Since the election of Donald Trump, we have been keenly focused on industry positioning within the healthcare sector. Between "repeal, replace, and repair," and the constant noise about drug pricing, we thought it worthwhile to review the areas within each industry where we expect to find good investment ideas in the new Trump world.

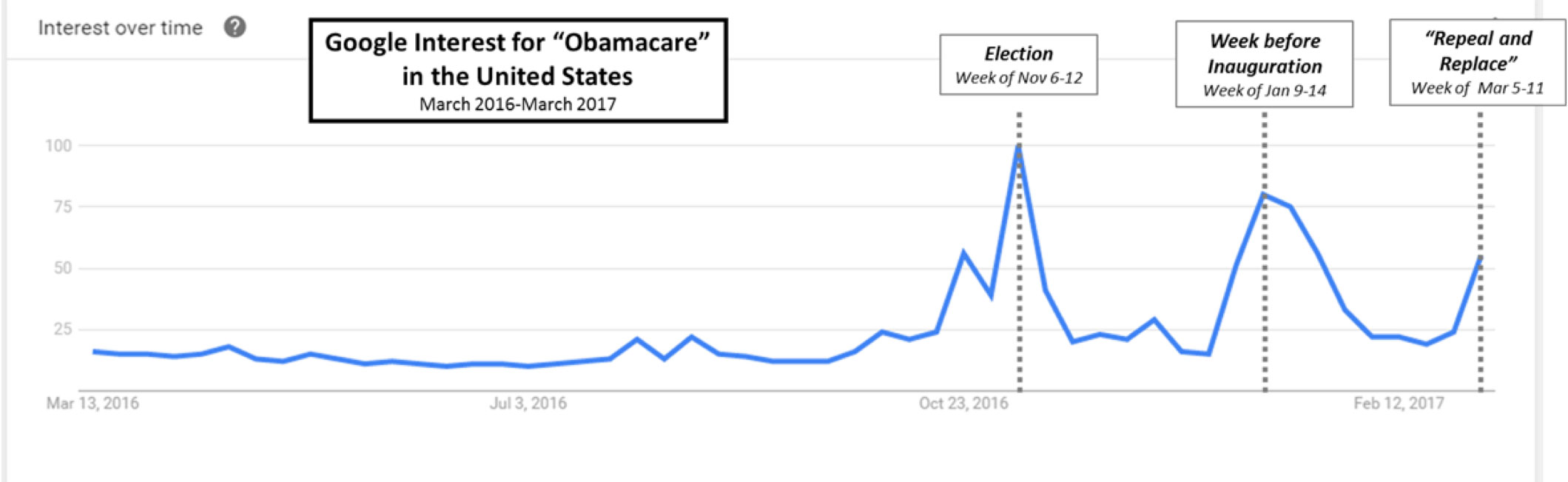

Exhibit 1: US Google Interest for “Obamacare”

Source: trends.google.com

Therapeutics: Strong data, Severe disease, and Limited competition

While noise around drug pricing has persisted for well over a year now, we still think the drug industry is fertile ground for investing. The consensus view seems to be that drug pricing in the United States will not move toward the socialized systems present elsewhere in the world. However, we are cautious that the status quo may shift more than the consensus expects. As a result, we continue to focus on investments where companies clearly differentiate the quality of their drugs through robust data, generated from well-designed clinical trials. Further, we focus on diseases where data matters to prescribing patterns, and where competition is limited, thus preventing excessive risk that companies will be forced to compete on price. This formula has worked in the past and may be the best way to insulate companies from broad-based pricing pressure, should it emerge.

*Medical Devices: * Data Increasingly Matters

Hospitals have aggressively acquired their physician practice referral channels and outpatient facilities for discharged patients. This long-term trend has meaningfully increased hospital purchasing power as the primary buyer of medical devices. In response, medical device companies have sought scale to enable them to compete effectively in an environment where hospitals are reducing the number of vendors used.

While this trend of vendor consolidation seems to favor only the largest device companies, hospitals are unable to eliminate vendors that offer differentiated medical devices that save lives, reduce costs, and are essential for certain procedures. Similar to our approach in therapeutics, we are focused on investing in these differentiated devices. Since most device companies do not generate much data, let alone randomized data, those that do have been, and should continue to be successful in competing with their larger peers.

*Diagnostics: * Disruptive Technology and Strategies

Diagnostics companies often struggle to capture the economic value they create. Low barriers to competition have reduced the advantage of innovative players to the point where the industry has become dominated by a few large players who can afford to fast-follow any innovation and then win with scale. In this environment, companies with diagnostics that are able to construct defensible technological, regulatory, or channel barriers are the ones most likely to succeed. For example, a strategy that we think is particularly effective is one where a new diagnostic enables prescribing physicians to capture value that they were otherwise giving away to a third party. This “channel disruption” does not always work, but with the right team, the right product, and customers looking to increase their value, this strategy can be powerful.

Healthcare Services: Efficiency-drivers Streamlining an Inefficient System

For a number of complex reasons, the delivery of healthcare is massively inefficient in the US. Although a large component of these inefficiencies are structural and can only be addressed by public policy changes, others can and often are addressed in the private sector. Companies that can reduce or remove some of the friction in the system have proven to be excellent investments in the past. For example, companies that help hospitals improve throughput via superior communication processes, while retaining quality, have been shown to have good return-on-investment for hospitals. These companies are then able to grow sustainably.

Companies harnessing these themes have historically shown the ability to generate value for patients, physicians, the healthcare system, and investors, and we expect them to continue doing so in an uncertain environment.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of March 2017 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since March 2017 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Data Center

By Ben Olien, CFA

Driehaus Micro Cap Growth Strategy March 2024 Commentary with Attribution

By US Growth Equities Team