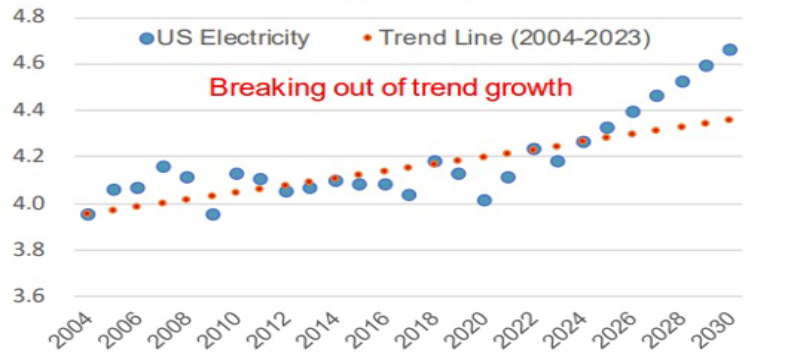

Electricity generation in the United States has been stable the last two decades growing at roughly 0.4% annually. This stability seems set to end due to new demand from the build out of new manufacturing facilities to “reshore” supply chains, the buildout of data center infrastructure, crypto currency mining, artificial intelligence (AI), and rising penetration of electric vehicles. As shown in Exhibit 1, the convergence of these demand drivers could double or triple the annual power consumption growth rate seen over the last two decades.

Exhibit 1: U.S. Electricity Generation (Terawatt hours (TWh) per annum)

Source: Cornerstone Macro

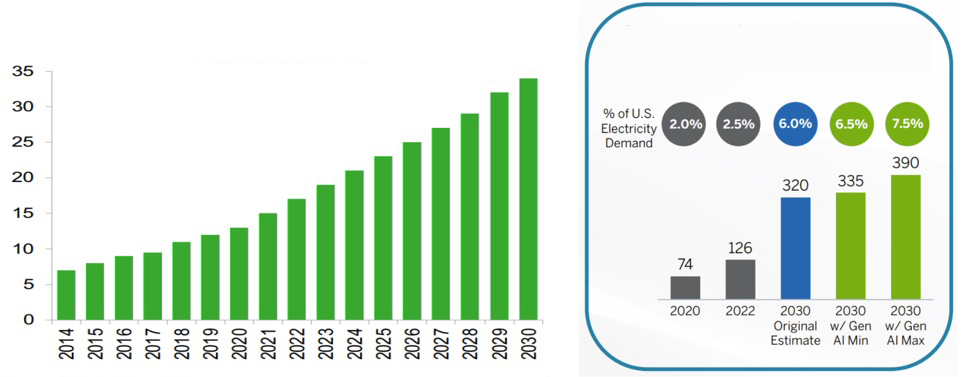

While several emerging technology sectors are mentioned, the primary driver seems to be data centers and more specifically data. Evercore ISI recently called attention to a report from Jones Lang LaSalle that forecasts data generation from consumers and businesses the next five years will be twice as much as all data created over the past ten years. And according to Boston Consulting Group, data centers will grow from 2.5% of US electricity demand currently to 6.0-7.5% by 2030 (Exhibit 2). This growth would imply turning on roughly 3 gigawatts (GW) annually in terms of power demand. This is a big number, but Morgan Stanley, in conversations with hyper-scalers indicated the actual need could be 5-7 GW annually.

Exhibit 2: Forecasted U.S. Data Center Demand Growth (Right Chart: Capacity in GW, Left Chart: TWh)

Source: Evercore ISI Research

Ramping data center construction has generated investment opportunities in the equipment suppliers, but there are limiting factors, namely the availability of power. On a recent Morgan Stanley expert call, the speaker indicated that the power requirements of data centers have tripled in the past few years from 10-30 megawatts (MW) to 100-500 MW. This could be higher as ISI called attention to a McKinsey & Company study indicating that AI data center racks could require seven times more power than traditional data center racks. This creates complications as the electrical infrastructure of most countries is not ready to handle the spike in high voltage power demand created by data centers. As a result, it is becoming increasingly difficult to find locations to support 100-500 MW power. This will support investment opportunities in the build out of electrical infrastructure with more transmission lines and substations.

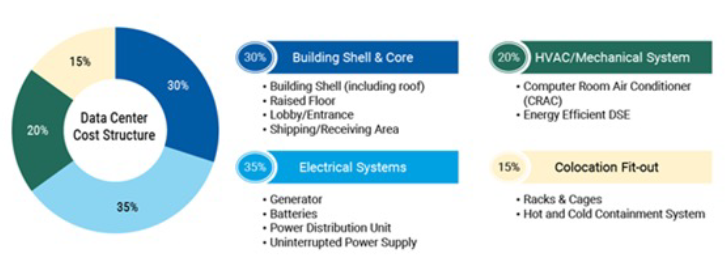

Exhibit 3: Data Center Cost Structure

Co-location data center Capex split (excluding IT equipment) - Cap Goods TAM can be up to 70% of the total wallet, with electrical systems compromising half of that (35%).

Source: Morgan Stanley

Power infrastructure availability aside, we view the coming data center buildout as a multi-year trend with broad-based investment opportunities across the industrial, technology, and utility space. As shown in the Exhibit 3, there are multiple ways to play the data center trend and we continue to search for investment opportunities in our growth funds. These opportunities include engineering companies to design facilities, construction companies to build facilities, thermal management equipment for inside the facility, transmission capacity buildout to supply power for new facilities, natural gas to power electrical power generation, and backup power to keep facilities operational.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of April 2024 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since April 2024 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team