In what should have been a banner year for retailers and retail stocks given a strong consumer spending environment, favorable weather and clean inventories, turmoil and uncertainty arising from a trade war between the U.S. and China have clouded the final months of 2018. With a looming threat from President Trump to impose a 25% tariff on all goods imported from China, retailers and their suppliers are being prompted to consider restructuring well-developed supply chains that have been in place for years.

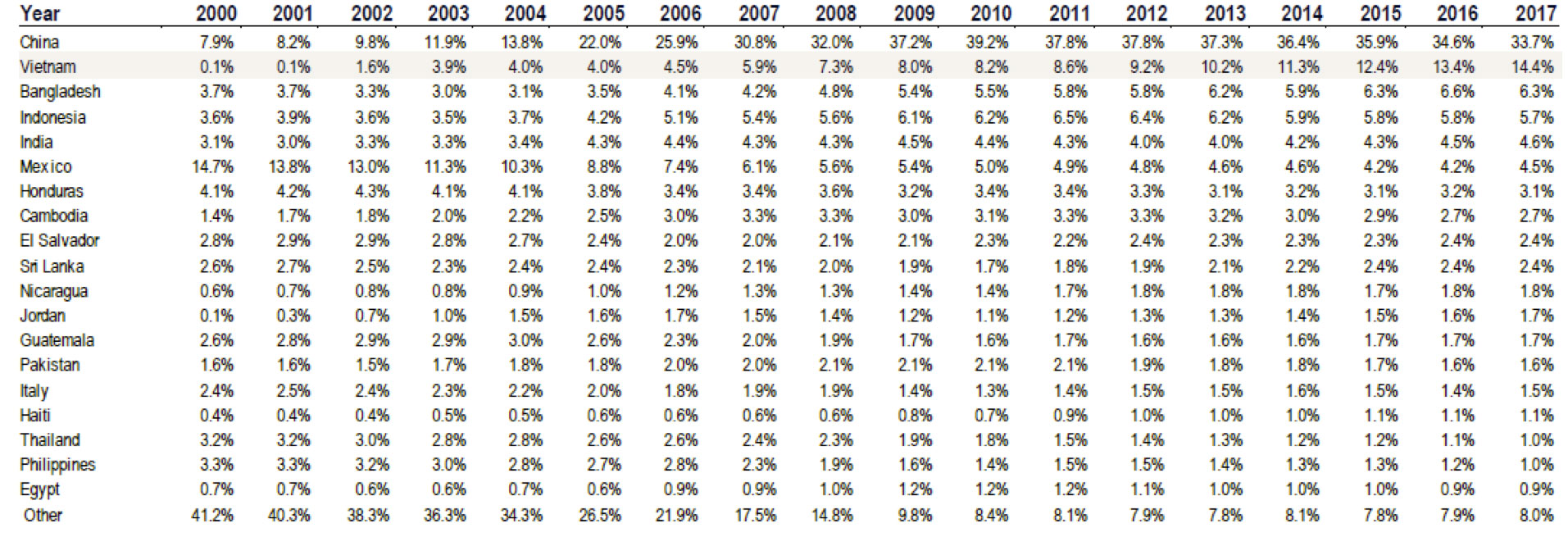

Apparel companies appear to be ahead of the pack in terms of diversifying their supply chains. With apparel manufacturing having left the U.S. decades ago, this industry is already accustomed to sourcing goods from numerous countries. Interestingly, after rapidly growing into the U.S.’ largest source of apparel imports, China has seen its share decline every year since peaking in 2010 at 39.2%. The primary beneficiary of China’s fading importance for apparel manufacturers has been Vietnam, which has grown from near zero at the start of the century to 14.4% in 2017.

Exhibit 1: US Apparel Imports by Country - % of Total

Source: BofA Merrill Lynch Global Research

Rising wage rates in China have been the main driver of changing apparel supply chains, with BofA Merrill Lynch Global Research estimating labor costs 30-50% lower in Southeast Asia. While China remains the largest source of apparel imports for the U.S., the trade war may well just serve to accelerate a trend that has already been in place for many years. Even should the trade war get resolved, China is likely to continue ceding its apparel manufacturing share to Vietnam due to an aging population and increasingly strict environmental regulations.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of December 2018 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since December 2018 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team