While equity markets at large suffered in 2022 from the FED’s latest hiking cycle, the unprecedented pace of interest rate hikes created opportunities in certain parts of the markets. As we all know, the stock market is an incredible discounting mechanism. One might be surprised to know that, despite the obvious negative impact of higher interest rates on housing demand, building products and homebuilding stocks began outperforming in April of 2022. This was only one month after the Fed began increasing the Fed Funds Rate. See Exhibit 1 showing the relative performance of ITB (iShares US Home Construction ETF) vs. RUO (Russell 2000 Growth).

Exhibit 1: US Home Construction ETF Performance Relative to Russell 2000 Growth Index

Source: FactSet

Many at that time began to fear an impact on the housing market like that of the Great Financial Crisis (GFC) as affordability became stretched and housing starts and existing home sales began to slow. However, conditions today are nothing like the GFC. The Mortgage Risk Index is at 13% compared to 36-37% in the 2006-2007 timeframe. This index percentage reflects default risk. We also had strong home price appreciation of 35% leading into 2022, which created larger equity cushions and lower leverage compared to the GFC. Adjustable-rate mortgages do not present the risk they did one and a half decades ago given new rate caps, longer duration rate sets, and more stringent qualifications. These are just some of the high-level differences that give the housing market a much more stable foundation today compared to last cycle. Therefore, housing fundamentals are poised to hold up better than many would have expected.

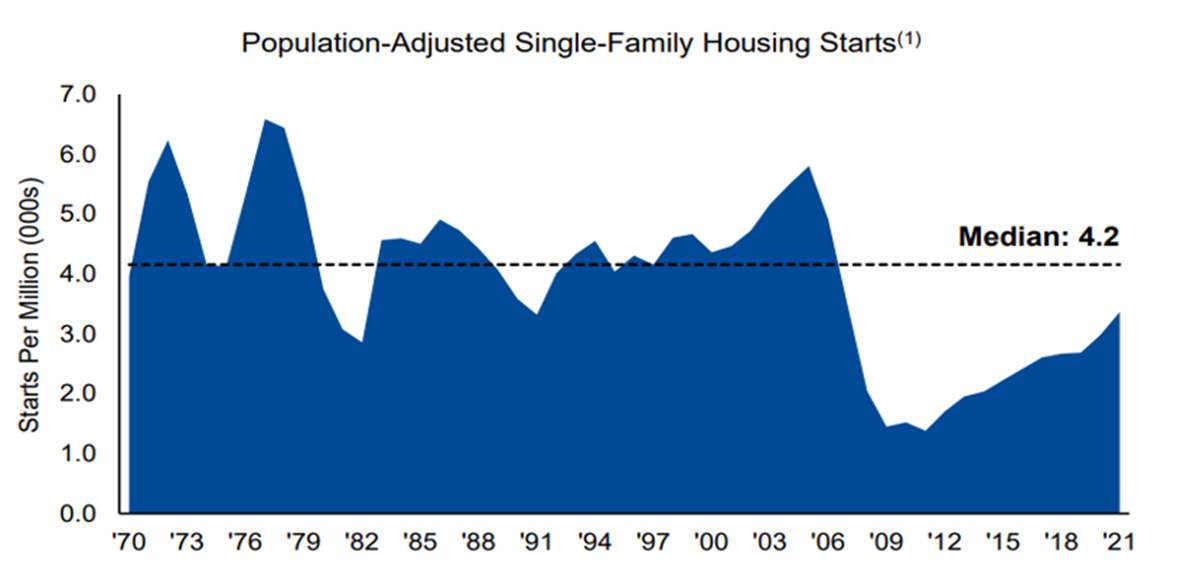

While interest rates increased quickly in 2022, turning 3% mortgages into a recent memory, sticker shock moved many buyers to the sidelines. Nonetheless, underlying demand for housing has arguably never been stronger. Ever since the GFC, homes in the US have been underbuilt relative to demographic demand. See Exhibit 2. According to Evercore ISI research, it will take a decade of two million annual housing starts to make up the deficit.

Exhibit 2: Housing Starts adjusted for demographics

Source: Portfolio Company Investor Presentation

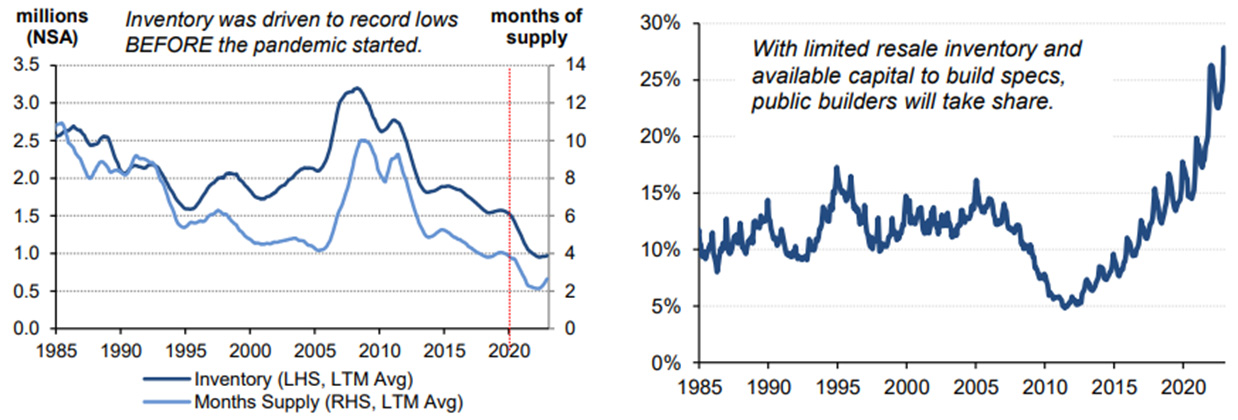

Given housing supply is low (2.9 months), much of the existing home base is locked in at lower interest rates and low affordability, there is a logical solution to the housing deficit. We need to build new, potentially smaller homes. This is beginning to playout as new homes are taking purchasing share from existing homes. See Exhibit 3.

Exhibit 3: Housing Supply and New Homes Market Share

Source: Evercore ISI Research

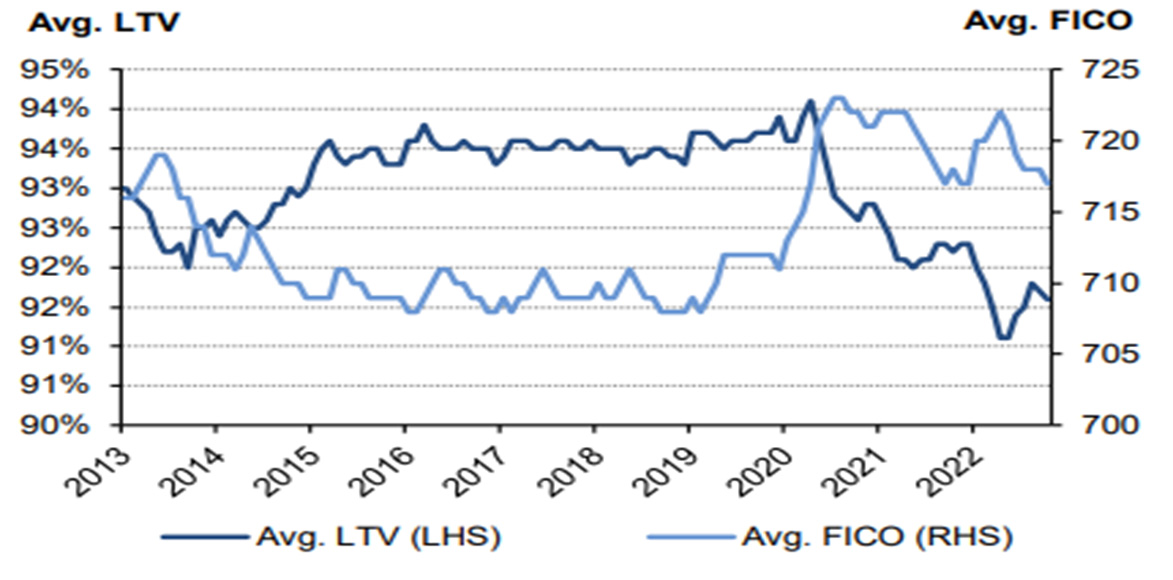

Who can buy these homes? First-time homebuyers are in strong financial positions given low unemployment, wage growth, and high FICO scores. Average loan-to-values have also come down. See Exhibit 4. As millennials finally embark on their family formation journeys, demand for single-family homes from this demographic is finally materializing. As a millennial myself, I can attest to this dynamic.

Exhibit 4: First-Time Homebuyer Credit Metrics.

Source: AEI Housing Center, Evercore ISI Research.

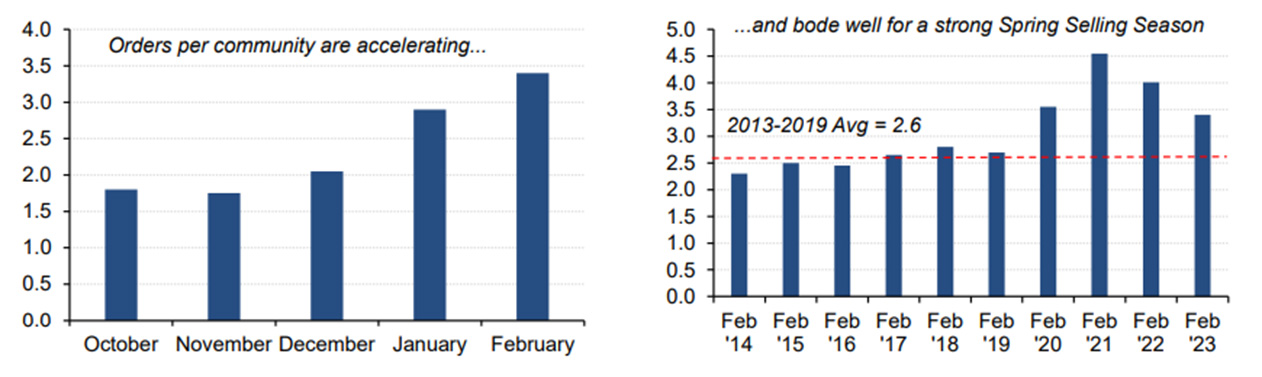

As mortgage rates came down toward the end of 2022, we saw this demand improve. Homebuilding companies reported better-than-expected YTD order trends when they reported DecQ22 earnings as pent-up housing demand was released. See Exhibit 5 for recent order activity.

Exhibit 5: Recent Absorptions Rates

Source: Evercore ISI Research

In conclusion, the longer interest rates remain at stable levels, and specifically around 6%, the more palatable mortgage rates become. Relative to 2020-2021, a 6.5% mortgage rate is very high. However, relative to history these levels are compelling. At risk of stating the obvious, interest rates moving lower will only strengthen existing demand, as we saw at the beginning of 2023. Many building products and homebuilding stocks are poised to benefit from strong demand that we expect to translate into upside to consensus earnings estimates and valuation currently.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of March 2023 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since March 2023 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team