Restaurant stocks have been struggling this year, with an equal-weighted composite of 54 restaurants meaningfully underperforming the Russell 2000 Index (Exhibit 1).

Exhibit 1: Strength of an equal-weighted basket of restaurant stocks relative to the Russell 2000 Index

Source: FactSet, Driehaus Capital Management

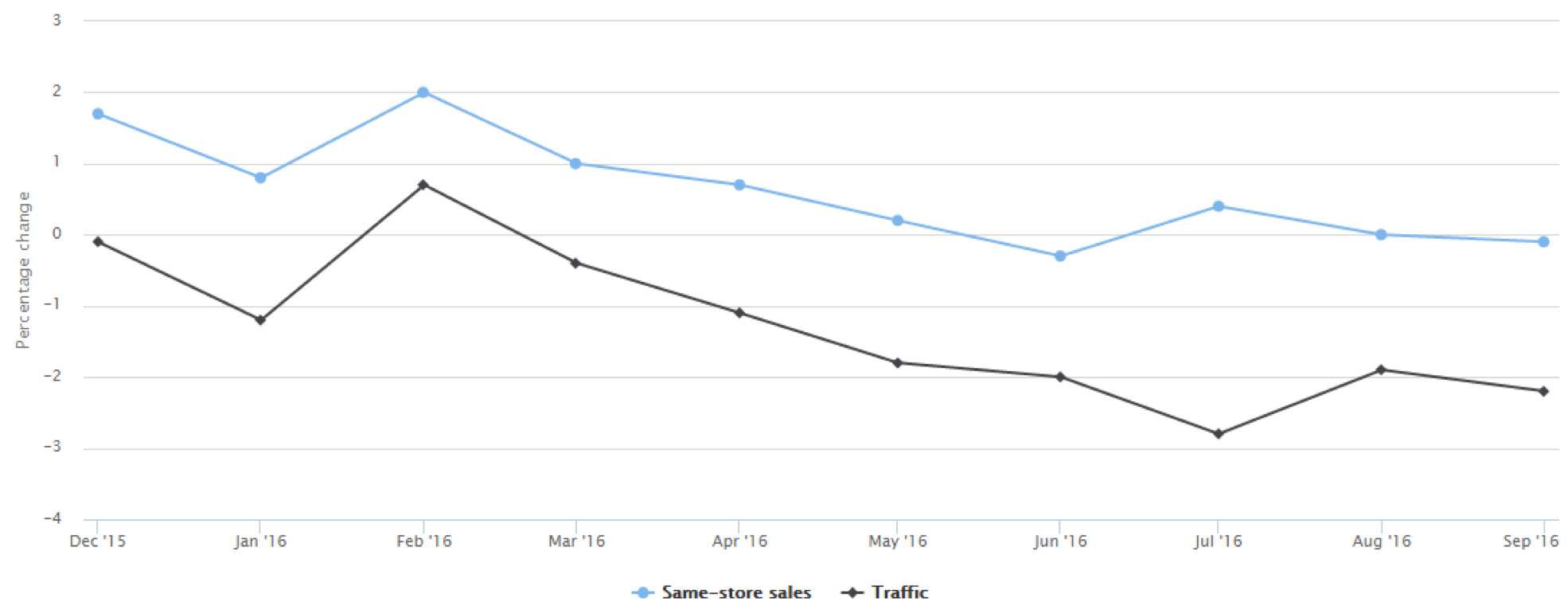

This has surprised many as various measures of consumer spending have been positive and same-store sales were strong at the start the year, helped by an unusually warm winter. However, growth started to decelerate in March and sales trends across the industry have remained sluggish ever since (Exhibit 2).

Exhibit 2: Restaurant industry performance. Change in year-over-year results, monthly

Source: MillerPulse

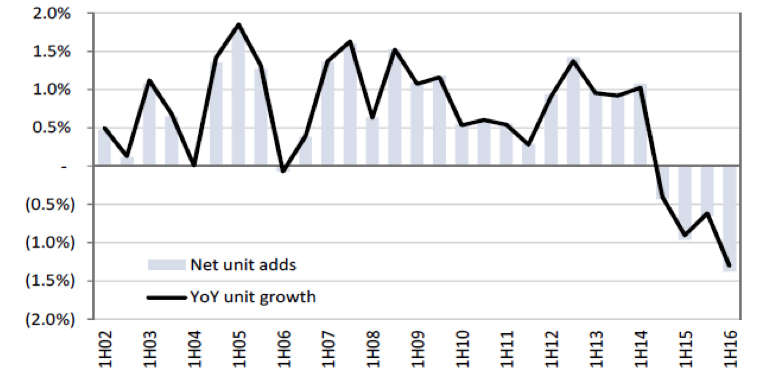

Several explanations for weak same-store sales growth have emerged. One theory is that rapid expansion by fast casual operators has outpaced demand and cannibalized existing units. However, a look at the most recent restaurant census by The NPD Group shows that industry capacity has been shrinking for the last two years (Exhibit 3). This makes capacity growth an unlikely culprit. With eight bankruptcy filings by major restaurant companies over the last 10 months, capacity seems likely to continue declining.

Exhibit 3: Restaurant net unit growth and year-over-year change in unit growth

Source: NPD Recount data, Goldman Sachs Global Investment Research

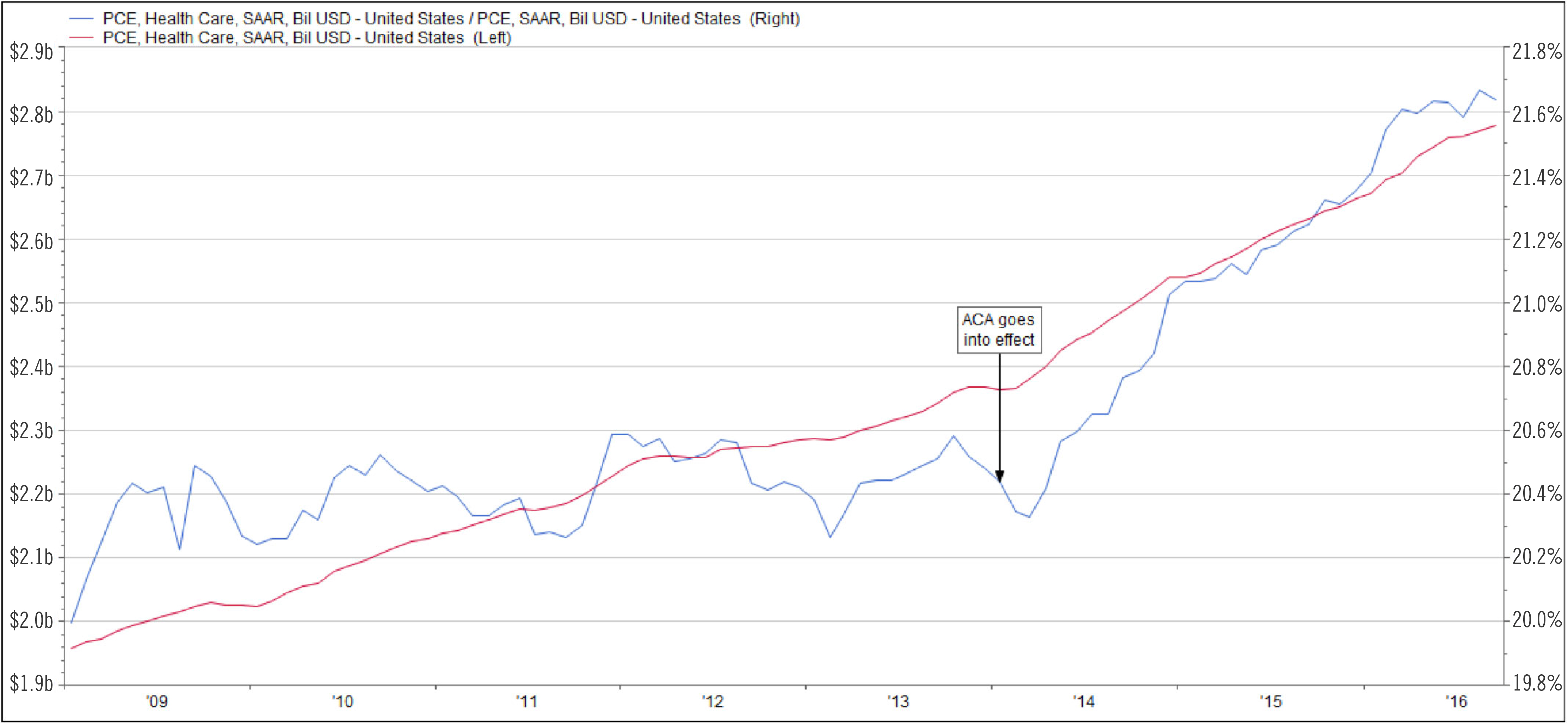

Another opinion was offered by Andy Puzder, CEO of CKE Restaurants, in a recent Wall Street Journal op-ed. As a Trump supporter, he argued that health care costs are consuming an increasing amount of consumer spending and that ObamaCare is to blame for declining restaurant sales. While obviously a biased opinion, the Personal Consumption Expenditures (PCE) report at least backs up his claim that health care spending is taking wallet share (Exhibit 4). Health care’s share of PCE has risen over 100 basis points to 21.6% and total spending is up $410 billion, or 17% since the bulk of the Affordable Care Act went into effect on January 1, 2014. With ACA premiums set to rise 25% in 2017, this source of pressure on restaurant sales seems likely to continue.

Exhibit 4: Health care’s share of total Personal Consumption Expenditures (blue, RHS,) and total health care spending (red, LHS)

Source: FactSet, Driehaus Capital Management

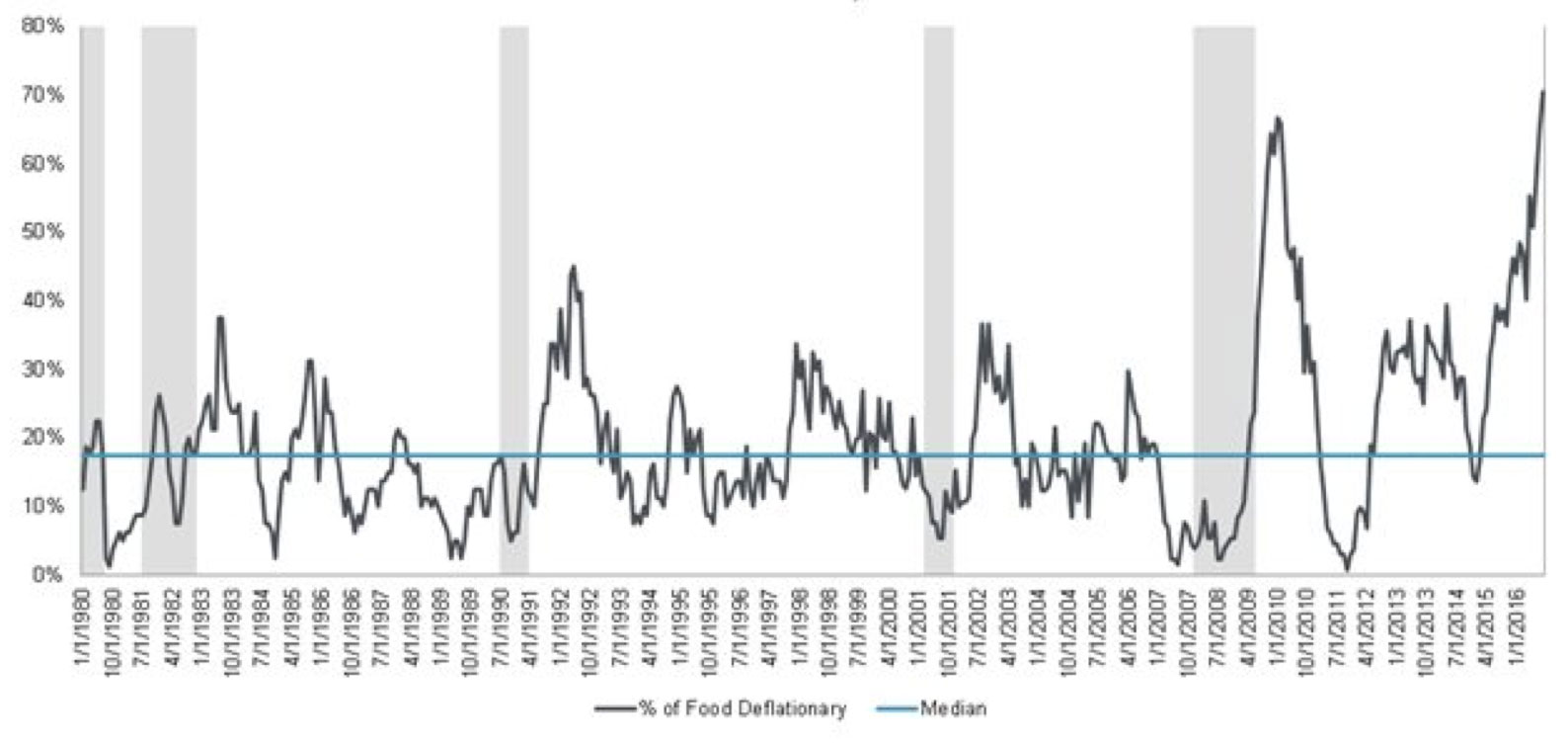

Perhaps the most widely-held view among industry participants is that food deflation is to blame for sales woes. Food prices have been falling across a record number of categories with beef and dairy products leading the way lower.

Exhibit 5: Percent of food categories exhibiting year-over-year deflation

Source: BLS, Piper Jaffray & Co.

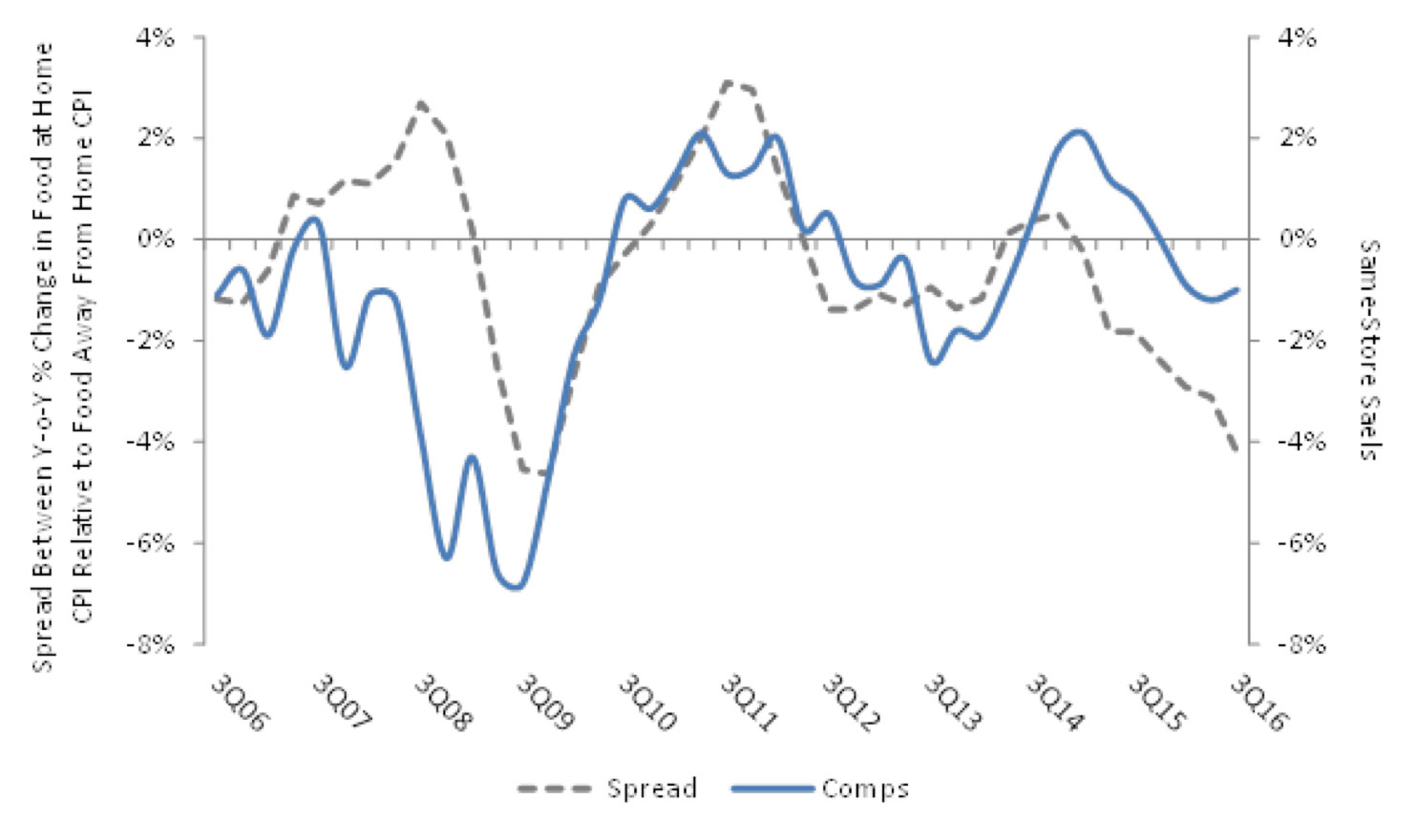

While restaurant companies have been beneficiaries of these lower food costs, they have been unable to take full advantage because of rising minimum wages and low unemployment pressuring labor costs. This has caused the difference between food prices away from home (i.e., restaurants) and food prices at home (i.e., food bought at grocery stores) to hit levels usually seen only during recessions. Faced with the choice between saving money by cooking at home or paying up to eat at a restaurant, the theory is that more people are opting to save money and forgoing eating out. This view is supported by the high correlation between the weaker relative value of restaurants and Knapp Track’s measure of industry same store sales (Exhibit 6).

Exhibit 6: The increasing relative cost of eating away from home is hurting restaurant sales

Source: USDA, Knapp Track and BMO Capital Markets

Until this trend in relative value reverses, the restaurant industry will remain under pressure, making it important for investors to identify companies that have unique traffic drivers and strong brands that can withstand the poor sales environment.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of November 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since November 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team

Driehaus Small Cap Growth Strategy March 2024 Commentary with Attribution

By Jeffrey James