Google search activity can be used by investors as a good barometer of what consumers are looking to purchase. While only one data point, year-over-year changes in Google searches can in many cases, be correlated with a company’s revenue growth. With this in mind, we can check in with Google Trends, a publicly available tool, to learn what consumers are interested in while sheltering in place.

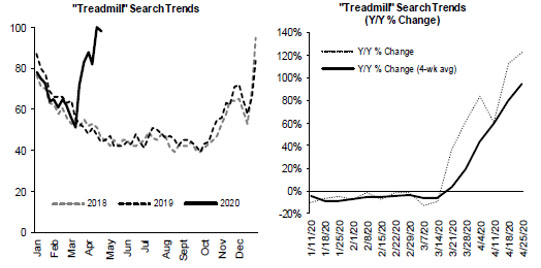

With gyms across the country closed, millions of people are having to look for alternate ways to exercise. Not surprisingly, this has led to an explosive growth in Google searches for various types of exercise equipment, such as treadmills (Exhibit 1). Investors have taken note; with the stocks of a few exercise equipment companies meaningfully outperforming in recent weeks.

Exhibit 1: Treadmill Search Trends

Source: Google Search Trends, Baird Analysis

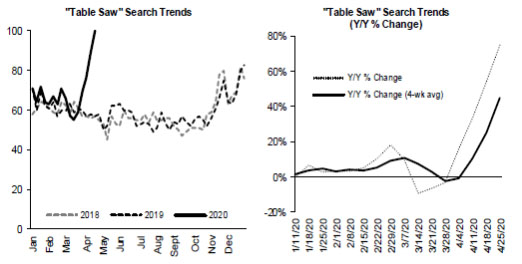

For those that are handy around the house, now seems to be the time to take care of some home improvement projects, leading to a big increase in consumers looking for table saws (Exhibit 2). Unfortunately, there are no table saw stocks to invest in but many companies in the home furnishings industry with strong ecommerce businesses are similarly seeing the benefits of a population sheltering in place and looking to make their homes more comfortable.

Exhibit 2: Table Saw Search Trends

Source: Google Search Trends, Baird Analysis

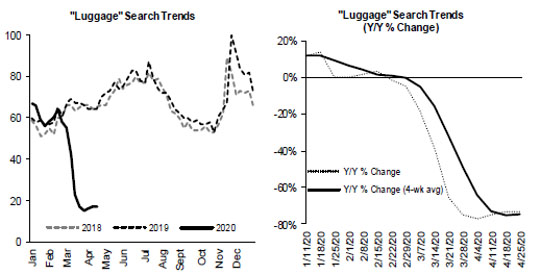

So what are consumers not looking to buy? Given all the cancelled vacation plans, luggage has moved way down on shopping lists (Exhibit 3). For those looking for bargains, it may be a good time to get a new suitcase!

Exhibit 3: Luggage Search Trends

Source: Google Search Trends, Baird Analysis

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2020 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2020 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James