While it is generally accepted that the relative value of the US dollar is important, its central role as a driver of relative asset performances is likely more important now than during any time in recent memory. This is due to elevated currency-driven correlations, the dollar’s effect on the commodity complex, and its effect on aggregate earnings growth.

First, the fluctuations in the dollar have had a profound effect on market performance, especially in developed markets. For example, both European and Japanese indices have shown extremely high levels of correlation with their respective currencies the past six months. In the case of Japan, this is a relationship that investors have been familiar with for some time, but for Europe it’s a new phenomenon (Exhibit 1).

Exhibit 1: Correlations (90 day) of the Euro Stoxx and Nikkei indices to their respective currency’s weakness has never been higher in Japan and is a completely new relationship in Europe

Source: Bloomberg

In a world where earnings growth has been more a function of margins than top-line revenues the last few years, this makes complete sense. And as Europe’s prospects have become more tied to external growth, this also makes sense (look at the composition of the German DAX Index: chemicals, autos, industrials, etc.; makes it a China proxy in many ways). It also means that so far this year being “right” has resulted less from being correct that European growth surprises to the upside and more from determining the direction of the euro. We do not think this is a temporary phenomenon. Going forward, we expect the positive correlation between European equities and the euro will remain high and that it won’t return to its historical negative correlations. We continue to expect the yen-Nikkei correlation will remain tight as well. Therefore, sound allocation among developed markets requires a view on the dollar.

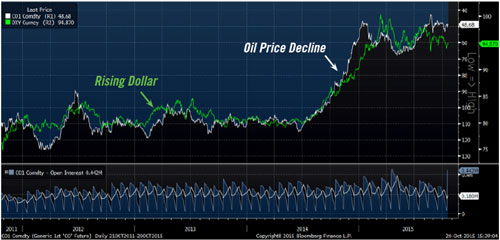

Second, the effect of the dollar on the commodity complex has increased in importance due to the stress in the energy sector. Commodity prices and oil prices are always somewhat related, and in spite of the many narratives surrounding declining oil prices (e.g., breakdown in OPEC, shale production, etc.), much of the fall remains a dollar phenomenon (Exhibit 2). This is particularly important now due to the heightened role of energy companies’ fortunes in determining risk sentiment. Given the level of energy-debt held by credit investors and the banks themselves, the default rates with oil at $30 look significantly scarier than with oil at $50, and the dollar will play a key role in determining that price. Additionally, the relationship between breakeven inflation rates and oil prices remains extremely high. So much so that the oil price will have a large role in determining the steepness of the US yield curve, regardless of what the Fed does.

Exhibit 2: The oil price decline (inverted, white) has been largely a response to a rising dollar (green)

Source: Bloomberg

Finally, the dollar’s value will have a significant effect on earnings growth, or lack thereof, going forward. While earnings are always important, we are of the belief that they are taking more primacy. It’s difficult to quantify the exact drag the dollar has had on earnings but once again this quarter a majority of companies in the US have cited it as a major headwind to earnings. The issue is that we are still seeing debt levels and leverage increasing in the US. Independent of what happens with interest rates or the energy sector’s credit quality, leverage outpacing profits will result in wider spreads and, ultimately, lower equity valuations at a time when equity risk premia are already very low in the US. With corporate debt issuance still running higher and leverage-fueled corporate transactions moving equity markets, we must see better earnings growth soon, something that will prove difficult if the dollar’s rise continues.

From a positioning standpoint, the binary nature of the dollar and its effect on the likely forward returns of different assets advocates for increasing the weight to ‘weak dollar’ assets in the event that the US economy stumbles, the Fed does not raise rates as much as is currently priced, and the dollar subsequently weakens. Judging by positioning data, most investors are significantly underweight these ‘weak dollar’ areas and a reversal in the dollar would cause a sharp reaction.

While many have overlooked emerging market equities, they may provide the best hedge to US weakness. Valuations have improved for the asset class and a positive rebalancing has taken place as domestic weakness within some countries has completely erased external deficits. While these improvements are good, they still require capital outflows to slow, which is impossible to forecast. However, you can forecast that if investors rethink their dollar view, emerging market currencies’ returns would be substantial, which would be likely to bring capital flows back into EM markets.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of October 2015 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since October 2015 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy February 2024 Commentary

By Chad Cleaver, CFA

Driehaus Emerging Markets Small Cap Equity Strategy January 2024 Commentary With Attribution

By Chad Cleaver, CFA