In 2002, an inflection point occurred in commodity prices. Following a prolonged period of underinvestment, supply tightness began to emerge that coincided with China’s ascent, which saw a wave of urbanization and fixed asset investment.

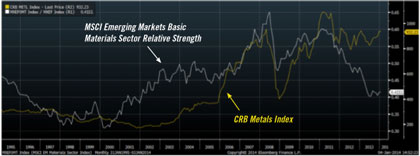

Exhibit 1 shows that the meteoric rise in metals prices spurred significant outperformance over the same period by the basic materials sector within emerging markets. In response to the global financial crisis in 2008, China’s stimulus package and the Federal Reserve’s successive rounds of quantitative easing led to renewed outperformance by both metals and the basic materials sector through the end of 2010.

Exhibit 1: MSCI Emerging Markets Basic Materials Sector Relative Strength vs. CRB Metals Index

Source: Bloomberg

While metals prices have remained range-bound during the past three years, the relative performance of the basic materials sector has substantially decoupled to the downside. What factors are at play here?

Exhibit 2 provides the answer. Prior to the global financial crisis, higher commodity prices meant higher profit margins. However, post crisis, profit margins staged a relatively meager recovery into 2011 and then collapsed in 2012-2013, dragging down performance of basic materials equities.

Exhibit 2: MSCI Emerging Markets Basic Materials Relative Strength vs. Trailing 12-Month Profit Margins

Source: Bloomberg

While numerous factors have influenced this, a few of the more notable are:

- Higher marginal cost of new projects as the “low hanging fruit” was picked during the initial boom phase

- Increased government interference through resource nationalism, taxes, royalties and regulation

- Higher unit cost of production, driven by wages, materials and equipment

This is important because it has arguably driven a portion of the underperformance of emerging markets in recent years. At the peak in 2008, the basic materials sector held a 17% weight in the MSCI Emerging Markets Index. Moreover, the energy sector, where a similar dynamic has occurred, represented a further 20% of the index as of June 30, 2008.

The recalibration of the index has been accompanied by poor relative performance of emerging markets, but also a greater dispersion of returns at the individual stock level. These trends have played to our strengths at Driehaus, namely identifying macro trends and seeking companies with differentiated growth.

This information is not intended to provide investment advice. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, market sectors, other investments or to adopt any investment strategy or strategies. You should assess your own investment needs based on your individual financial circumstances and investment objectives. This material is not intended to be relied upon as a forecast or research. The opinions expressed are those of Driehaus Capital Management LLC (“Driehaus”) as of December 2013 and are subject to change at any time due to changes in market or economic conditions. The information has not been updated since December 2013 and may not reflect recent market activity. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Driehaus to be reliable and are not necessarily all inclusive. Driehaus does not guarantee the accuracy or completeness of this information. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Other Commentaries

Driehaus Emerging Markets Small Cap Equity Strategy March 2024 Commentary With Attribution

By Chad Cleaver, CFA

Driehaus Emerging Markets Growth Strategy March 2024 Commentary with Attribution

By Howie Schwab