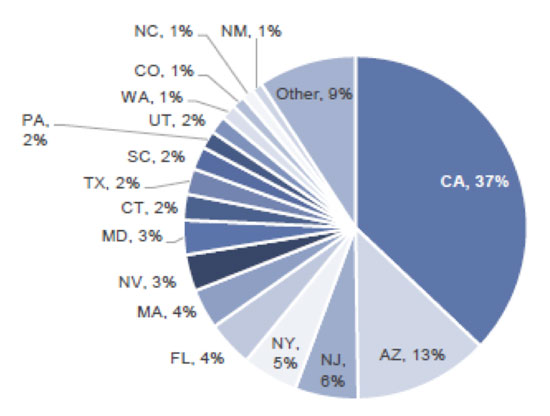

The solar industry has been slowly moving from government driven subsidized industry a decade ago, to one that is at grid parity in most markets, both in and outside the US. Solar has been able to achieve grid parity as Levelized Cost of Electricity is equal to or less than electricity delivered from the grid. California, Arizona and Hawaii were among the first states where solar energy achieved grid parity as sunshine is abundant/high number of sunny days and grid electricity prices are high. As a result, California has emerged as the largest solar market in US (based on megawatt installed), as shown in Exhibit 1.

Exhibit 1: Solar Market share by state in 2018

Source: Energy Information Administration, Solar Energy Industries Association

In the US, government subsidies and credits for solar installations are largely being phased out; but governments continue to play an important role in setting mandates to drive solar adoption as it is at grid parity and solar is green/an environmentally friendly energy source. One upcoming mandate that was set in 2018 that could serve as major growth driver for the industry is the California state mandate requiring every new residential home (three stories and under) built in 2020 to have a rooftop solar system. Goldman Sachs estimates rooftop solar was installed in 15,000 homes out of a total of 130,000 residential homes built in 2018. Assuming similar number of homes built in 2020, the new mandate would subject an additional 115,000 homes to be installed with rooftop solar, indicating a material step-up to current run rate.

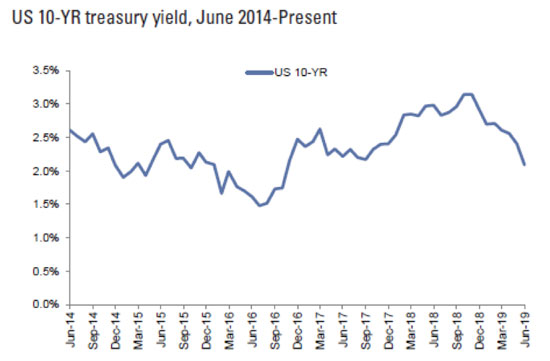

Meanwhile, 10-year interest rates have declined materially over the last 12 months (Exhibit 2), bringing solar installers cost of capital lower and thereby making monthly cost of having rooftop cheaper.

Exhibit 2: US 10-YR treasury yield, June 2014-Present

Source: Factset

With new mandates going in to effect and interest rates lower than any time in the last 18 months, strong growth drivers are in place for the US residential solar market in 2020. We are actively looking at investment opportunities in companies that have unique leadership position and are set to benefit from the growth in the US residential solar industry.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of August 2019 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since August 2019 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James