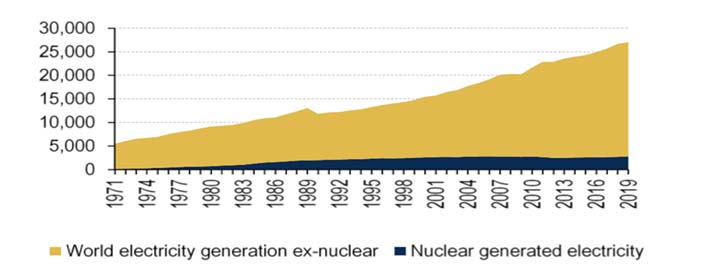

The term “energy crisis” has crept its way into several research reports and news articles across Wall Street in recent weeks. I am not here to say if the term is being used accurately or not, but at the very least it is reflective of recent developments within energy’s commodity markets. Oil and natural gas are up 70% and 127% YTD in the US, respectively, as oil attempts to work its way out of a deficit and natural gas markets struggle to build inventory ahead of winter. It makes one consider what other sources of energy we have that are both reliable and clean, as in de-carbonized. Wind and solar have been popular and growing for years, but they are not always dependable. Another source that is coming back in favor after a decade of shrinking capacity is nuclear power and its mineral feedstock, uranium. Uranium is extremely clean and efficient. According to Bank of America, 1 kilogram (kg) of uranium produces about 50,000 kilowatt-hours (kWh) of carbon-free electricity compared to 1 kg of thermal coal producing just 3 kWh of carbon-producing electricity. Governments around the world are recognizing nuclear power’s value as a carbon-free and reliable source of electrical power. Demand for electricity ultimately drives demand for uranium, and demand for electricity is showing no signs of slowing down. See Exhibit 1.

Exhibit 1. Electricity Demand

Source: Bank of America

As you can see there is a large opportunity for uranium and nuclear power to play a much larger role in the world’s production of electricity. Last week, 10 EU member states declared that nuclear power needs to be part of the European taxonomy going forward. Last month, Illinois approved $700 million in subsidies to prevent two nuclear power plants from shutting down. These are two of many examples, but the drumbeat is getting louder. The American Jobs Plan proposes increased funding for development and support of our nuclear fleet. China’s latest Five Year Plan includes an initiative to double nuclear capacity by 2030 to 120 gigawatt electrical (GWe). As a frame of reference, global nuclear capacity today is 384GWe, according to Canaccord Genuity. Nuclear power development is now a global initiative.

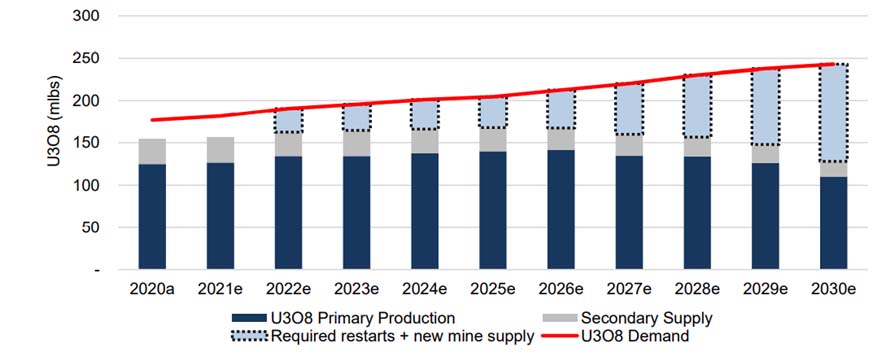

Even more enticing from an investor’s point of view is the supply/demand imbalance that currently exists in the uranium market. After the nuclear disaster at Fukushima in 2011, demand for nuclear power plummeted and capacity utilization dropped. Additionally, the uranium industry is concentrated with the top five producers controlling 70% of the market, and these producers have been very disciplined about bringing production back online. The largest producer in the world has announced extended production cuts of 20% through 2023. Add in the impact of the COVID pandemic, and we have a market that is short its primary feedstock. See Exhibit 2.

Exhibit 2. Uranium Supply and Demand

Source: Company Reports, WNA, UxC LLC, Canaccord Genuity estimates

The uranium miners are currently in a favorable position as uranium spot prices are believed to be well below prices that would incentivize idled capacity to restart. Prices need to increase anywhere from 25-45% to entice significant supply to come on the market. See Exhibit 3 for a historical price chart. Once that happens, it will take 6-18 months to ramp production. It seems the only way to meet the world’s increasing demand for nuclear energy is for uranium prices to increase from here. Higher-priced contracted volumes with utility customers are likely to lead to significant positive earnings revisions for uranium miners going forward.

Exhibit 3. Uranium Price History

Source: UxC LLC, Bank of America

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of October 2021 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since October 2021 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team