Many investors worry about overcapacity in various sectors in China, such as property, cement, steel, and several others. This leads to bouts of greed and fear within Chinese equities with risk-on and risk-off periods that continue to play out with increasingly shorter cycles. However, Driehaus research has uncovered an exciting area of underinvestment within China that may provide sustainable investment opportunities for the next several years: Industrial automation in China.

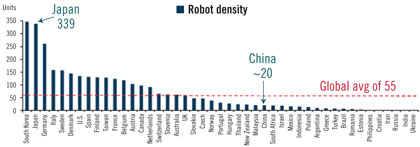

Industrial robot density by country, 2011 (per 10,000 employees)

Source: IFR Statistical Department, Barclays Research

China currently faces increasing labor costs, a rising currency, slowing demographics, and limited growth in lower-end manufacturing markets. In this environment, we believe Chinese companies have no choice but to invest in automation for their factories. We have identified several companies that are leading that charge with innovative domestic automation products and capturing increasing market share despite overall worries around PMI, fixed-asset investment, and a macro slowdown.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of October 2013 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since October 2013 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab