The long-term relative case for emerging markets is underpinned by superior growth rates, demographics and lower per capita consumption of most goods and services. Yet since 2010, emerging market equities have dramatically underperformed their developed market counterparts by more than 10% annually and almost 45% cumulatively. Why this difference in performance?

Exhibit 1: Trailing 5-year performance of MSCI Emerging Markets Index versus MSCI World Index

Source: Bloomberg

One reason is earnings growth. Over the past five years earnings per share for the MSCI Emerging Markets Index contracted by 25% cumulatively, substantially lagging the MSCI World Index. During that period, emerging market earnings suffered disproportionately from US dollar strength and the commodities cycle bust. Another reason is valuation. The relative valuation of emerging markets has deteriorated steadily in conjunction with weaker earnings growth and larger deterioration in return on invested capital.

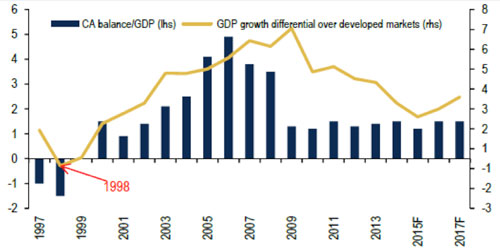

Several months ago, we began to make the case that the relative valuation of emerging markets versus developed was starting to look attractive. Depending on the metric you use, relative valuation was—and still is—hovering near decade-plus extremes. We now see evidence that the growth balance may also be moving back in favor of emerging markets. While the spread of EM versus DM economic growth has fallen for the past six years, our work suggests it is increasingly likely that 2016 will be the year the spread begins to widen again. Convergence in recent years has been catalyzed by the commodities cycle bust, but the worst has passed. While potential growth rates of emerging economies have fallen, they have also declined for developed economies, and EM’s advantages in terms of demographics and productivity improvement still imply far superior long-term growth rates.

Exhibit 2: EM-DM growth differential (yellow line)

Source: Haver, BofA Merrill Lynch Global Research Note: GDP growth differential = real GDP growth for emerging markets - real GDP growth for developed markets, F=BofAML forecasts

A positive inflection in the spread of EM versus DM GDP growth would be a significant development. Considering that GDP growth affects earnings growth, to the extent that EM GDP growth improves relative to DM growth, EM earnings prospects should also improve on a relative basis. The case for emerging markets over developed markets may be moving beyond simply valuation.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of May 2016 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since May 2016 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab