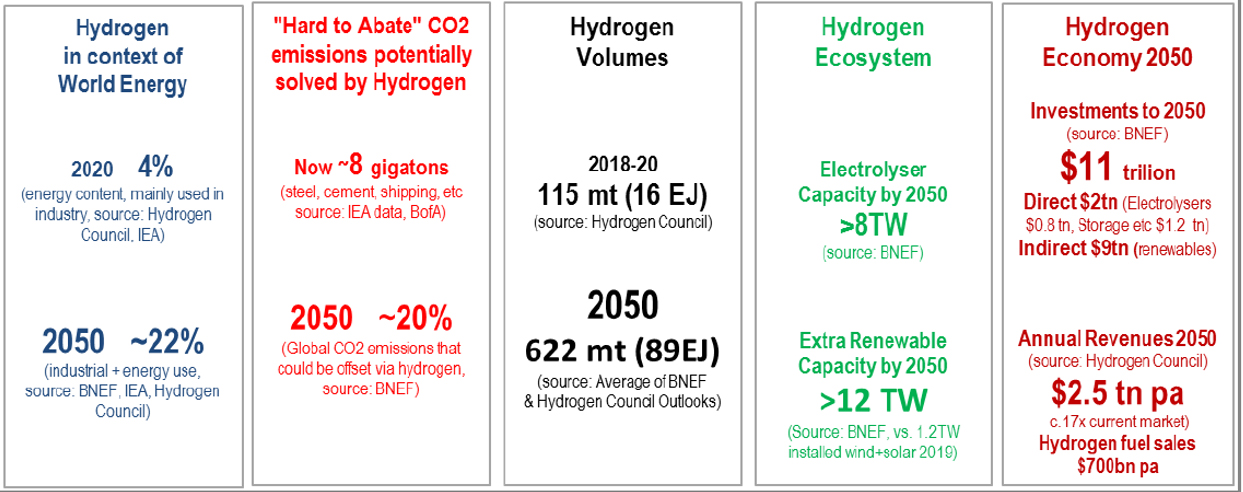

Several European nations have pledged to become carbon-neutral by 2050 by having zero net-emissions. While financial details for achieving zero net-emissions are lacking, it is interesting that hydrogen, an element accounting for roughly 2% of global carbon emissions, has a part to play. According to the Bloomberg National Energy Finance (BNEF), hydrogen generation was a roughly 115 million tons ($142B) market in 2019 and could grow to over 696 million tons (~$2.5 trillion) by 2050 as demand rises (Exhibit 1). According to the BNEF, roughly 30% of global emissions come from industries generating emissions that are difficult to reduce via electricity, such as the production of aluminum, cement, and steel. Other solutions such as hydrogen will be required. These industries include aluminum, cement, and steel production. Other industries such as transportation fuel and energy storage are also expected to see growth. However, with hydrogen currently a big carbon emissions emitter, technology advancements are required in order to turn it “green”. Link

Exhibit 1: Hydrogen Drivers Through 2050

Source: Bank of America Securities

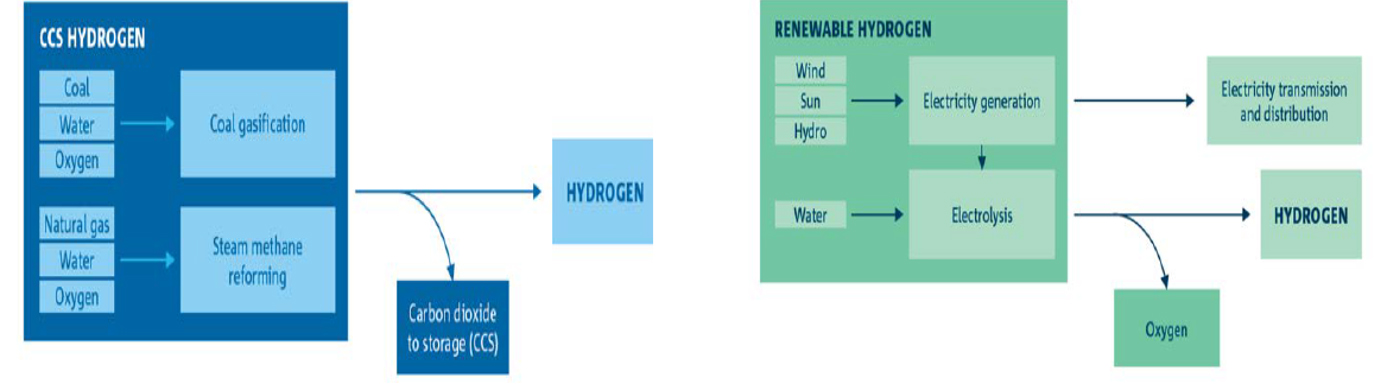

Hydrogen is produced through a process called electrolysis in which an anode and cathode in water are separated by a permeable barrier. An electric current is then passed through, splitting the water to produce zero carbon hydrogen or oxygen. Hydrogen is not considered clean because roughly 99% of the electricity used in the production process is sourced from fossil fuels such as coal and natural gas, and are often termed “brown” or “grey” hydrogen. Investments are being made in “blue” and “green” hydrogen production. Blue hydrogen is produced from fossil fuels, but alongside some type of carbon capture or storage technology while green hydrogen from electricity generated by renewable energy sources such as wind or solar (Exhibit 2). Turning hydrogen green will help achieve 2050 carbon neutrality goals.

Exhibit 2: Blue and Green Hydrogen Pathways

Source: Bank of America Securities

The cost of blue and green hydrogen production is not yet economic, but the hope is costs will fall over 90% by 2050, driven by economies of scale and technology advancement. If 2050 BNEF market estimates prove accurate, an estimated $11 trillion in investments spread across electrolysers, energy storage, and wind and solar power generation are required. Solar and wind electricity generation could grow from roughly 1.3 terawatts to over 12.3 terawatts by 2050. This will create investment opportunities across the hydrogen supply chain.

Achieving net-neutral carbon goals by 2050 is unlikely achieved with a one-sized fits all technology and our view is that hydrogen has a part to play. We continue to look for growth opportunities related to hydrogen in the fuel cell, carbon capture, and renewable energy power generation spaces for our investment strategies.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of February 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since February 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James