The semiconductor end market, which had a cyclical bottom in the first quarter of 2016, in concert with the low point of the US economy, continued to see two years of strong, unabated cyclical growth which finally succumbed to cyclical pressures in the second quarter of 2018. In the first half of 2018, the group started exhibiting many telltale signs of late cycle phenomenon – lead times well above prior cycle peaks, commodity sub-segment operators (like discretes) seeing lead times extend to a quarter or more instead of a few weeks historically, industry surveys pointing to increased double ordering. The semiconductor stock index (SOX) broadly reflected these trends as the index peaked coincidentally in the first half of 2018 along with peak fundamentals.

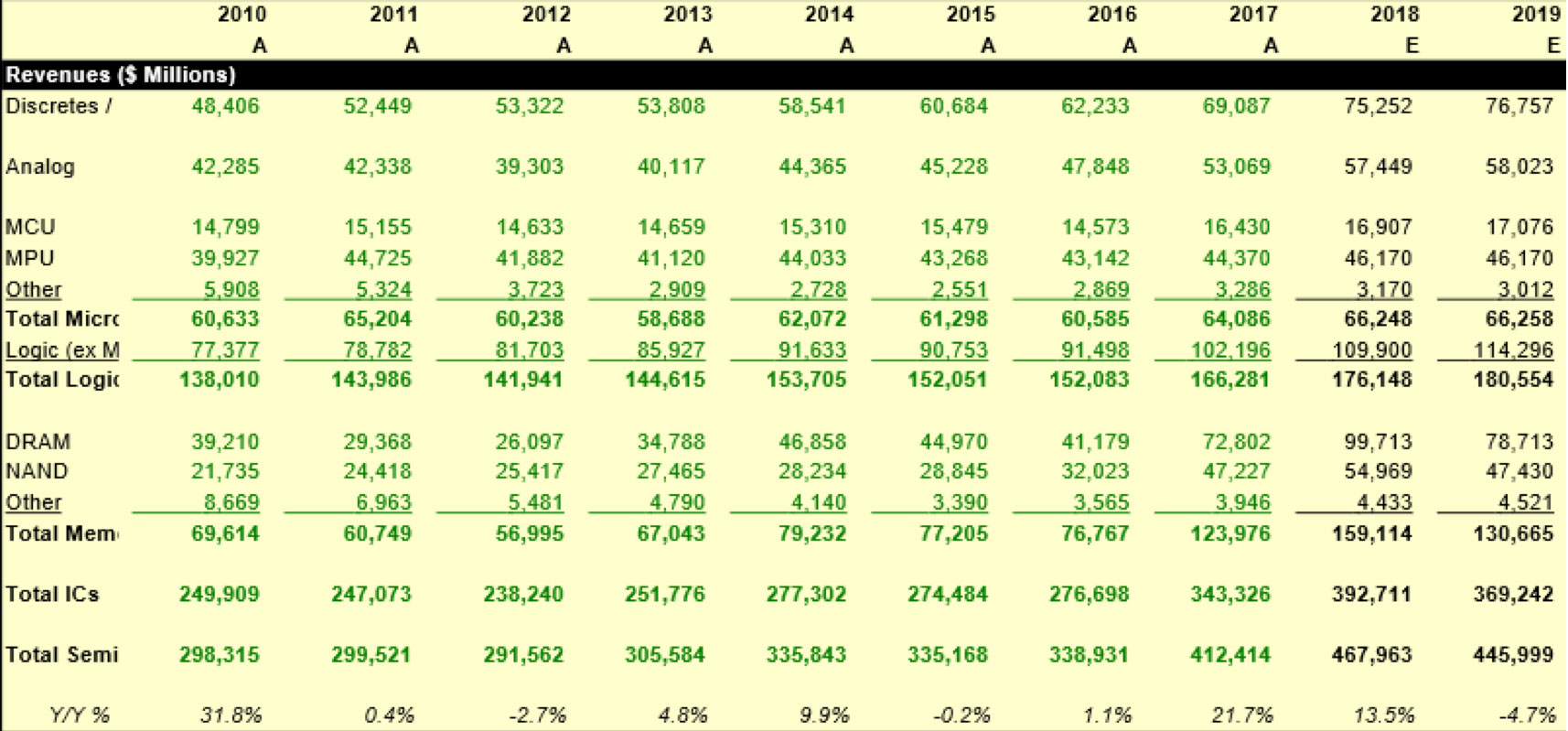

Semiconductor sector fundamentals broadly deteriorated in the second half of 2018 as a combination of global economic slowdown, tariff headlines that resulted in volatile ordering patterns, and excess channel inventory which resulted in marked deceleration in overall semiconductor growth rates in the second half of 2018. As we sit in the first quarter of 2019, some of the overhang from the cyclical excess of the prior cycle continue to linger and, combined with a slower US economic growth outlook (as reflected by recent Institute of Supply Management numbers) and malaise in some end markets like China auto and global Smartphones will result in the overall semiconductor industry seeing revenue decline in 2019. Morgan Stanley and Semiconductor Industry Association (SIA) model for 2019 shows overall semiconductor revenues down 4.7% year over year, all of the revenue decline coming from memory segment.

Exhibit 1: Morgan Stanley and the Semiconductor Industry Association’s 2019 model

Source: SIA, Morgan Stanley

While industry forecasts for all other segments outside of memory do show modest growth, risks remain to the downside for these estimates for two reasons:

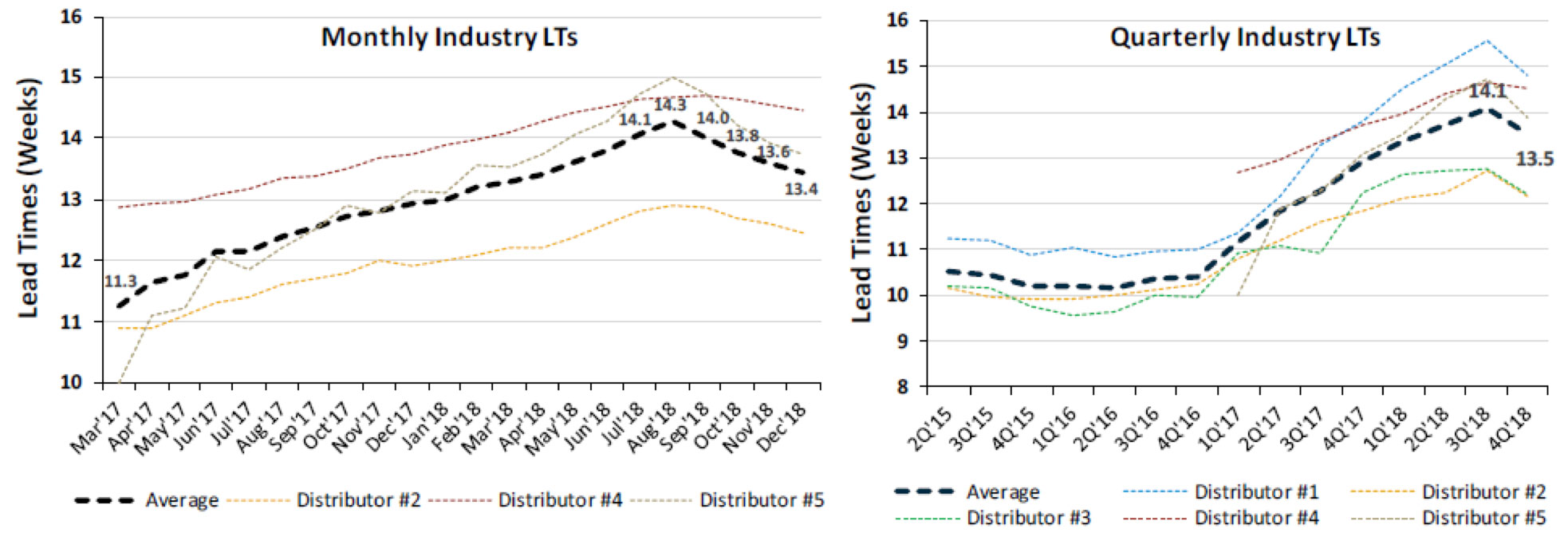

Lead times (LT), which is an indication of visibility for future orders, are contracting after an extended period of expansion. Overall industry lead times have extended well above the median level and are likely to contract further.

Exhibit 2: Overall semiconductor industry lead-times (monthly – left and quarterly – right)

Source: Susquehanna Financial Group

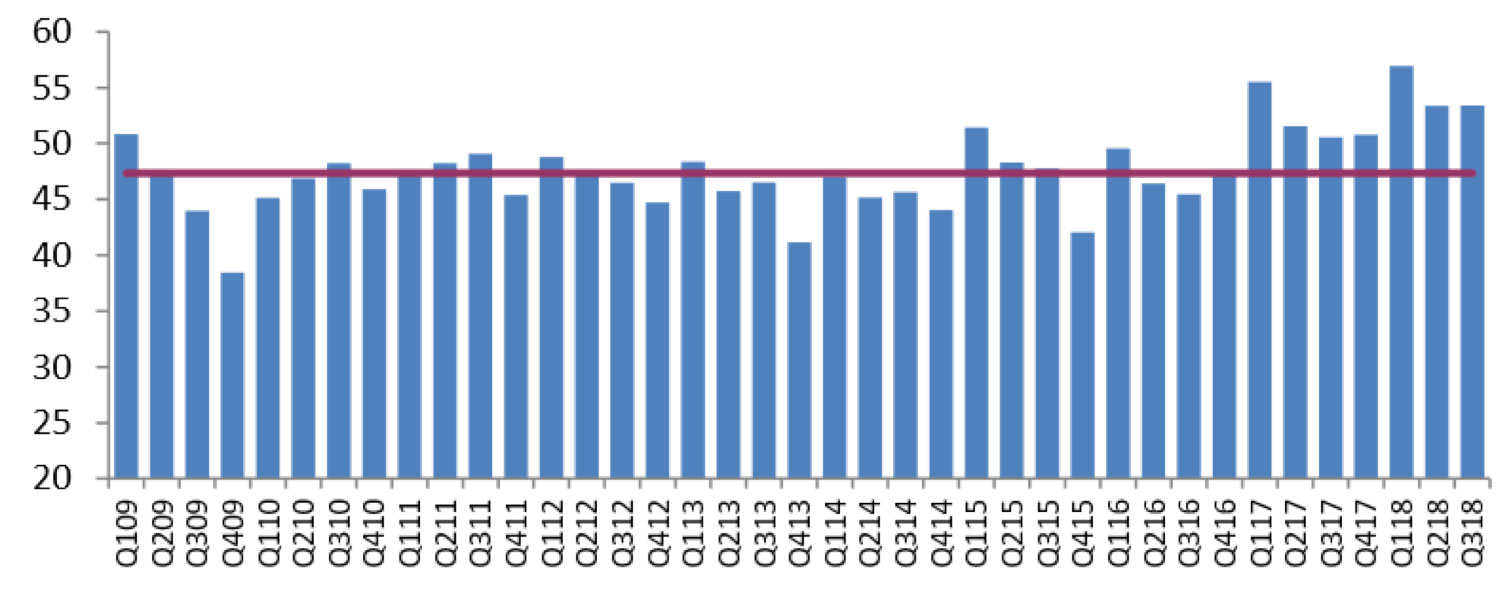

Contraction in Lead Times are happening at a time when distributors are carrying inventories over long term median levels (Red Line in Exhibit 3 below). This suggests that distributors have room to digest inventories before placing new orders to suppliers (which will cause Lead Times to stop going down).

Exhibit 3: Distributors DOI

Source: Morgan Stanley, Thomson Reuters

On a positive note, investors and analysts covering the industry have marked down growth expectations and valuations of all companies in the industry; valuations are quite attractive in certain sub-segments within semiconductors, in-line with non-recessionary cyclical bottoms. However, it is premature to call the bottom in the industry purely based on valuation alone as we are just one to two quarters into a down cycle after 10 quarters of continued expansion. We continue to monitor data points within this industry seeking signs of stability, looking for a cyclical bottom in the months ahead.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of January 2019 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since January 2019 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team