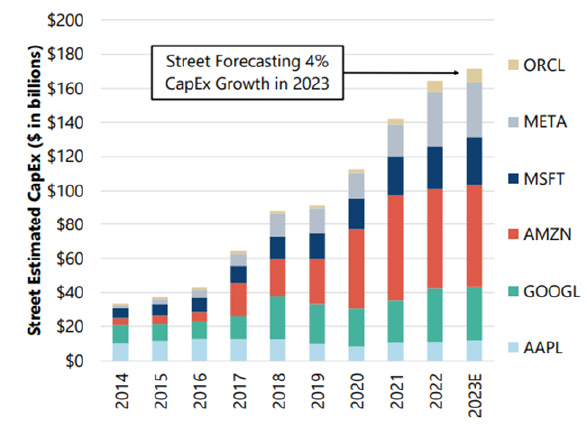

As shown in Exhibit 1, consensus expects 4%y/y growth in aggregate datacenter capex in 2023 from top 6 spenders. We believe the foundation remains strong for continued secular growth in capex beyond 2023 for the next several years.

Exhibit 1: Datacenter Capex by Top Six Operators

Source: Jefferies, DCM, Factset

In summary, AI/ML adoption and the transformation it can bring in multiple industries are at a nascent stage. To kickstart this adoption and to rollout products incorporating AI/ML models, we believe large capital expenditures towards compute and networking infrastructure are needed upfront. We are focusing our efforts on identifying investment opportunities in innovative companies that are uniquely positioned to benefit from increases in datacenter capital expenditure by large technology companies to enable AI/ML.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of February 2023 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since February 2023 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team