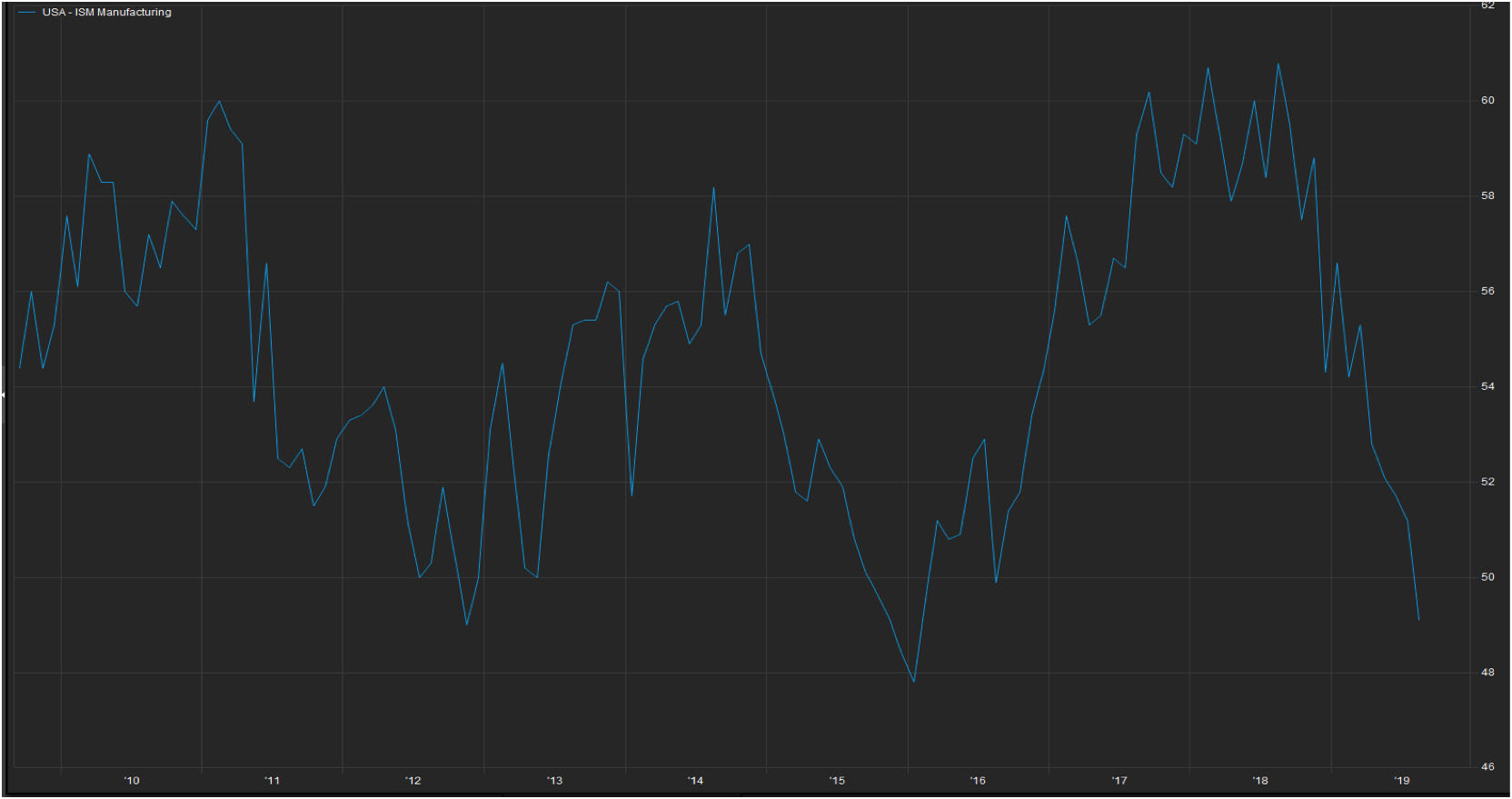

2019 has been an inconsistent year for materials and industrial stocks. After a severe correction to end 2018, the group rebounded in the beginning of 2019 as the Federal Reserve turned dovish and investors became optimistic about better growth prospects in the second half of 2019, perhaps aided by trade deal optimism. Unfortunately, believing in such a resolution has been a fruitless endeavor for materials and industrial investors. At this point, the second half recovery looks more akin to a second half deterioration as the USA ISM Manufacturing PMI’s sub-50 print in August confirms. (Exhibit 1)

Exhibit 1: USA ISM Manufacturing

Source: Factset

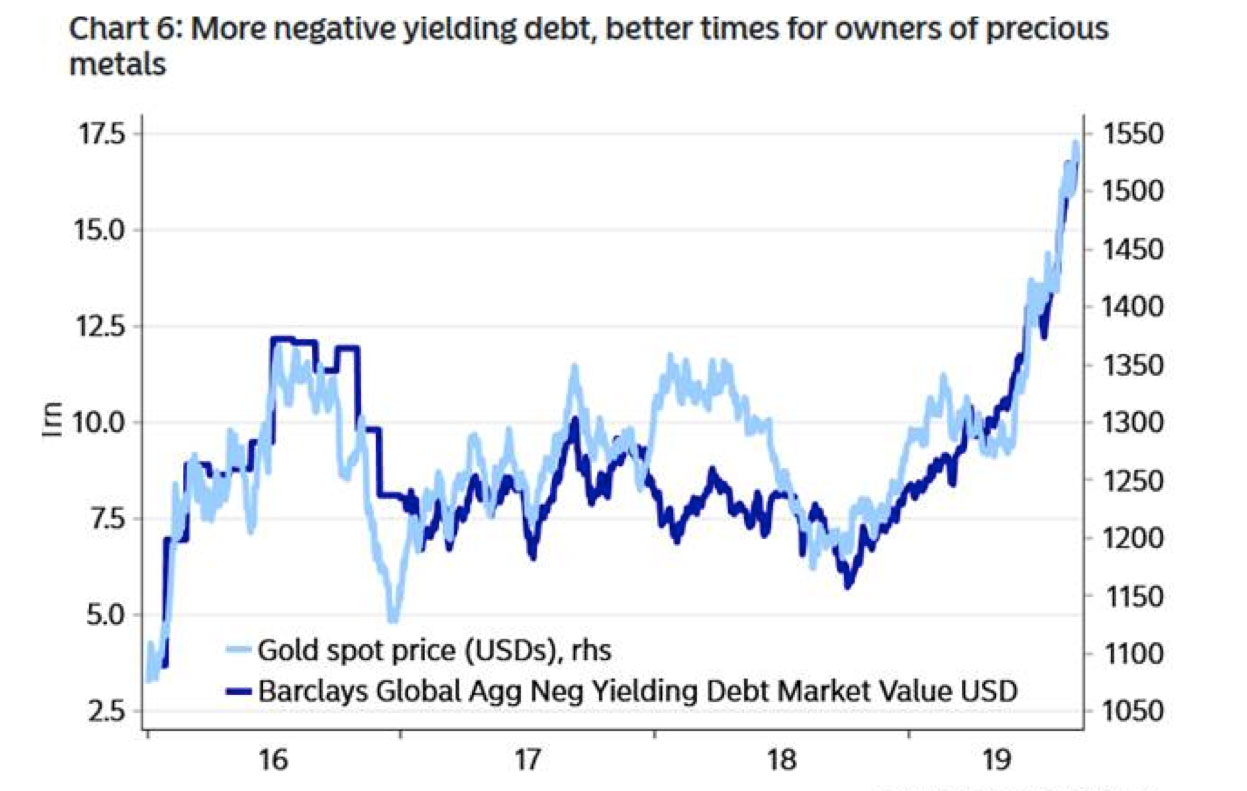

Fortunately, trade deal analysis is not part of our process. We are afforded the ability to be selective, so we look for sustainable trends in earnings drivers such as volume growth, pricing strength, or market share gains, to name a few. All those investment characteristics drive outsized earnings growth over time. Thus far in 2019, materials and industrial stocks, such as capital goods or industrial metals producers, have been unable to replicate their strong fundamentals from 2018. It turns out that investors have been better off owning gold mining stocks, which possess strong leverage to increases in gold’s spot price. Year to date, gold is up 22% and over the past year, gold miners have outperformed the Russell 2000 Growth Index by 3200 basis points. While the US dollar tends to negatively correlate with gold, the fall in interest rates, or more specifically, real yields have been the bigger contributor to gold’s strong performance. The US 10-year yield is down 54% from its peak in October 2018. People use currencies when they are paid to use it, when there is a real yield associated with the currency driven by a country’s economic growth. When growth declines or moderates, the ensuing drop in interest rates increases the opportunity cost of not owning gold. Below is an interesting chart that demonstrates the relationship between the growth in negative-yielding debt globally and gold spot price. (Exhibit 2)

Exhibit 2: Gold vs. Negative Yielding Debt

Source: Macrobond and Nordea

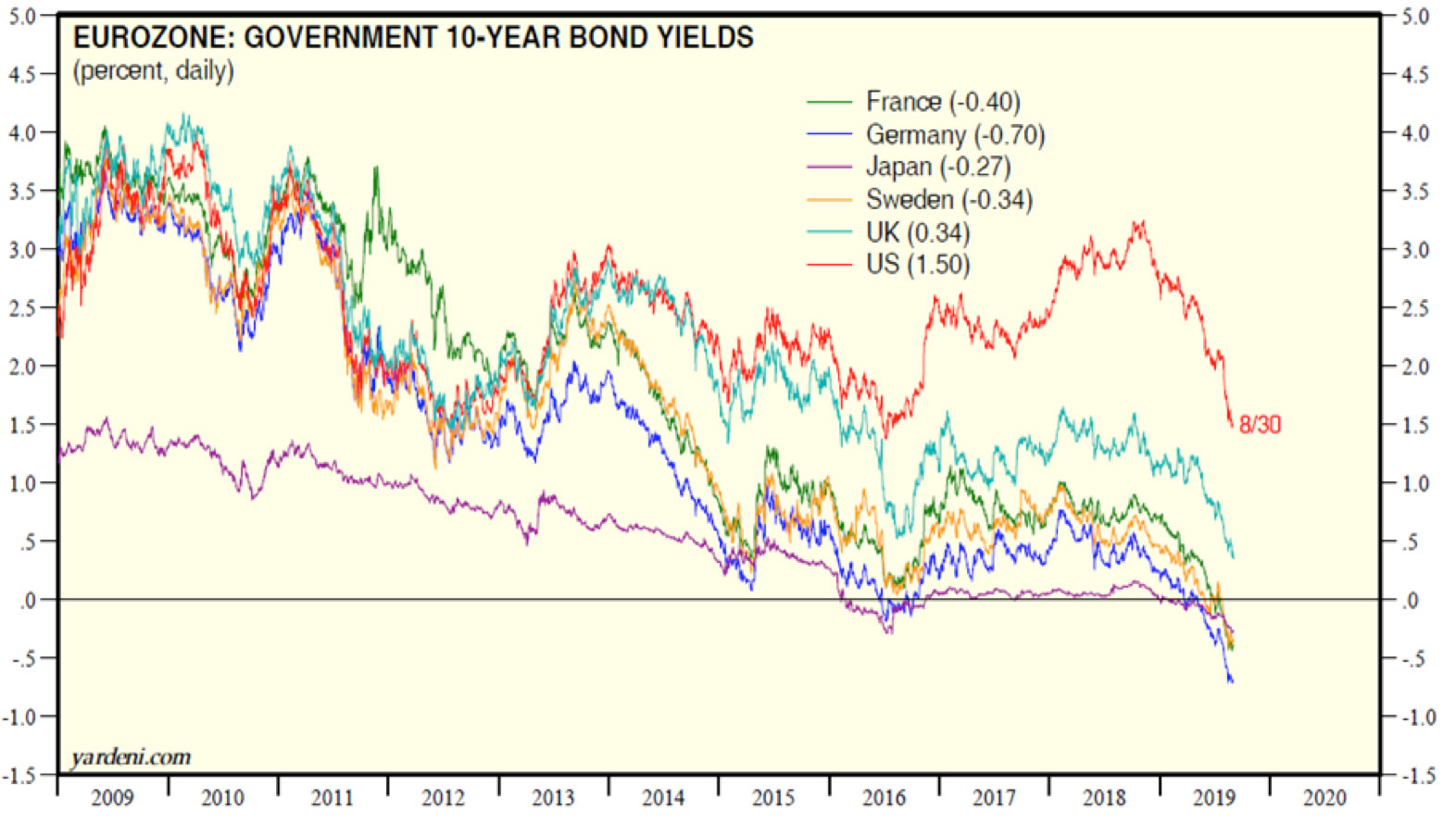

Gold is benefiting from its haven status as more uncertainty created by negative interest rates creeps into the market. Nonetheless, interest rates continue to fall on a global basis. It remains to be seen what the lasting impact of this environment will be, but in the meantime, investors are taking solace in gold and gold mining stocks. (Exhibit 3) The latter are poised to experience strong earnings growth as the price of gold moves to the highest level in five years.

Exhibit 3: Bond Yields

Source: Yardeni

It’s possible this uptrend in gold prices continues if global growth fails to accelerate and central banks become incrementally dovish. The environment can always change, but lower interest rates are needed to support the theme.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of September 2019 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since September 2019 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team