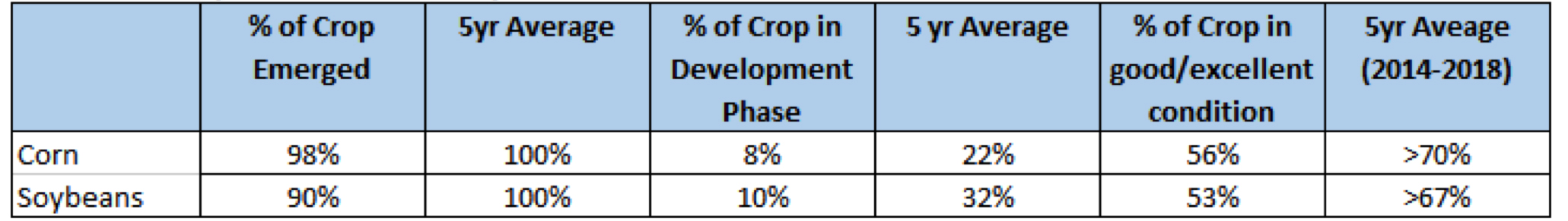

It has been a rough year for the American farmer. If absorbing the impact of an escalating trade war with China and its adverse impact on crop prices and export volumes was not enough, farmers are now having to contend with Mother Nature. Cold, wet weather and flooding in the spring of 2019 has created a difficult operating environment for farmers. As shown in Exhibit 1, as of July 2, both planting progress and crop conditions for soybeans and corn are below five-year averages.

Exhibit 1: US Crop conditions as of July 2, 2019

Source: USDA, Driehaus Capital Management

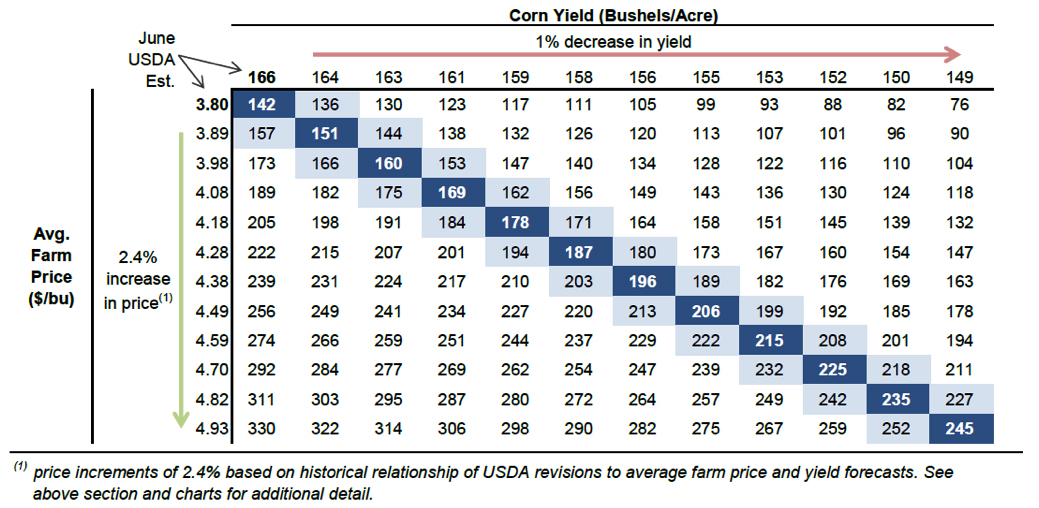

A delayed planting translates into a delayed harvest, which increases the risk of early frost or inclement weather negatively impacting the crop and a downside surprise in yields. In the June World Agricultural Supply and Demand Estimates (WASDE) report, the United States Department of Agriculture reduced its corn yield estimate from 176 bushels per acre to 166. While a yield of 166 bushels per acre is near the range of 168.4-176.8 bushels, seen from 2014-2018, further reductions will likely drive a higher corn price. As shown in Exhibit 2, on average each 1% drop in yield has translated into a 2.4% increase in corn prices. Corn prices, currently around $4.40 per bushel, have rallied significantly over the last two months, but are well below the $5-7 per bushel price levels seen in 2011-2013 when yields ranged from 123-158 bushels per acre. The next WADSE report, scheduled for release on July 11, 2019, will be an important data point to watch.

Exhibit 2: Corn Crop Economics: Sensitivity to Lower Yields ($ per planted acre)

Source: USDA, Baird Research

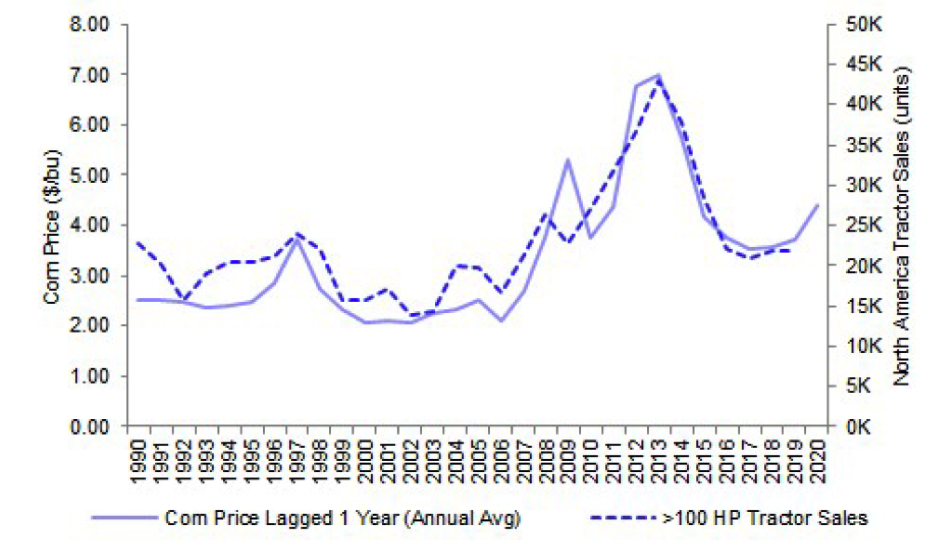

A further increase in corn prices would be a positive development for farmer income as corn typically accounts for nearly 25% of crop receipts. As shown in Exhibit 3, agriculture equipment purchases often correlate with corn prices on a one-year lag. Should corn yields decrease further, equipment purchases could see improvement in 2020.

Exhibit 3: If Corn Hits $5+ in 2019, 2020 HHP Volumes May Increase By 20%

Source: Bloomberg, AEM, Deutsche Bank

Even if a rally in corn prices fails to materialize, there are some tailwinds for a cyclical recovery in agricultural machinery in 2020:

- The installed base of large agricultural equipment is the oldest in at least five years, and with equipment tax depreciation bases that are used to offset income depleting, farmers will have an incentive to trade-in equipment.

- Farmers will receive roughly $16 billion in federal aid for lost money from the trade war.

- Corn and soybean inventories are likely to be in a more favorable position entering 2020 as inventory is likely sold to compensate for acres that are unable to be planted in 2019.

- New technology such as high-speed precision planters, combine automation, precision sprayers, and telematics, could be a secular driver for farmers to upgrade equipment.

An escalation in the trade war is a possible risk, but our view is at the margin, things will get better on that front. The U.S. Growth Equities Team sees several opportunities in companies that are positioned to benefit from an improved farmer outlook in 2020.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of July 2019 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since July 2019 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team