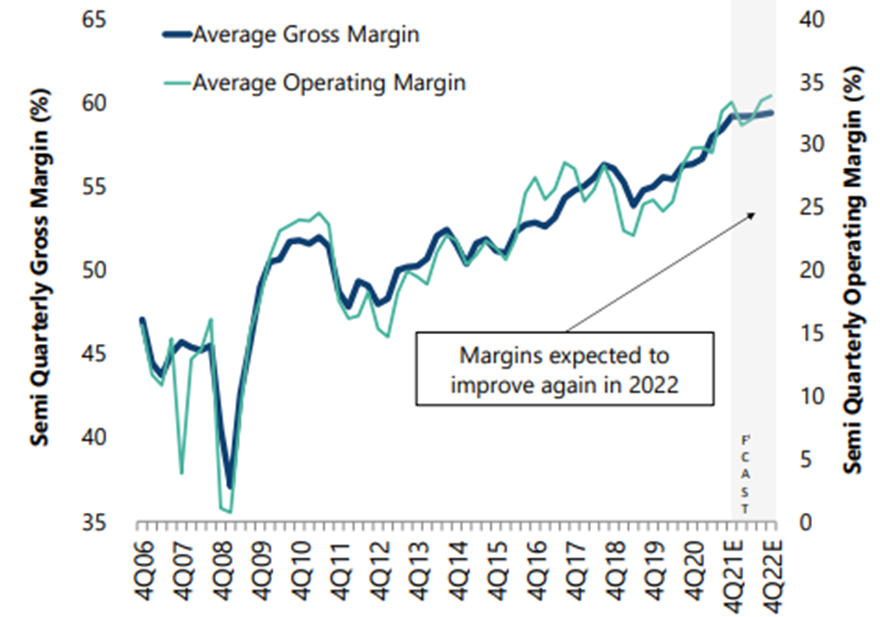

Coming out of the pandemic lows in the market in March 2020, the semiconductor sub-sector emerged as a top performing group as the sector enjoyed several tailwinds. Prior to the lockdowns/shutdowns in 1Q2020, the sub-sector was undergoing inventory correction with industry clearing out excess and lean inventories across the supply chain. Strong stimulus response in 1Q2020 and Government support from economies around the world led to strong demand for goods, but COVID restrictions resulted in crippling semiconductor supply chains with production disruptions. This allowed most of the companies in the semiconductor sector to enjoy strong demand outstripping supply. This resulted in a strong pricing environment, with margins reaching decade highs. The chart (Exhibit 1) below shows the average gross (left scale), operating (right scale) margins over the last decade with margins at all time highs in 2022.

Exhibit 1 – Average Gross and Operating margins for semiconductors

Source: Jefferies, public companies’ disclosed financial data, Factset

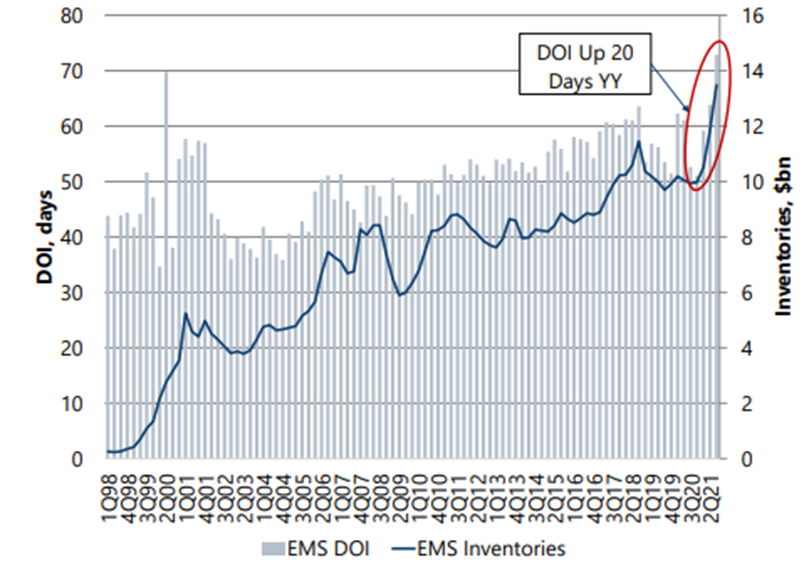

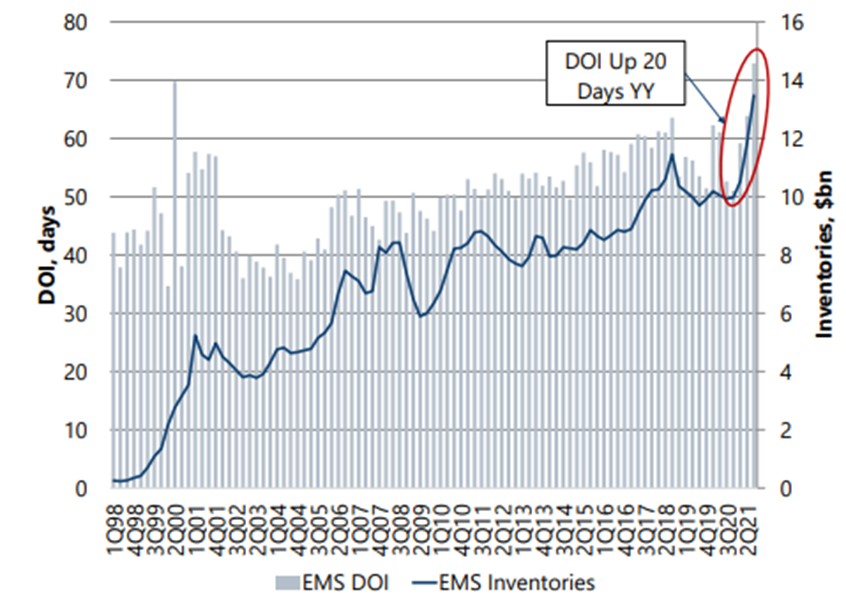

After the most recent earnings update from semiconductor companies, the common theme continues to echo strong demand conditions. We believe that supply chain tightness will continue through 2022 resulting in elevated lead times, customers committing to non-cancelable contracts with semiconductor companies lending visibility to growth and profitability through 2022. Despite this positive update, semiconductor stocks have seen lackluster reaction to strong earnings reports and upward revisions, which is a cause for concern as it is typical for cyclical investors to sell near a perceived cyclical peak on good news. One fundamental reason for concern sparking ‘Peak’ concerns is the growing inventories downstream at contract manufacturers that have shown increases in Inventory Dollars held and Days of Inventory (DOI) (Exhibit 2), while chip distributor inventory on dollar basis also stand at all time highs (Exhibit 3). These trends suggest semiconductor companies' revenue recognition is being pulled forward before the actual product is being shipped out from EMS/Distributor partners.

Exhibit 2 – EMS inventory (line, right scale) and DOI (bars, left scale)

Source: Jefferies, public companies’ disclosed financial data, Factset

Exhibit 3 – Chip distributor inventory (line, right scale) and DOI (bars, left scale)

Source: Jefferies, public companies’ disclosed financial data, Factset

The semiconductor industry is cyclical and these trends around inventory building and correction are part of the cycle. Investors treating the most recent earnings reports in the semiconductor sector with skepticism is normal at this point of the cycle – while some inventory correction is possible and healthy for the industry into summer 2022, industry backdrop suggests the upcycle can continue in to 2023 post this inventory normalization downstream this year. Growth tailwinds include:

- Semiconductor content is increasing secularly in multiple existing industries such as automotive/industrial.

- Large new markets such as EV, Datacenter, Internet of Things (ioT), Autonomous driving are in early stages of driving semiconductor unit growth.

- End market demand profile continuing to remain robust with several large end customers in industries such as auto, consumer appliances and networking continuing to note inability to meet demand due to chip shortages.

As we look at our positioning in this period where market participants worry about inventory correction into the summer, focus in the sector has been on cheaper cyclical companies that have company specific growth dynamics such as capacity coming online to meet demand, receiving additional wafer commitments from foundries that have not been adequately modeled into market expectations.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of February 2022 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since February 2022 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James